Forex trading is a popular method in which people are using to make money online. Although forex trading has been around for years, the approach got more popular in the past few years as the internet became widespread.

In this article, we will take a deep dive into what forex trading is, how it works, and some of the top strategies to use in the market.

What will you find here?

What is forex trading?

The term forex stands for foreign exchange. It refers to the process where people exchange currencies with the goal of making a profit.

Ideally, the concept is relatively simple. So, let us explain it using an example.

Assume that you are an American travelling to Kenya. In your trip, you have $10,000 and assume that you will exchange the dollar to Kenyan shilling at an exchange rate of 100. Therefore, in this case, when you get to Kenya, you will have KSH 1,000,000.

Now, as you go back to the US, you find that the exchange rate has fallen to $90. In this case, your original $10,000 will now be $11,100. In this case, you have indirectly done a forex trade and made a profit of $1,100.

Therefore, in forex trading, your goal is to identify similar market opportunities using several types of analysis that we will look at later in this article.

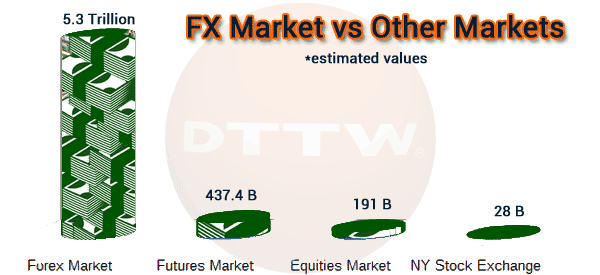

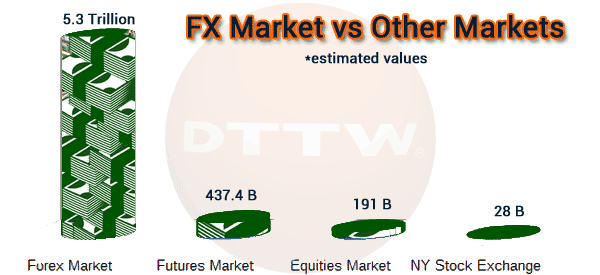

Today, the forex market is the most liquid in the world. On any given day, traders exchange currencies worth over $5 trillion.

How the forex market works

In the previous part, we have looked at what forex trading is. So, let us explain how the forex market works. Ideally, forex trading is a simple method that automates the manual trading above.

It works by having a number of participants. First, there are forex brokers, which are companies that provide the trading platform.

Second, these companies work with other players behind the scenes. For example, there are liquidity providers, banks, and software providers. Finally, there are traders who provide the capital and do the real trading.

Most brokers don’t charge a commission. Instead, they make money through a simple spread that exists between the bid and ask prices. For example, if the EUR/USD has a bid of 1.1345 and ask of 1.1360, the broker will take the difference. In this case, it will be 15 pips.

» Related: Forex vs Crypto

What to know before you start trading forex

There are several things you need to know BEFORE you start trading forex. Let us look at some of these things.

Rules and regulations

The forex market is a relatively risky one. Indeed, most people who start day trading lose money. Therefore, regulators have come up with some tough regulations that govern the industry.

Some of the most important regulators in forex are:

- ASIC – This is the Australian Securities and Investment Commission.

- ESMA – This is the financial regulator of the European Union.

- FCA – This is the regulator of the United Kingdom.

- CySEC – This is the main regulator in Cyprus.

- SEC – This is one of the many regulators in the United States.

There are many regulations in the industry. For example, in 2018, ESMA introduced the MIFID II regulations that took aim at many sectors in the industry.

For example, the regulations forced brokers to reduce the size of leverage they offered to their customers. Some of these regulations were also embraced by ASIC.

The US also has some of the strictest regulations on forex, which explains why most brokers don’t operate in the country.

Common terms in forex

There are several important terms that you will encounter in the forex market. Some of the most popular are:

- Pips – this is the smallest movement of a currency pair. For example, if the EUR/USD pair moves from 1.1200 to 1.1250, then it has risen by 50 pips.

- Micro, mini, and standard accounts – a micro account is the smallest type of account that brokers represent about 1,000 unis of the base currency. A mini account has 10,000 of the base currency while standard has 100,000 of the base currency.

