Equity traders can be divided into 4 main types. Small Cap is one of these

The US equities market is a giant industry, with a market cap of over $40 trillion. Some of the biggest companies in the market are Apple, Microsoft, and Amazon. Beneath the surface, there are thousands of companies that are not well-known.

Broadly, there are 4 main types of equity traders:

- Who specialize in small caps stocks

- Others specialize in mid cap sized companies

- Experts in large caps.

- Traders who combine the 3 asset classes

In this article, we will look at what small-cap stocks are and how to day trade them well.

What are small-cap stocks?

Small-cap stocks are companies that are relatively small in America’s standards. In most cases, these small-cap stocks are seen as companies whose market cap ranges between $250 million and $2 billion.

In other countries, companies with such market cap are seen as large-cap firms.

Small-cap companies are just like other large-cap companies, with the only difference being their small sizes. At times, large-cap companies can move back to small-cap firms based on the performance of their stocks.

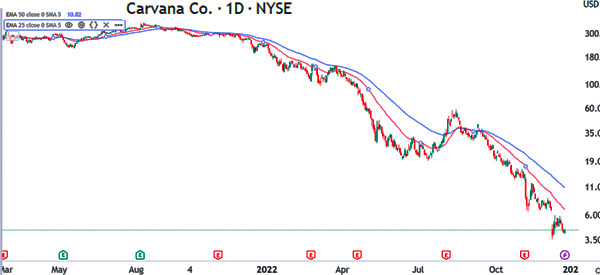

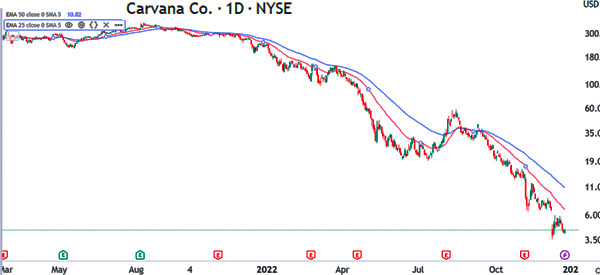

For example, a company like Carvana had a market cap of more than $50 billion before it plunged to less than $1 billion.

Market cap is the main measure that determines the real valuation of a company. It is calculated by multiplying the stock price by the number of outstanding shares. As such, if a stock is trading at $10 and it has 1 million outstanding shares, it means that the company has a market cap of over $10 million.

There are thousands of small-cap stocks in the US. In fact, the number of such companies is significantly higher than large and mega cap stocks combined.

Small-cap vs penny stocks

A common question is whether there is a difference between small-caps and penny stocks. Penny stocks are small companies that have a tiny market cap.

In most periods, these companies are either fallen angels that were once big and then crumbled. Their shares are usually priced at less than $5 per share.

Most penny stocks are traded in the Over-the-Counter (OTC) market. Therefore, while penny stocks are small-cap stocks, not all small-caps are penny stocks.

Small vs Large vs mega-cap stocks

Another group of stocks is known as large-cap and mega-cap stocks. These are usually large companies that have a substantial market share in their industries. Large-cap stocks have a market valuation of between $10 billion and $100 billion. Most popular stocks are in this category.

Mega-cap stocks, on the other hand, are companies that have a market cap of over $100 billion. In the United States, there are over 77 publicly-traded companies with a market cap of over $100 billion.

Small-cap vs mid-cap stocks

Small-cap stocks have a difference with mid-cap stocks. While the definition changes from time to time, mid-cap stocks are those that have a market cap that ranges between $2 billion and $10 billion. There are thousands of companies that are in this group.

Qualities of small-cap stocks

Small-cap stocks have several qualities and characteristics. However, these companies are not all the same. Some small-cap stocks are high-quality ones while others are highly risky and volatile.

In some cases, however, many small-cap stocks are usually more volatile than mega-cap stocks like Apple and Berkshire Hathaway.

Another quality of small-cap stocks is that they derive most of their revenue in the United States. That’s because they don’t have a significant exposure to the international market.

