Whoever coined the phrase “time is money” probably had no idea how true this holds for scalp trading.

Looking to make a daily profit, experienced funded traders (or day traders) leverage various techniques, including buying at the start of the market and selling before it closes at the end of the day.

Now imagine doing this every few minutes throughout the day—that’s what scalping is about.

The goal is to make many small daily profits, while limiting the number of losses.

In this article, you’ll learn how scalping works, what a 1-minute scalping strategy is, and several approaches that you can adopt.

As always, we recommend you do some testing in your demo platform first, primarily to get used to picking up signals much faster.

What Is Scalping in Trading?

Before we dive into some specific scalping strategies, let’s quickly elaborate on what we mean by “scalping” and the role it plays in trading.

Scalping in trading involves making numerous trades over the course of a single day with the aim of capturing small profits from minor price movements.

Traders who employ this strategy, known as scalpers, typically enter and exit trades within minutes, seeking to exploit short-term fluctuations in asset prices. Scalping requires a high level of discipline and the ability to make quick decisions, as the success of this approach relies on accumulating a large number of small gains that together can add up to significant profits over time.

It also involves the use of short-term charts.

In the context of “funded trading,” where traders are given capital by a funding provider or firm to trade in exchange for a share of the profits, scalping takes on a significant role.

Funded trading programs often look for skilled traders who can generate consistent returns while managing risk effectively. Scalping, as a strategy, fits into this framework by allowing traders to exploit short-term market movements to accumulate profits with the provided capital, under the agreement that risks are kept within predefined limits.

The role of scalping in funded trading is crucial for several reasons.

First, it allows traders to demonstrate their ability to generate quick, consistent profits with strict risk management, a key metric for funded trading programs when evaluating a trader’s performance.

The high volume of trades involved in scalping enables traders to showcase their skill in reading the market and making rapid decisions, which are valuable traits for any trading strategy but are especially critical when using someone else’s capital.

Secondly, because funded traders are typically working within a profit-sharing arrangement, scalping can be an attractive strategy for generating a steady income stream. By capturing small profits across many trades, scalpers can aim to meet or exceed the performance benchmarks set by their funding providers, thus maximizing their share of the profits.

How 1-Minute Scalping Works

“1-minute scalping” is a specific approach within the broader scalping strategy used in day trading.

As the name suggests, 1-minute scalping involves using 1-minute time frame charts to make trading decisions and execute trades. This method is highly focused on short-term movements.

Like with general scalping, the objective is to capture small price movements for a profit, leveraging the high frequency and volatility of market movements observable on such a short time scale.

Traders use technical analysis indicators such as moving averages, MACD (Moving Average Convergence Divergence), RSI (Relative Strength Index), and stochastic oscillators to identify potential entry and exit points within the market’s minute-by-minute fluctuations.

The emphasis is on spotting immediate trends, price breakouts, or reversals that can lead to quick, small profits. Due to the fast-paced nature of this strategy, it’s essential for traders to have a clear set of trading rules, including predetermined profit targets and stop-loss orders, to manage risk effectively.

Given its reliance on rapid execution, 1-minute scalping is particularly suited to markets with high liquidity and tight spreads, such as major currency pairs in the forex market or large-cap stocks.

Also, traders engaging in this strategy need to consider the impact of transaction costs, as the high volume of trades can quickly accumulate significant fees, potentially eroding the small profit margins targeted by scalping.

As such, successful 1-minute scalping requires not only a deep understanding of market dynamics and technical analysis but also efficient risk management and the ability to operate effectively under intense, fast-moving market conditions.

Pros and Cons of 1-Minute Scalping

While scalp trading with a one-minute time frame offers a number of advantages (including the potential for rapid gains), it also comes with its own set of drawbacks.