- Leverage – Leverage is a loan that a broker offers you. For example, if you have a $1,000 and a 1:20 leverage, it means that you have a buying power of about $20,000.

- Margin – Margin is the amount of money that you need to maintain your leverage. A margin call is when the broker asks you to increase your cash to avoid the trade being ended.

How forex pairs are quoted

A forex trade happens in terms of a pair. This means that you need to exchange one currency with another currency. For example, in the example above, you need to change the US dollar to the Kenyan shilling.

Examples of popular forex pairs are: EUR/USD, GBP/USD and USD/JPY. In this case, the currency on your left is known as a base currency while the one on the right is the counter currency.

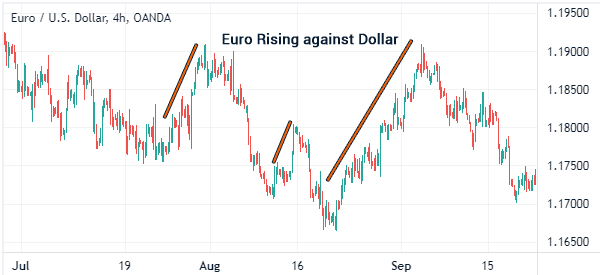

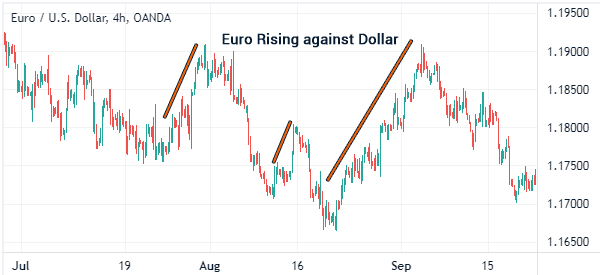

Therefore, if the EUR/USD chart is rising, it means that the euro is gaining while the US dollar is retreating.

Types of forex pairs

There are three main types of forex pairs;

- Majors – These are the currency pairs of developed countries that have the US dollar. Examples are EUR/USD, GBP/USD, and USD/JPY.

- Minors – These are currency pairs of developed countries that don’t have the dollar. Examples are EUR/GBP, EUR/JPY, and AUD/NZD.

- Exotics – these pairs have a combination of developed world and emerging market currencies. They are USD/ZAR and USD/TRY

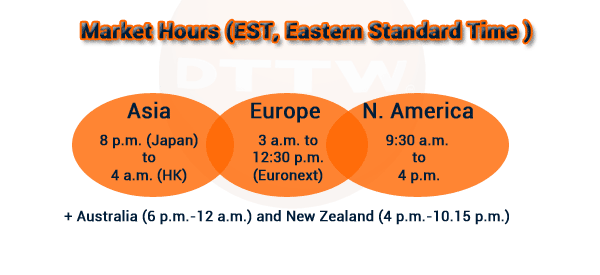

Forex market hours

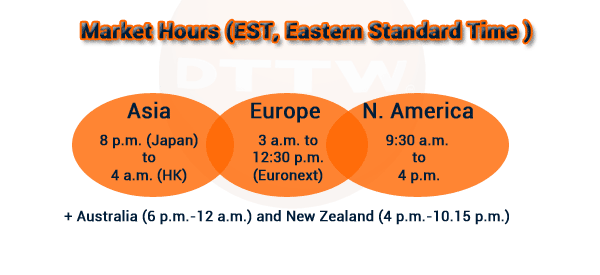

A good thing about the forex market is that it has long trading hours. The market always opens on Monday when the Asian market opens and closes on Friday when the American session closes. Therefore, if you are in the United States, you can trade forex from Sunday to Friday (here you can see all the sessions).

In most cases, the Asian market is usually characterized by low volatility and volume. Volume starts rising during the European and American sessions.

The intersection between the Asian and European and between the European and American is usually the most busy.

Ways to trade forex

There are several ways you can trade forex including:

- Spot market – spot market is where you are buying and selling currency pairs at the present prices.

- Forward market – The forward market is mostly an over-the-counter market that sets the price based on the future delivery. They are different from futures market because they are highly customizable.

