There are many trading strategies used by traders in the financial market. These strategies are divided into technical and fundamental analysis.

In technical, traders use a combination of technical indicators like moving averages and Bollinger Bands to make decisions. In fundamental analysis, they use the news and other economic data. The indicators regularly used here are interest rates, inflation, confidence numbers, and employment numbers.

News trading, here, is one of the most popular strategies in the financial market. It is so crucial because news is often the most common driver of assets like stocks, currencies, and commodities.

Some traders have achieved success by just focusing on news. Others have succeeded by combining news with other strategies like trend-following, reversals, and arbitrage.

This article will look at the concept of news trading, how it works, why it matters, and some of the pros and cons.

What is news trading?

As the name suggests, news trading is a strategy that involves looking at news to determine whether to buy or short an asset. News can range from a company’s earnings to CEO appointments, to economic data.

News can be positive or negative (day traders and scalpers can benefit from both). Some of the top negative news include bankruptcy filings, product flop, and an investigation by an entity like the Securities and Exchange Commission (SEC).

Some of the top positive news are a successful product launch, entry of an activist investor, an acquisition, and higher oil prices (for energy companies).

A news event can have major implications on a stock or any other asset. In some cases, a company’s shares can go up or down by more than 50% after publishing its earnings.

A good example of all this is shown below. In this chart, we see that FarFetch shares dropped by 13.26% in a day. It was down by 86% YTD in 2023 and by 97% in five years.

In most cases, a 13% stock drop usually happens after a company generates negative news. Therefore, a simple search in Google News shows that the stock dropped because the company was on the verge of collapse.

News is useful for both long-term investors and day traders. Day traders use news to find entry points for an asset. While long-term investors are prepared to weather short-term volatility, others can use emerging issues to exit their positions.

For example, Warren Buffett has held a position in Coca-Cola for more than 30 years. In this period, the company has had some negative and positive news, which Buffet has ignored. However, he used some news events to exit his losing position in IBM.

How news affects trading decisions

News has a major impact on a person’s trading decisions. It does this by changing the sentiment of an asset among investors and traders towards a company.

For example, if a company’s stock has been in a downward trend for long, a positive earnings report can help to change sentiment among investors.

News can also have a negative implication for a financial asset. A good example of this is when a company publishes financial results that show falling revenues and profitability. In this case, traders and investors can exit their positions in search for better opportunities.

In technical terms, news can lead to a continuation or a reversal. Continuation is a situation where a stock in an uptrend continues rising after a major news event. A reversal, on the other hand, happens when an asset changes direction.

In other words, news can validate a person’s bullish or bearish view of a financial asset. In other periods, news can see them change their minds about the assets.

How to trade the news

Broadly, there are two main ways in which you can trade the news: fundamental analysis only and in combination with technical analysis.

The fundamental approach is a situation where you focus on using news events to make decisions. For example, you can decide to trade in the direction of the news event. This approach is commonly known as gap and go.

The other strategy is where you use the current news event and combine it with technical analysis. For example, you can do a multi-timeframe analysis to find support and resistance levels.

Types of news

There are many types of news in the financial market. News can be broadly divided into two: breaking news or scheduled news.

Breaking news are events that come out of nowhere, meaning that they are unscheduled. Some examples of breaking news are M&A deals, death or sudden resignation of a CEO, an investigation by a regulator, and a product failure.

Scheduled news is already expected by market participants. These news events can be found in key calendars like:

- earnings

- splits

- economic calendars.

Some of the top scheduled news events are earnings, inflation, jobs, and retail sales data.

Economic news

One popular type of news is known as economic data. These numbers have implications on all assets, including stocks, cryptocurrencies, and currencies.

The implication comes from their impact on central banks like the Federal Reserve and the European Central Bank (ECB). You can use the economic calendar to see a schedule of these numbers.

The most popular numbers to have in mind are inflation, jobs, GDP, retail sales, and industrial production.

Corporate earnings

Publicly traded companies are required by law to publish earnings, either quarterly, annually, or biannually, based on their countries. In the US, they are required to publish their results every quarter.

In most cases, stocks tend to either drop sharply or rise after publishing their financial results. This happens because results provide investors with an overview of how the company is performing.

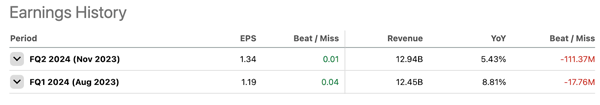

There are several things to watch when a company publishes its financial results. First, it is the headline revenue and EPS figures. Traders want to see whether a company has beaten the estimates by Wall Street analysts.

Second, they look at the company’s guidance of its future performance. Further, they listen to the earnings call to hear the initiatives the management is making.

A good example of this is in the Oracle chart below. As you can see, the stock dropped sharply after publishing two consecutive results.

In the chart below, we see that the stock crashed because the company’s revenues came short of analysts’ expectations.

