Crude Oil is one of the world’s most important commodity. It is responsible for virtually all sectors of the economy. For instance, without oil, it would be impossible for other commodities to be produced and transported.

The movements on the commodity ends up affecting other asset classes. In fact, in the past we have seen the crude prices affect the major global averages (we can say it has been the key driver of the financial markets).

They have had a near perfect correlation: this means that the key indices are turning positive when oil goes up and vice versa.

In this article, we will look at the crude oil pricing, what can move it and why it matters.

What Moves the Crude Oil Price?

To better understand the concept of crude oil pricing, you need to understand what moves its price.

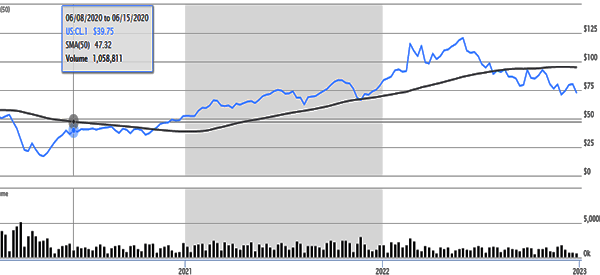

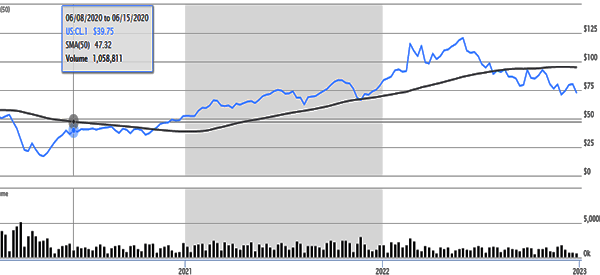

In the last few years because of the Covid-19 pandemic and then the war between Russia and Ukraine, we have seen a sharp fluctuation in the price of crude oil (and not only that, also gas and other commodities)

Russia and Saudi Arabia are two key players of this commodity, and traders must be carefull on what the rispective oil ministers can say. Saudi is a member of the Organization of Petroleum Exporting Countries (OPEC) while Russia is the largest non-opec producer.

Therefore, if the two countries agreed to limit production, it is expected that other countries would also follow their lead and limit their production. And as mentioned before, a limit in the production would boost the oil price.

Demand and Supply

This is the most underlying factor. In economics 101, demand and supply are the key drivers of any items price.

As with any commodity, the price of oil is determined by its demand and supply. When the supply is very high with the demand stagnant, then the price will move down. If on the other hand the demand is on the rise with the supply stagnant, then the price will definitely go high.

The basic economics 101 topic therefore plays a very important role. It states that when there is an increased supply, the price of the commodity will likely come down. On the other hand, when the supply reduces, the price will ultimately come up.

For example, consider your local farmers market: in such a market, when there is a huge supply of tomatoes, shoppers usually have an option to buy from many farmers. Each farmer wants the buyer to buy from them.

Therefore, in this situation, they will price the tomatoes at a lower price so that you can buy from them. This is the same way that the crude oil market works.

On a weekly basis, EIA releases the crude oil inventory data. OPEC and other agencies also release this data on a regular basis. This data gives the market participants a good indication of what the oil market is like.

As a trader, this data is very important, and it should be on your fingertips.