- Futures market – These are exchange-traded derivatives that gives a person the right but not the obligation to buy a currency pair.

Forward and futures are mostly used by highly experienced people.

How to start trading forex

Trading forex is a relatively complicated thing, which explains why most day traders fail. Therefore, in this section, we will look at how you should start trading forex so that you can succeed.

Know the chart types

As you will notice later, it is mandatory for you to do chart analysis as a forex trader. This type of analysis is known as technical and price action analysis. There are several types of charts in forex that you will use, including.

- Line chart – This is a chart that simply connects the closing or opening prices of a currency pair. In most cases, you will not use this type of chart.

- Bar chart – This is a chart that shows the open, high, low, and closing (OHLC) prices. While it is a good chart, you will use it rarely.

- Candlestick chart – This is a chart that shows OHLC and more details. It is the most popular chart type in forex and is shown in the chart below.

There are other advanced chart types that are mostly used by advanced traders. These include Heikin Ashi, Renko, Kagi, and Point and Break.

Have in mind what affects currency pairs

Before you open a trade, it is always important to understand what moves currency pairs. As we will see below, some of the most important things you need to know are the actions of central banks, prevailing news events, economic data, and other things such as the performance of the bond market and commodities market.

Have a solid strategy before you start trading

In a section below, we will focus more on the need for having a forex trading strategy and then identify some of them. As you start your trading journey, ensure that you have a good strategy that you have developed and tested for a while.

At times, traders take several months to create a good trading strategy. Here you can find some useful tips to exploit your exchange rates trading.

Analye the forex market

The next stage is where you conduct your analysis before you open a trade. Ideally, there are three main methods of analyzing currency pairs. These are;

- Technical analysis – this is a strategy that involves looking at a chart and using technical indicators to predict its future direction. Indicators include moving averages, relative strength index, and MACD.

- Fundamental analysis – this is a strategy that involves looking at the news of the day and then predicting the future direction of a currency pair.

- Price action analysis – here, you look at a chart and then identify chart patterns like triangle, flag, pennant, and wedges.

Chose a currency pair to trade

Finally, identify a currency pair to trade that meets your criteria. Ideally, look at pairs that have some volatility or those that are moving in a certain trend.

Styles to use in forex trading

There are several types of styles that are commonly used by day traders. Some of these styles are;

Scalping

Scalping is a trading strategy in which a trader opens a trade and exits it within a short period, typically less than 5 minutes. The goal is to make a small profit multiple times a day. Scalpers typically use very short timeframes like 3 minutes or even a minute chart.

Swing trading

This is a trading strategy where you buy a currency pair and hold it for a few days. Swing traders typically use longer charts like hourly and four-hour.

Day trading

Day trading is a trading strategy whose goal is to identify a pattern, buy or short a currency pair, and ensure that it is closed before the day ends. Scalping is considered a form of day trading (in this post we have highlighted similarities and differences between scalp and day trading).

Carry trade

A carry trade is a situation where you aim to take advantage of differentials in interest rates in countries. The concept is simple: for example, if the dollar is yielding 2% and the Japanese yen is yielding 0.5%, then you can borrow the yen and invest it in the US dollar.

Copy-trading

This is a trading strategy that involves copying trades from an experienced professional. Many brokers offer features to simplify how people copy trades.

Algorithmic trading

This is a trading strategy that involves the use of expert advisors or robots to automate the trading process.

How to place a forex trade (step-by-step)

There are several steps you need to follow when opening a trade in forex. Let us look at some of them. Do not be scared if they seem a lot of step or difficult, they are the basis for every trader! With experience this little checklist will come to you automatically, because they will be routine actions.

Identify the market sentiment

The first thing you need to do before you open a trade in forex is to identify the market sentiment. Ideally, you should try to see what is going on. There are several ways to go about this.

First, you can look at the news of the day and identify whether they are positive or negative for a certain currency pair.

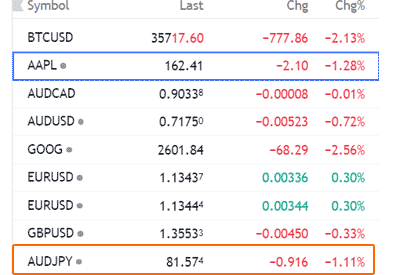

Second, you could use a watchlist to see the typical deviations in currencies. For example, the chart below shows how several currency pairs are trading.

