5G is one of the most important things happening globally today.Many countries are investing billions of dollars to upgrade their telecommunication infrastructure. In all this, several companies that you can trade in will benefit.

In this article, we will look at what 5G is, how it works, and its benefits to companies and individuals. Also, we will list some of the best known 5G stocks to invest and how you can day trade them.

What is 5G?

The simplest way to explain 5G is that it is a telecommunication standard that will be faster than the previous standards.

A good way to explain this is that of a movie download. Today, to download a 2GB movie takes less than 2 minutes using the fastest networks. In the past, this was different. It took more than one hour to download such a movie. With 5G, these downloads will be much faster.

Estimates say that 5G will be 100 times that of 4G speeds. It will also help networks carry more data in a reliable manner. It will also have low latency, which means that there will be little delay between when the signals are sent and received. This will be a must in the so-called Internet of Things (IoT) applications such as those by driverless cars, robotics, and machine-to-machine communications.

And yes, it’s a great thing for day trading as well.

Benefits of this new technology

There are several benefits of 5G to both individuals and companies. These are:

- Faster connection speeds – 5G will help increase the speed of internet connection. For individuals, this will mean faster streaming and computer use. For companies, it means faster computing since speeds can reach up to 10 gigabits per second.

- Lower latency – Latency refers to the time between when data is sent and when it is received. With 5G, this latency will be improved.

- Higher device capacity – Company networks will not be limited to a certain number of devices.

Most importantly, 5G will make some technologies like machine learning, Internet of Things (IoT), and artificial intelligence more effective.

5G and day trading

As a day trader, 5G will have an impact on what you do because of the need for speed. Indeed, many large investment banks and hedge funds spend a lot of money to be close to where the main exchanges locate their data centers.

By so doing, these companies are able to receive data at the fastest rate. With 5G, these companies will be able to access this information faster.

5G will help you in several ways. First, it will save you money since you won’t have the need to pay for a virtual private server (VPS). A VPS is an online server that you get data fast. These servers can ensure that your orders are executed fast. With 5G, you will have limited use for these VPS.

Second, 5G will reduce the load time of your computer. As such, this will ensure that you are able to get news and other items faster.

Finally, it will help ensure that your orders go through on time and possibly reduce slippage. Slippage is where your order is executed at a different price than where you initiated it.

How and on which companies to Invest for 5G

Chip Companies

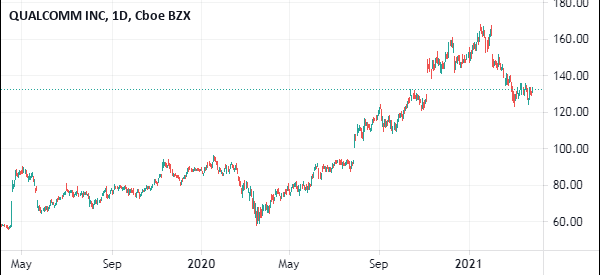

Many companies will benefit from 5G. The first big beneficiaries will be chip companies like QUALCOMM. This is simply because mobile companies like Apple, Samsung, and OnePlus will increase their spending on 5G modems. This demand will mean that these companies will supply more, which will increase their profitability.

At the same time, a chip manufacturer like Intel has been ruled out because it will not have a 5G model ready for the foreseeable future.