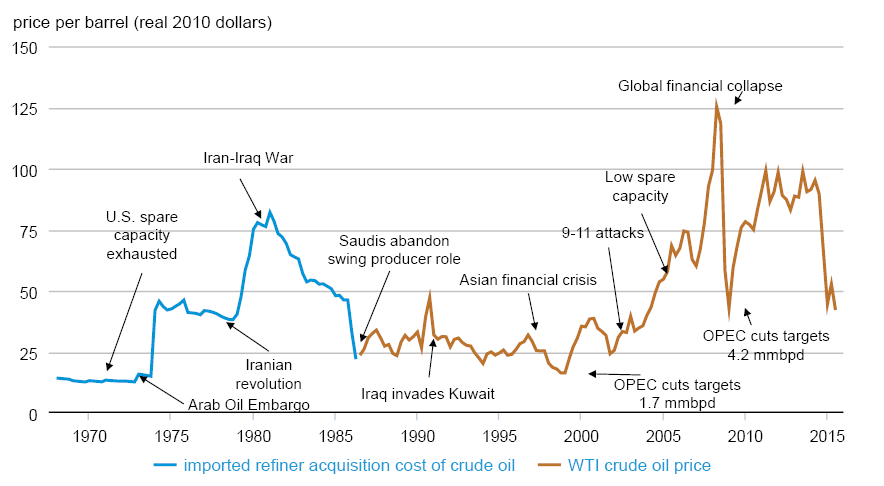

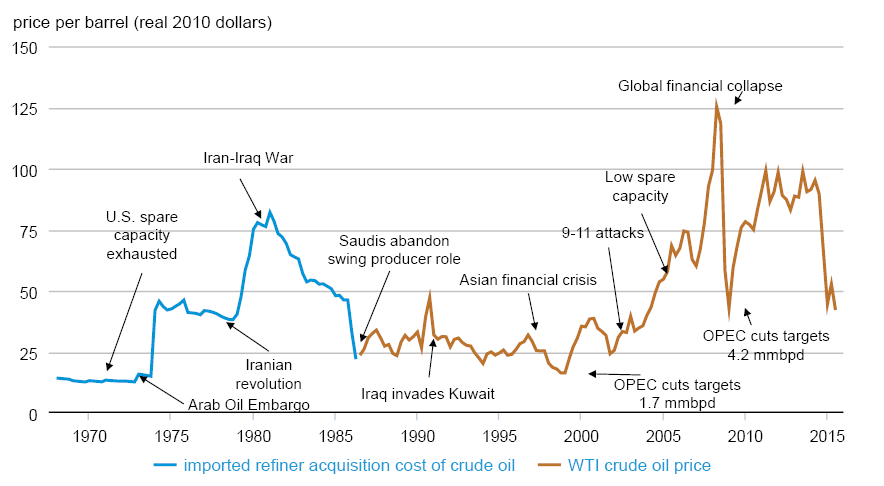

Geopolitical risks

The supply of oil is affected by a number of factors. For instance, if more countries discover huge oil deposits, oil will definitely increase in quantity. This increase in supply will lead to reduced prices. Geopolitical issues are also key drivers of crude oil futures prices.

The largest oil producing countries include countries in the Middle East, China, USA and Russia among others. Sadly, these countries are faced with major geopolitical issues which affect how oil is supplied.

For a trader, if news of political instability in the Middle East arise, you should always place a buy trade. This is simply because political instability could affect oil production thus curtain the amount of oil supply.

Global Economy and the Dollar

Additional factors are the global economy and the dollar. In terms of the global economy, if the economy is weak, then chances are that the demand will not be high. This will pull the prices down, as we already know from the Covid pandemic. As people and companies become more liquid, they tend to engage in more production.

For instance, assume that you earn $1000 a month and therefore you opt to take a cab to work on a daily basis. Then, one day your boss calls you and gives you a pay hike. You will now be earning $6000 a month.

This is an indication that the company is doing well. If you are not a fun of cabs, you will now opt to use your car leading to a slightly high demand for the product.

The same is the case for countries and their economic growth: if a country reports improved economic numbers such as GDP, then it means that the people and companies will increase their spending on oil. This will lead to increased demand.

On the second factor, oil is quoted in dollar terms. As such, if the dollar strengthens, then the price of oil will be brought down. If on the other hand the dollar becomes weak, it will pull the price of oil down.

OPEC+

OPEC+ is the most important organization in the oil market. It is made up of some of the biggest oil producing and exporting countries like Saudi Arabia, Russia, Qatar, and United Arab Emirates (UAE).

In the past few years, the cartel has been holding monthly meetings, where they set the next production targets. In these meetings, they deliberate on whether to hike or reduce oil production in the following months.

For example, during the Covid pandemic, as oil prices moved negative, the cartel met and decided to dramatically curtail production. As a result, oil prices rallied from the negative level to over $100 in two years.

Therefore, traders look closely at the meeting and what the members decide. Oil prices rise when the cartel hints that it will lower production and vice versa.

Related » Failures and Successes of OPEC

Market sentiment

Another important thing that tends to move oil prices is market sentiment. Sentiment refers to the general feeling of the market participants. It involves them looking at the market and deciding whether it is bullish or bearish.

It involves them looking at the market and deciding whether it is bullish or bearish. This has to do with the economic data that is released. If the data supports a bullish oil, then chances are that crude oil futures prices will move up.

In this regard, oil tend to do well when stocks are rising (and investors are enthusiastic) and perfor poorly when the fear and greed index is in the greed area.

Why monitoring oil prices is important

There are several reasons why traders should monitor oil prices. First, oil traders should always look at the performance of oil prices to determine whether to buy or sell.

Second, oil has an impact on other financial assets. For example, oil movements have an impact on oil and gas stocks like Marathon Oil, ExxonMobil, and Chevron. These shares tend to rise when oil price is rising and vice versa.

Oil also has an impact on currencies. Some of the top oil currencies are the Canadian dollar, Saudi Arabia riyal and Mexican peso,

Further, oil price is often seen as a leading indicator for the state of the economy. Higher prices mean that there is strong demand. In most cases, higher oil prices lead to higher inflation.

Past & Future: What Traders can do

When trading crude oil, you only need to understand a very few details. In fact, on a weekly basis, there are about 2 economic data relating to crude oil.

The challenge is that most countries are not in a position to limit their oil production because their economies depend on oil. As a trader, you should watch the recent happenings in the oil market carefully.

You should also watch out on the official and unofficial meetings by members of the major oil producing countries.

In addition, you should watch carefully the weekly releases. The weekly EIA report will be an important tool to help you trade the commodity. An increase in stockpiles means an increased supply and thus a reduction in crude oil pricing and vice versa.

Crude Oil Price – External Useful Links

- Determinants of Crude Oil Prices: Supply, Demand, Cartel or Speculation? – ResearchGate

- Oil Market Report – EIA