In this case, you could be interested in AUD/JPY, which has declined by 1.10%.

Decide pairs to trade

The next section is where you decide on the right pairs to trade. One way of doing this is to use the watchlist as we have done above. The other way is to use the economic calendar to see currencies that will have some actions on that day.

The calendar is simply a schedule that shows the key events that will come out in a certain day. In most cases, select currency pairs that have some events coming up.

Another way is to have a small list of currency pairs that you will typically be trading. In most cases, traders opt for currency majors, which tend to attract lower fees.

At the same time, you should do analysis on these charts. In this case, you should do technical analysis by using indicators like moving averages and the Relative Strength Index (RSI). Also, you should incorporate price action to your trading strategies.

Place your trade

After conducting this analysis, you should go ahead and place your trade. As you will realie, there are two main types of trades that you could place;

- Market order – These are trades that executed instantly. For example, if you place a buy trade on the EUR/USD pair, the trade will be executed right away.

- Pending order – These are trades that are executed at a later time when the conditions are met. They include buy and sell-stop and buy and sell-limit. A buy-stop will initiate a buy trade at a higher price while a sell-stop will initiate a sell trade at a lower price. Similarly, a buy-limit will initiate a buy trade below the price.

After you place your trade, you should protect it by having a stop-loss and a take-profit. A stop-loss is a tool that automatically stops a trade when it reaches a certain loss threshold. A take-profit, on the other hand, stops the trade when it reaches a certain profit level.

Exit your trade

The final step is when you exit your trades. If you followed the guidance above, then, in most cases, the stop-loss and the take-profit will be the ones to stop the trades.

However, there are times when you need to manually stop your trade. For example, you can close it when you are heading to the weekend or when a day is ending without the levels being tested.

What affects the forex market?

As we told you above, there are several things that affect the forex market. And they are not all strictly related to the financial world. Some of these are:

Central bank actions

The central bank is the most important institution in the forex market. For one, it is the only institution that is given the mandate to print money. The bank makes its decisions in a bid to ensure that a country has a low unemployment rate and stable inflation rate.

In difficult time, as during the covid-19 pandemic, the central bank will cut rates and implement quantitative easing (QE). you should watch out for the economic calendar to see when a central bank will deliver its interest rate decision.

Geopolitical activities

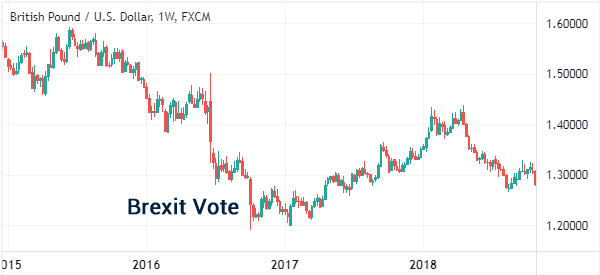

At times, geopolitical events will have an impact on key currency pairs. There are some good examples of geopolitical events that have had an impact on currencies. For example, in 2016, the British Pound declined sharply after the UK voted to leave the European Union.

Similarly, the US dollar tended to jump when there were elevated tensions between the United States and North Korea and US and China.

In most cases, tough geopolitical events tend to lead to a stronger US dollar simply because the dollar is viewed as a safe-haven currency.

Market sentiment

Sentiment in the market has a role to play in the forex market (as we already stated). There are two main types of sentiments: risk-on and risk-off.

Risk-on is when forex traders are embracing risky assets like they did in 2020. In this case, the US dollar will tend to retreat. Risk-off sentiment is when investors are running away from risky assets.

FX Trading Strategies

As for stocks, there is no method or trick that can be valid always and everywhere. And there is no absolute ‘best’ or ‘worst’ strategy, because this depends on many factors.

Here’s why traders use different trading strategies in the forex market. It is not necessary that you use all of them at the same time, in fact it would be counterproductive.

As a professional it’s enough that you master 2/3 of them, but you need to know the others for every eventuality. Let us now look at some of the most popular trading strategies in forex trading.