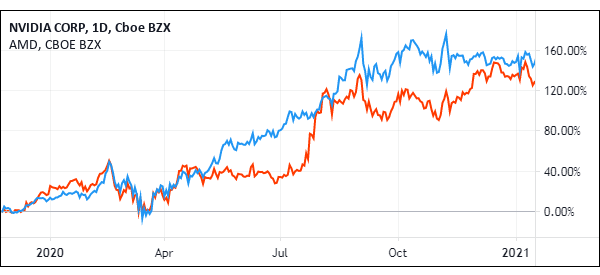

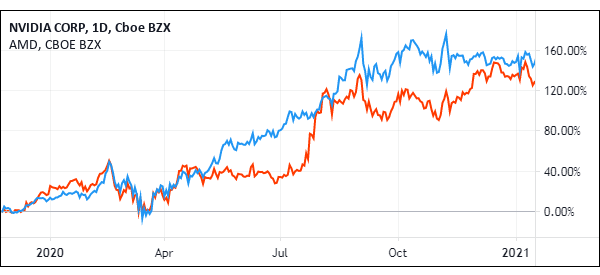

Another chip company that will benefit will be Nvidia. This is a company that has been creating chips designed for the internet of things.

Other chip companies to watch out for are Xilinx, Micron, Advanced Micro Devices (AMD), and Broadcom among others.

Payments and Networking

In addition to chips, payments are likely to increase as cloud transactions continue to grow. If this is the case, then companies like Square, Visa, Mastercard, and Paypal will continue to grow.

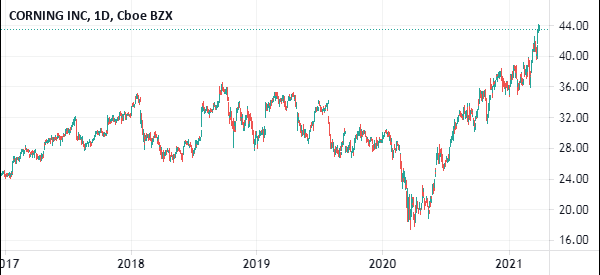

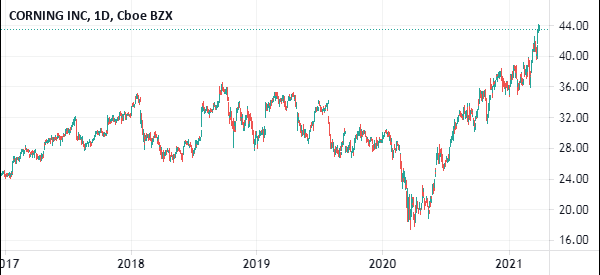

Another company that will likely see increased growth will be Corning. This is the biggest manufacturer of optic fiber, which is the backbone of the 5G network.

Networking companies like Cisco, Barracuda Network, Ericson, and Alcatel, and Aruba networks will see growth.

Mobile Devices

Mobile devices companies like Apple and Samsung will likely see growth as demand for 5G devices increase. This is because the users will continue to demand faster devices.

On the other hand, companies like AT&T, T-Mobile, Verizon, and China Mobile will be critical for the industry. However, unlike the others, these companies will need to update their networks. This will happen at a time when the companies have taken a lot of debt to acquire content companies. Therefore, the returns to shareholders will likely be reduced.

We just introduced some of them in our post on 6 fields on which you should think about investing for Future Trends

How to day trade 5G stocks

We have already looked at some of the companies that will benefit in 5G from an investors’ standpoint. Since most of our readers are traders, how can they use this information?

First, you should pay close attention to 5G spectrum bidding. In early 2021, the UK carried out its auction, which ended being less costly than initially feared. This led to some substantial gains in stocks like BT Group and Vodafone. You should follow these headlines carefully.

Second, you should look at any 5G-related news since it will move the respective stocks. For example, in 2020, shares of Ericsson and Nokia rose after several countries like Australia and the UK banned Huawei from their implementation.

Finally, you should always use fundamental, technical, and price action strategies to day trade 5G stocks.

Final thoughts

In this article, we have looked at what 5G is, its benefits to individuals and companies, its role to traders, and some of the companies that will benefit.

In summary, network devices manufacturers like Nokia, Ericsson, and Huawei have already started to benefit. Similarly, chip companies like AMD, Intel, and Taiwan Semiconductor will benefit.

External Useful Resources

- 5G Technology: How the Push for 5G Will Affect the Stock Market – TimothySykes