The table below gives you a good idea of what you can expect from 1-minute scalping—go over it to understand whether it works for your trading profile.

| Pros | Cons |

| Trade results are available in one minute, so there are no overnight risks. | Your risk appetite and quick decision-making skills are constantly tested. |

| It gives you the flexibility to proceed with trading or strategize for loss recovery. | The 1-minute time frame introduces a lot of background noise, which makes it challenging to analyze data. |

| There’s a greater probability of profit owing to the frequent, small market moves in the 1-minute periods. | You need commitment—otherwise, access to market information and complex algorithms is limited. |

| Higher trading volumes allow to make up losses. | Multiple trades attract commissions and spreads that could eat into your profits, or make losses hit harder. |

Of course, 1-minute scalping isn’t for everyone. In order to succeed, you must be both disciplined and skilled. If you’re recently getting into scalp trading (or even trading in general), take some time to practice and learn your way around it.

Top 1-Minute Scalping Strategies

Now that we have laid the groundwork and you are aware of the pros and cons of this type of trading, let’s get into the specific 1-minute scalping strategies you need to know to make the most of your trades.

1. Trend Following

Trend following is one of the most popular strategies. It identifies an already-established trend in a 1-minute chart and then follows it until it changes direction.

If an asset moves upward, you can initiate a buy trade and hope the trend continues. The goal is to find an asset in a bullish trend and buy it when it makes a pullback.

Similarly, if the asset moves downward, you can short the asset and profit as the price rises.

Trend traders employ various tools, including trendlines, moving averages, and technical indicators, to analyze swing highs and lows, identify the trend direction, and potentially generate trade signals.

2. Bullish and Bearish Flags and Pennants

This strategy involves identifying an existing trend and establishing flag and pennant patterns on a 1-minute chart.

Flags

A flag is a price pattern that moves counter to the prevailing price trend in a shorter time. This pattern ranges from 5 to 20 price bars and is also accompanied by volume changes: it increases during the initial trend, and decreases or holds during consolidation.

To spot a bullish flag, look for a rise in the price action during the initial trend move and note its descent through the consolidation area. A surge in the breakout suggests that investors and traders are entering the stock.

In a bearish flag, the pattern depicts a down trend with increasing volume and a brief upward consolidation with decreasing volume, before the downtrend resumes.

Pennants

A pennant is a triangle-shaped continuation pattern formed when a period of consolidation experiences a breakout.

To spot a bullish pennant, look for a pronounced upward movement (i.e., the pole) followed by a roughly symmetrical triangle formed from support and resistance lines.

For a bearish pennant, after a bearish price move indicated on the pole, look for support and resistance lines forming a rough symmetrical triangle.

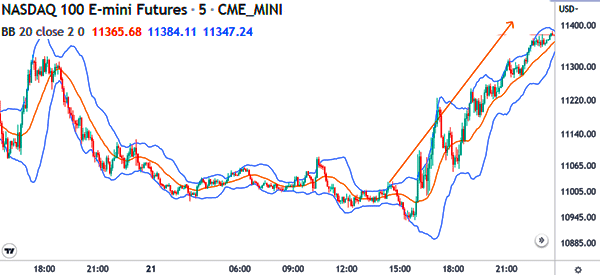

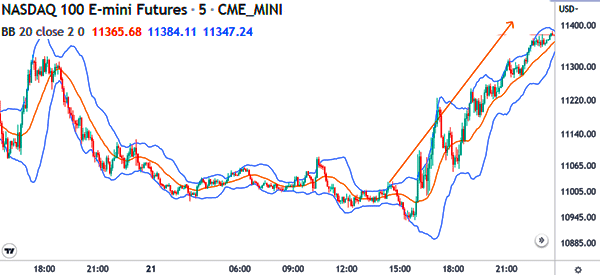

Whenever they happen, they usually end with a continuation of the existing trend. A good example of a bullish flag pattern in a 1-minute chart is shown in the chart below.

3. Other Continuation and Reversal Patterns

In addition to flags and pennants, you can identify other types of continuation and reversal patterns in a chart.

For continuation patterns, you can look at:

- Ascending and descending triangles, which indicate that an asset’s price will likely have a bullish (ascending) or bearish (descending) breakout.

- Cup and handle, which is interpreted as a bullish trade signal. Look for cups with longer and uniformly U-shaped bottoms, handles that aren’t very deep, and volumes that decrease and increase with stock price fluctuations.