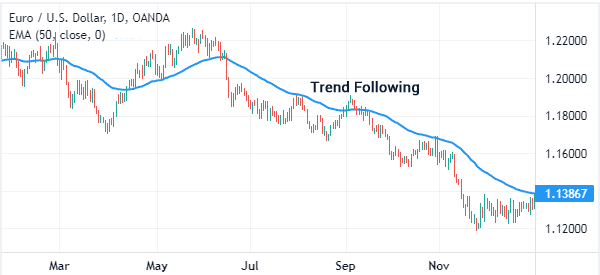

Trend following

Trend following is a popular trading strategy. Its concept is relatively simple. Traders first identify a currency pair that is moving in an upward or downward trend and then execute a trade in that direction.

To do that, traders use several tools like indicators and trendlines. Some of the most popular trend-following indicators are:

- Moving average

- Bollinger Bands

- Ichimoku cloud

- Parabolic SAR

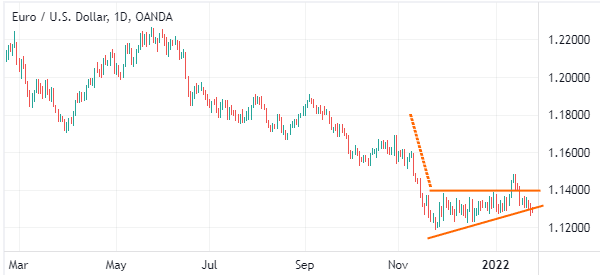

The chart below shows how trend following works. As you can see, the EUR/USD pair has formed a descending trend. Therefore, a trend follower would simply place a sell trade as long as the price is below this moving average.

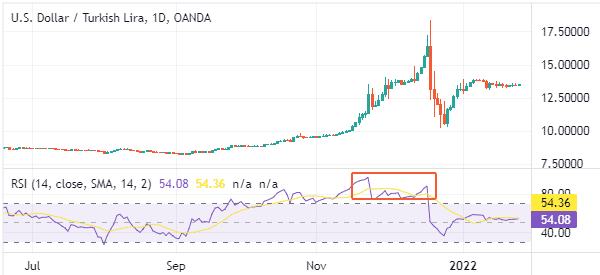

Overbought and Oversold levels

Another way is to find overbought and oversold levels. A currency pair is said to be oversold after it has been in a strong bearish trend. It simply means that investors think that the currency pair is undervalued.

On the other hand, a pair is said to be overbought when it has been in a strong bullish trend. In this case, analysts believe that it is in the overbought zone. Some of the best-known indicators to identify overbought and oversold levels are:

- Stochastic oscillator

- Commodity channel indicator

- Relative strength index (RSI)

- MACD

- Klinger oscillator

A good example of how traders used the overbought and oversold levels is shown in the USD/TRY pair below. As shown, the pair made a parabolic rally and then the Relative Strength Index (RSI) moved above the overbought level.

The pair then declined sharply after getting to the overbought level.

The main risk for trading overbought and oversold levels is that a currency pair may remain at these levels for so long before it changes direction.

As such, it is recommended that you combine different types of indicators.

Breakout

Another forex trading strategy is known as breakout. A breakout happens after a currency pair has been in a consolidation phase for a while. Therefore, your goal will be to predict the direction of the breakout.

In most cases, people use chart patterns to predict the direction of the breakout. Some of the common patterns to predict a breakout are;

- Bullish and bearish flag

- Bullish and bearish pennant

- Triangle pattern (ascending, descending, symmetrical)

- Wedge

- Head and shoulders pattern

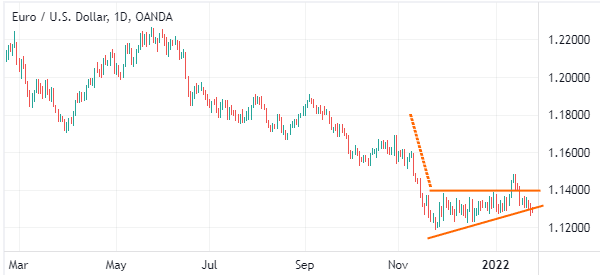

A good example of this is shown in the chart below. As you can see, the EUR/USD pair has formed a bearish pennant pattern during this consolidation. Therefore, if a breakout happens, there is a likelihood that it will be in the downward direction.

