China has been one of the top economic miracles of the past few decades. The country has grown from a poor third-world economy to the second-biggest after the United States.

It has also turned into the biggest buyer of most commodities like crude oil and copper. These are enough elements for us to understand how the economy of this country – and all that surrounds it – has gradually become more and more relevant to traders and investors.

In this article, we will look at the Chinese economy, why it matters, and other key details to know.

Economy of China: overview

China is the second-biggest economy in the world after the US, with a GDP of over $17.7 million. Its economy has grown so fast over the years considering its GDP was less than $60 billion in the 1970s. Its GDP per capita has jumped to $12k from less than $1,000 in 2000.

China’s economy is highly diversified. Real estate is the biggest constituent, accounting for more than 25% of the total output. The sector has historically done well since it has been the best investment for many Chinese over the years.

Manufacturing is another important area in China’s economy. For a long time, China was known for low-tech manufacturing like clothes and shoes. Today, the country has emerged as a key player in areas like aviation, semiconductors, and automobiles.

China is a leading player in other industries as well. Some of the most notable ones are tourism, agriculture, technology, and mining.

Still, there are signs that the Chinese economic growth has peaked. For example, the real estate sector is slowing, leading to the collapse of big companies like Evergrande and Country Garden. Home prices have also dropped sharply in the past few years.

China’s role in global trade

China is highly intertwined in the trade industry. Over the years, it has become the most important country for most companies because of its big population and high spending power.

As the world’s factory, China is the biggest buyer of key commodities like copper, iron ore, corn, soybeans, and aluminum. It buys these products from key countries like Australia, the United States, Peru, Brazil, and Argentina.

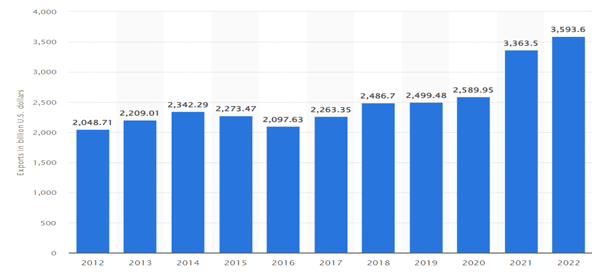

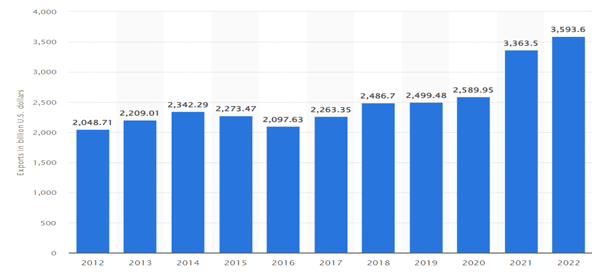

China is the biggest exporter and importer in the world. In 2022, the country exported goods worth over $3.5 trillion. As shown below, its exports have been in a strong upward trend over the years.

Its biggest export countries are the United States, Hong Kong, Japan, South Korea, and Japan. The US accounts for 16.2% of China’s exports.

China is also a leading importer. It imported goods worth over $3.13 trillion in 2022, up from $3.09 trillion in the previous year. The key imports are machinery, gems, and precious metals, vehicles, plastics, and copper.

Signs that China’s economy is slowing is the biggest macro event today because of how the country is intertwined in the global supply chain. For one, if the decline continues, it will have an impact on a country like Australia that sells most of its products to China.

Why is China’s economy slowing?

There are three main reasons why China’s economy is slowing. First, the real estate sector, which has boomed in the past few decades, has shown signs of slowing down. That’s mostly because of China’s move to control its debt and the fact that China has adequate homes.

The collapse of the real estate sector has major implications because land sales have always been the biggest source of funds for local governments. These governments are highly indebted, raising concerns that most of them will struggle.

Second, China is slowing because of the ongoing de-risking as most companies look for other sources of manufacturers. For example, in the United States, Mexico has become the biggest source of goods.

Third, China is also facing demographic challenges as population growth stalls. A study by Brookings found that the population will drop below 1 billion by 2080 and below 800 million by 2100.

There are other reasons why China is slowing, including rising tensions with the West, too much debt, and weak foreign direct investments.

Related » What inflation means for day traders

How China can fix its economy

China faces a difficult task to boost its economy. We believe that the country needs to implement structural reforms in a bid to promote consumption in the long term.

Consumer spending, the biggest part of America’s GDP, is the most reliable driver of an economy. It can boost spending by reducing taxes and placing measures to support it.

Further, China can gradually increase its retirement age and even implement measures to boost immigration. Unlike in the United States, China is known for being a bit unfriendly to immigrants.

Most importantly, China needs to work extra hard to boost its relationship with western countries like the United States. One area it should do is to boost its attempt to find solutions to the Taiwan issue.

Additionally, China can fix its economy by deregulating, especially in technology and financial services. China thrived when its light-touch regulatory framework led to the establishment of companies like Alibaba and Tencent.

China key industries and sectors

China has a leading role in virtually all sectors in the world. As mentioned, real estate is the biggest sector in China’s economy. It accounts for more than 25% of the total output and employs millions of people.

Manufacturing is another industry that is integral in China’s economic growth. A notable thing is that China has evolved to be one of the top vehicle manufacturers in the world. It also manufactures other things like machines, smartphones, and computers.

Consumer spending is another sector that does well in China. For example, most consumer-oriented companies like LVMH, Kering, and Hermes count China as their biggest markets.

China, thanks to its vast land, is emerging as a leading player in the agricultural sector. It has allocated millions of acres of land to farming as it seeks to be independent from countries like the United States.

How China impacts the financial market

Currencies

China has an important impact on the currency market. The most important currency pairs that react to China’s data are the USD/CNY and USD/CNH. CNY is the renminbi that is traded within mainland China while CNH is used outside mainland China like Hong Kong and Singapore.

China also impacts the Australian dollar because of the volume of goods it sells. The chart below shows that the Aussie dropped in 2023 as the Chinese recovery faltered.

Stocks

China’s economic events have a major impact on global stocks. The most impacted are stocks listed in Shanghai and Shenzhen. Further, traders watch the Hang Seng index because its constituents do a lot of business in the mainland.

Most importantly, China’s data and events impact stocks in countries like the United States and Europe. That’s because companies listed in these countries do a lot of business in China.

Commodities

China is the biggest buyer of commodities like copper, coal, natural gas, copper, and aluminum. Therefore, weak macroeconomic numbers lead to weak commodity prices.

That happened because China tends to buy less commodities when its economy is not doing well.

Cryptocurrencies

In theory, China has no role in the crypt industry since it banned them a few years ago. In reality, however, China is still a major player in the industry.

Reports show that China’s customers account for 20% of Finance customers. Therefore, some actions by authorities have an impact on these coins.

China opportunities for day traders

China’s economy presents major opportunities for most traders and investors. For one, some Chinese companies with exposure to China have seen their share prices collapse over time.

Some of the most notable ones are Alibaba and Nio. Traders can buy and sell these stocks since they are listed in America’s exchanges.

Further, the slowdown is leading to major swings in commodities like copper and crude oil. Traders can benefit from these swings in the market by buying when prices are low and shorting when prices are high.

It is also possible to short some of the collapsing real estate companies in China. In the past few years, companies like Country Garden and Evergrande have all collapsed.