Reversal patterns include:

- Double bottoms, which seem like the letter “W” and indicate a likely bullish movement.

- Triple bottoms, which are an extension of the double bottom.

- Double tops, which resemble the letter “M” and show a likely bearish breakout.

- Triple tops, which are an extension of the double top.

Whichever pattern you’re studying and keeping out for, remember to make sure that you are thorough in your research, and watch for indicators.

Scalping Indicators

Knowing when to strike is crucial in scalp 1-minute scalp trading, as you only have a minute’s worth of data to make a decision.

Here are six scalping indicators to make the most out of 60 seconds.

1. Moving Averages (MA)

A moving average is a statistical calculation that smoothens fluctuations in a data series.

It’s obtained by computing the average of a set of values over a specified time period, which provides a trend indicator that helps identify patterns or trends.

Scalpers often combine a short-period MA (e.g., 9-period) with a longer-period MA (e.g., 50-period) to ascertain trend direction and potential crossover points.

2. Relative Strength Index (RSI)

RSI is a momentum oscillator that gauges the speed and change of price movements. Scalping strategies may involve adjusting settings to lower periods (e.g., 14 to 6) for increased sensitivity to movement.

Traders watch for overbought conditions (above 70) or oversold conditions (below 30) as potential reversal signals.

3. Stochastic Oscillator

Like the RSI, the stochastic oscillator compares a security’s closing price to its price range over a specified period. It identifies overbought and oversold conditions.

Scalpers utilize this to pinpoint entry and exit points, with values above 80 signaling overbought conditions and below 20 indicating oversold conditions.

4. Bollinger Bands

Bollinger bands signal potential reversals or trend continuations when the price touches or moves outside the bands.

Scalpers interpret the squeezing of bands as an indication of an impending volatility increase, which they can capitalize on.

5. Moving Average Convergence Divergence (MACD)

MACD, a trend-following momentum indicator, illustrates the relationship between two moving averages of a security’s price.

Scalp traders identify potential shifts in momentum, direction, and trend duration. Crossovers between the MACD and signal lines serve as possible trading signals.

6. Volume Weighted Average Price (VWAP)

Among the most notable indicators, VWAP calculates the overall average of an asset within a specific time frame.

VWAP’s utility lies in identifying areas of intersection with an asset, indicating prevailing bullish or bearish sentiments for potential trades.

A move above VWAP suggests bullish momentum, while a move below signals a bearish sentiment.

In the chart below, you can see several clear buying and selling opportunities.

Risk Management in Scalping

As we mentioned earlier, due to scalp trading’s rapid pace and high frequency of trades, risk management is paramount.

Scalpers who follow 1-minute strategies expose themselves to significant losses that can quickly erode their capital.

In order to safeguard your capital, while maximizing potential returns, consider implementing these risk management strategies:

- Set up stop-loss orders based on market conditions and volatility. This way, if a trade moves beyond a predefined threshold, the order automatically exits the trade and helps limit losses.

- Trade with smaller position sizes relative to your overall capital. This helps mitigate the impact of individual trades gone wrong.

- Identify opportunities where the rewards outweigh the risks. By adhering to a positive risk-reward ratio of 1:2 or higher, you ensure that profitable trades offset losses from unsuccessful ones.

- Use the right trading tools, such as advanced trading platforms that offer real-time risk analytics and position sizing calculators. Automated trading systems can even execute trades and manage risk according to your predefined parameters.

Above all, education is the most important tool: scalping video guides, courses, and literature—it’s all essential. Know what you’re doing, and never miss a chance to expand your scalp trading knowledge.

Start Scalp Trading With Real Trading

We’re confident that this article will give you all the fundamentals you need to test the waters as a scalper—and thrive in them.

If 1-minute scalping seems like something that fits your trading profile, then go for it.

The ethos at Real Trading is that we succeed only when you do. That’s why we offer our certification course, which gives you access to our proprietary Cube X™ hardware and Ppro8™ software.

Learn at your own pace, in a language of your choice, and tap into the wisdom of our growing community of trading experts.

Begin your success story with Real Trading today.