Reversal pattern

Another forex trading strategy is known as a reversal approach. A reversal happens when a currency pair moving in a certain direction suddenly or gradually starts moving in the opposite direction.

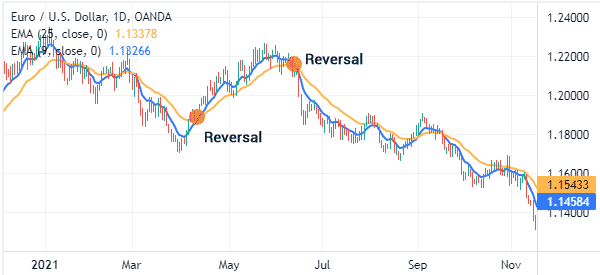

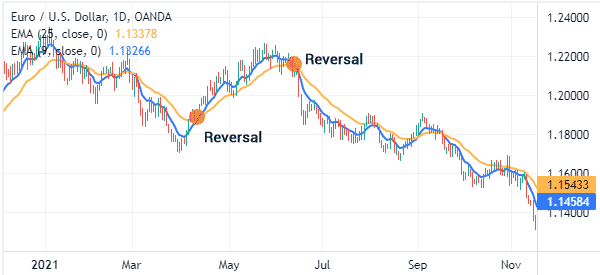

There are several approaches to reversal trading in forex. But the most popular one is that of using two moving averages. In this case, you identify two moving averages of different lengths and then identify when they make a crossover.

A golden crossover is when the 200-day and 50-day moving averages make a bullish crossover while a death cross is when it forms a bearish crossover. Day traders have identified their own lengths to use. A good example of this pattern at work is shown in the chart below.

This is undoubtedly the best method for this trading strategy. But there are many other indicators to spot a reversal, feel free to try some of them in demo mode and see the one that best suits you.

Range with support and resistance

Another approach to trade in forex trading is known as a range with support and resistance. For starters, support is an area where a currency pair struggles to move below while resistance is a point where it struggles to move above.

To use this approach, you need to first find a currency that is trading in a range. After this, you should use chart tools and draw the channel. Finally, you should buy it when it moves to the lower side of the channel and sell when it moves to the upper side.

An example of this approach is shown in the chart below.

Risks in forex trading and forex account management

Trading in general is risky, due to the unpredictable nature of financial markets. Obviously forex trading is no exception, and has many points where any trader could fall into error. This explains why most traders fail.

Let’s see together some of the most common (and dangerous for your account) risks.

Overtrading

This is a situation where you open many trades in a given day. Ideally, the more trades you open, the higher the risk that you expose yourself to.

Therefore, you should ensure that you open a few trades every day. Having a trading journal will help you in all this.

Slippage

Slippage is a situation where a trade is executed at a different price than where you initiated it. For example, you might open a buy trade at 1.1210 and the broker will execute it at 1.1215.

In most cases, slippage happens in high volatile markets. You can avoid slippage by focusing on pending orders instead of market orders.

Prolonged consolidation

Another leading risk in the forex market is when there is a prolonged consolidation. This is where you identify a market opportunity and execute a trade. Instead of it moving in your direction, it starts a prolonged period of consolidation.

At times, you will find it more profitable to exit with a small profit and then find opportunities elsewhere.

Multiple losses in a row

One of the worst things in day trading is when you have a series of multiple losses in a row. Even for the most experienced traders, this is a popular thing.

You can avoid the risks associated with this by having a stop-loss for all your trades and having a good risk-reward ratio.

FAQ

Is FX taxable?

How much money is traded in forex every day?

Is there a minimum amount to trade in forex?

Best currency pairs to trade in forex

Summary

As we have seen, the trading volume within currency pairs is much higher than within stocks, and this translates into many more opportunities to generate profits. Or in the risk of suffering losses, since the difficulties are various and many variables are involved.

This is not to say that you should be afraid to trade forex, especially once you understand the key concepts and set up those two or three strategies that you intend to use.

For those who have read this far, happy trading!