Further, some companies in this group tend to have faster growth than mega-caps and large-cap companies. They also tend to have higher risks than large companies that have sustainable free cash flows and revenue.

However, there are also some caveats:

- Most small cap companies usually have a problem with reporting where their information is usually not readily available.

- They do not offer dividends.

- Last but not least, companies suffer from poor management.

What is the Russell 2000?

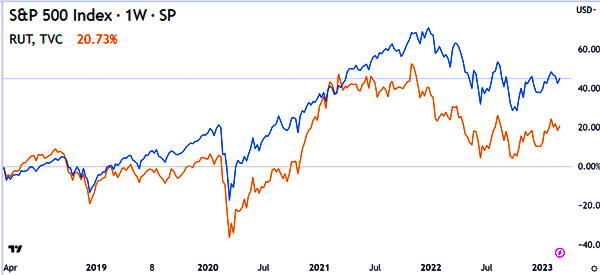

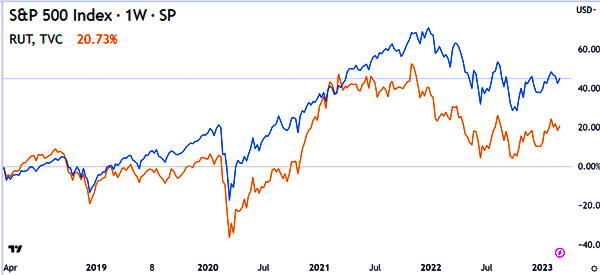

The best way to trade and identify small-cap stocks is to look at the Russell 2000 index. This is an important index that has 2000 small companies in the United States. In most cases, these are usually national in nature.

The median market cap of all companies in the index are $940 million. The other key index that tracks the Russell 2000 index is the S&P Small Cap 600 index, which has a median market cap of over $1.4 billion.

A look at the chart below shows that small-cap stocks have underperformed the S&P 500 index in the past five years.

How to day trade small cap stocks

In general, there is no major difference between how to trade small-cap stocks and large-cap ones. Traders use the same approach when trading these stocks.

The first thing a trader needs to do is to study the market. This is called market scanning. It is a process where a trader goes through all small caps stocks and studies each one of them.

This can be a tasking undertaking but the long term advantages outweigh the negatives. You are doing this so that you can get companies that you can understand. You are also looking for companies that are solid.

There are several approaches to day trade small-cap stocks, including:

Trading the news

One of the top approaches to trade small-cap stocks is to trade the news. This is the approach where you buy stocks that are making positive headlines and short those that are not.

It is one of the most popular approaches to trading stocks. Obviously it requires staying up-to-date, so having reliable sources of information makes a huge difference.

Scalping

Scalping is an approach where traders buy and sell stocks within a short period. In this case, you use extremely short-term charts, such as 1-minute and 5-minute to analyze the chart.

The main difference between scalping and other approaches is that traders enter many trades per day. In some cases, they can even place over 50 trades per day.

Swing trading

Swing trading is a trading approach where traders buy and sell financial assets within a few days. These traders use charts that range between 15 minute and daily charts to conduct their analysis.

It also focuses on fundamental analysis, which focuses on news and economic events.

Gap trading

Gap trading is a trading strategy that happens shortly after the market opens especially when there is important news in the market.

For example, a gap can happen after a company publishes earnings or when it makes a major announcement. In some cases, the company can move to fill the gap or extend the direction of the asset.

Tips

As a day trader, you should avoid the temptation of holding small cap stocks for a very long duration. Most of these companies usually lack the intrinsic value that is usually available in large cap sizes. Mostly, they are usually heavily in debt.

Once you exit the company, you should avoid trading it again for the day. If you continue doing this, you will end up losing your entire investment.

Related » Learn when to enter and exit

Summary: Are small-cap stocks good for day trading?

We believe that small-cap stocks are the best to day trade than even mega-cap and large-cap stocks. These companies tend to be more volatile, and in most cases, are reasonably priced. As such, you can easily trade companies whose share price is at $50 compared to many large ones that have a smaller market cap.

External resources for Small Cap Stocks Trading

- Where can I find good small cap stock suggestions? – Quora