Geopolitical events

The other important news event that impacts financial assets is based on geopolitics or relations between two or more countries. These events can have a major implication on companies, currencies, and commodities.

A good example of geopolitics was Russia’s invasion of Ukraine in 2022, which led to a sharp surge of oil and natural gas prices. As these commodities rose, companies that deal with them saw robust performance, which lifted their share prices.

Another potential geopolitical event will be China’s invasion of Taiwan. The impact will be substantial because of the role that China plays on the global economy since it is the biggest manufacturer and purchaser of raw materials.

If the invasion happens, chances are that many stocks will crash because China is their biggest market.

Central bank decisions

Central bank decisions also have a major impact on stocks and other assets because of their impact on money supply. In most cases, stocks tend to jump after the Fed (and other central banks) cuts rates and vice versa.

In 2022, stocks plunged as the Fed, ECB, and Bank of England decided to hike interest rates at the fastest pace in years.

Central bank decisions are based on economic data. Some of the most popular news that have an impact on companies are inflation, jobs, manufacturing activity, and consumer confidence.

News trading strategies

Separating the news – The economic calendar

This is an important tool used by traders because it provides a schedule for the economic events. The calendar is very accurate and is usually customizable according the data and their importance.

For example, while the interest rates decision by the Federal Reserve reverberates throughout the market, that of a smaller central bank like Ghana or Kenya has no impact in the overall market.

At the same time it would be irrelevant for a trader specializing in American equities to have South African economic data. This is simply because South Africa does not have a major impact on the American financial market.

To use the calendar well, it is recommended that you do a few things:

- Always check the calendar before the trading day; this will help you know more about the events that you expect.

- Look at the trends in the specific data. For example, if you are expecting employment numbers, you should expand the chart to show the recent trends in the chart.

- Clean the calendar by removing the unnecessary pieces of data. You can do this by removing the countries that you don’t follow and the economic data that does not have major impacts.

Today, these calendars can be accessed very easily. There are applications that only focus on the economic calendar. In addition, all the major financial news websites contain a calendar.

Another type of calendar is the earnings calendar. This is particularly important for traders involved in equities and indices.

However, be careful to choose your resources wisely and rely on a small number of them. Having too much data, particularly if discordant, can cause you confusion.

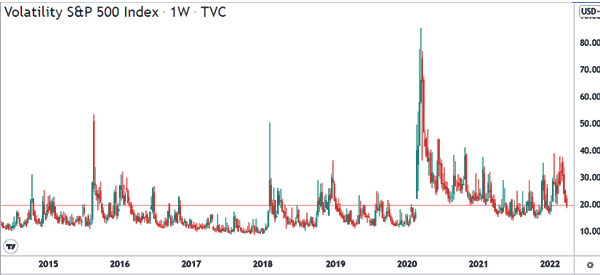

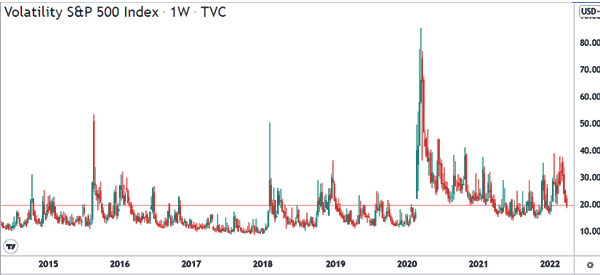

Spikes

When a major financial data is released, there is usually a lot of volatility in the market. For instance, when the Federal Reserve increases the interest rates, the market will always react. This reaction can be a blessing to those who were right in their prediction.

It could also be catastrophic to traders who missed the prediction. In fact, the period when the data is being released is the most volatile period for traders.

Related » How to Trade with High Volatility

We provide you an example.

We have put in the chart 4 lines (red, white, yellow, and pink). The red vertical line shows where the time when the news comes. A trader can do the following so that he can benefit from the trade regardless of what the news is.

- Set a pending order (BUY) at the yellow line.

- Set a pending order (SELL) at the pink line.

- The pink line should be the stop loss for the buy position.

- The yellow line will now be the stop loss for the short position.

In this case, if the news is positive, it will take the chart high. This will be a win to a trader who placed a buy position. If on the other hand the news will take the chart down, the trader will lose but he will be covered by the pink stop loss.

By using this simple strategy, it will be possible for one to make a good return regardless of the news.

Another important strategy to use when major news is to wait. In fact, unless one has a lot of experience as a trader, it is usually advised to avoid trading during the time when data is coming out.

For equity traders, the earnings calendar can be an important tool to speculate. For instance, if financial institutions such as Morgan Stanley, JP Morgan, and Citi released weak reports, then it would be a good idea to speculate that Bank of America’s results will be weak too and short it before the earnings.

Buy the rumor and sell the news

This is one of the most popular approaches in trading the news. It usually happens when there is an underlying rumor in the market about something. In most cases, a stock or crypto tends to rise ahead of the news event and then it dips after the news is confirmed.

A good example of this is shown below. In it, we see that the XRP price jumped sharply after the SEC lost a major case against Ripple Labs.

In an ideal situation, you’d expect the cryptocurrency to continue rising. Instead, the opposite happened as the token continued falling.

Fading the news

In most cases, news events tend to have major implications on financial assets like stocks and forex pairs. However, it is general knowledge that investors tend to exaggerate some situations based on fear and greed.

A good example of this is in the chart below, which tracks the SPDR S&P Regional Banks ETF. As the chart shows, the ETF plunged hard after the mini-banking crisis in 2023.

It dropped as investors feared a widespread collapse of regional banks, which did not happen. Therefore, the ETF then staged a strong recovery during the year.

This example is based on longer-term events. However, it can also be used to trade short-term movements of stocks and other assets. Fading is also known as a contrarian approach since it attempts to move against a broad trend.

Breakouts

The other news trading strategy is known as breakouts. A breakout is a situation where an asset moves sharply above or below a certain resistance or support level. In most cases, a breakout can happen after a major news event.

There are several approaches to trade this breakout approach. For example, you can use multi-timeframe analysis to find potential support and resistance levels. Also, you can decide to follow the new trend formed after a breakout.

A good example of this is in the chart below. As shown, the stock found a strong resistance at $10.80 in early 2023. It then made a bullish breakout in March, after the company published encouraging news.

After news trading strategies

In most cases, you will miss the initial price movement after a major news event. Therefore, most strategies focused on the news aim to take advantage of these events.

Some of the top after-the-news strategies are following the trend, fading the new trend, and scalping the news event.

Pre-market trading strategies

Most people who succeed in trading news events do so by focusing on the pre-market and extended hours because this is when most of them come up. Companies release their earnings mostly in the extended and pre-market.

One of the approaches to use in this is placing pending orders, which are executed at predetermined levels. For example, if a stock is trading at $10 and has earnings coming up, you can place a buy-stop at $11. In this case, the buy-stop trade will be executed if the price moves to that level.

Breaking News Approach

The good thing about the calendar is that it tells you about what to expect. However, there are other news that you don’t expect.

For example, when there is a major earthquake, there are usually impacts to the markets (or other exceptional events). It is worse because no one can accurately predict when an earthquake will take place.

Therefore, it is very important for you to be among the first people to receive the news. There are a few ways to do this.

Be on Twitter/X

Twitter is where most traders get their information. Here the 15 Best Trading Accounts and 7 Best Day Traders to Follow on Twitter.

Have access to the latest news by watching financial media. Two of the best sources of news are Bloomberg and CNBC. If you don’t have the channels at home, you can stream them online (Bloomberg and CNBC).

Look at the local news

For example, if you are an oil trader, you should spend time reading local news from countries like Saudi Arabia, Nigeria, and Venezuela. Before the news makes global headlines, it is first reported by the local news agencies.

Funny enough, most sophisticated investors rarely get this news because they depend on large news agencies like Bloomberg and Reuters.

Know how to interpret the data

For example, when there is an earnings release, most uninformed traders tend to trade using the headline numbers. In this, they ignore the important numbers that traders focus on.

For example, the revenues and EPS of a social media company might beat the estimates but if the user growth slows, the company will see the stock price falls. The same happens to investment banks where traders look at the trading revenues.

Related » The Best News Sources for Your Trading

Risks and challenges of news trading

There are some risks when we decide to focus our approach on news analysis, including

Market volatility

Financial assets tend to have heightened volatility after a major event. While volatility is a good thing to many traders, it can also lead to major issues, especially when you are already in a position.

Slippage

Slippage is a situation where a trade is executed at a different price than the one you placed it at. While slippage happens at all times, it often occurs in periods of high market volatility. This means that your profits can be impacted.

Emotional issues

In most cases, news events can have an emotional impact on a person, which can see them make bad decisions.

For example, if a company publishes strong earnings, the main assumption is that it will continue doing well. However, in reality, the stock can drop sharply when this happens.

False signals

In the era of social media, it is possible to make decisions based on false news events. For example, in October 2023, Bitcoin surged after a false report noted that the SEC had approved an ETF.

How to be effective in news trading

Like all trading strategies, using the news is not easy and it takes research and analysis to do it well. Here are some of the top strategies that will make you effective in news trading in the financial market.

- Research before you enter a position – Study the relevant news and consider all scenarios before you start a position.

- Study historical data – Always study historical data before you enter a position. Multi-timeframe analysis is one of the best approaches to do this.

- Relations between news and price movement – Further, study about how certain news events affect an asset price.

- Risk management – Like with other approaches, always embrace risk management strategies when using this strategy that involves news.

FAQs

What types of news do day traders focus on?

Is it advisable for beginners to do news trading?

How can traders educate themselves about news trading?

What is the difference between unexpected and scheduled news?

How can I avoid information overload?

Which are the top sources of news in trading?

More Useful Tips to Do News Trading

- Learn more on Investopedia

- Further Information Visit this Link Dailyfx