Raymond Dalio is one of the most successful hedge fund managers. He manages the biggest hedge fund with more than $168 billion in assets under management (AUM).

Ray is known for his deep analytic skills, knowledge on the financial market, and his economic model. He has published a long paper titled ‘how the economic machine works’. In this paper, he describes the cyclical nature of the financial market i.e., the market will always move in cycles.

He mentions three key cycles:

- bullish

- bearish

- sideways.

In the bullish cycle, the market is generally on the rise while the bear market is the opposite. When a market is stagnant, it means that there are no major movements.

Making money in the bullish market is pretty easy. Just buy assets and wait for them to appreciate. Here, instead, we will highlight five key strategies to help you make money in a bear market. First, though, some very useful definitions and basic concepts.

What is a bear market?

A bear market is a period when stocks are in a falling cycle. A real bear market is defined as a period when an asset such as stock or commodity has declined by more than 20% from its highest point.

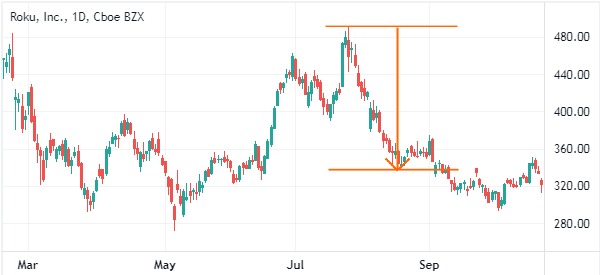

For example, the chart below shows that Roku shares have declined by about 31% from their YTD high. This means that they are in a bear market.

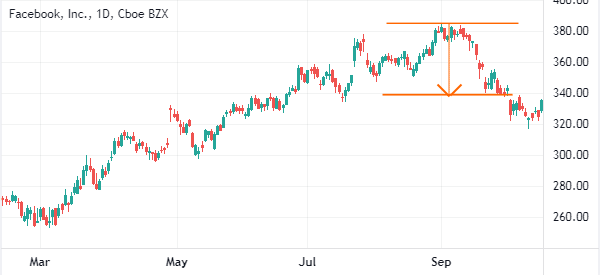

Another term often used to mean the same thing is known as a correction. A correction happens when an asset price declines by more than 10% from its highest level. In the chart below, Facebook can be said to be in a correction zone since it has fallen by more than 10% from its high.

Causes of bear markets

There are many causes of a bear market in stocks. Among the most popular are:

- Earnings – Some stocks move into a bear market after they release disappointing results or issue a weak guidance.

- Bad move by a company – At times, a stock can move into a bear market if investors believe that a company has made a bad move such as an acquisition.

- Legal issues – A stock can move into a bear zone because of legal issues such as when it has been sued by the Justice Department or by customers.

- Technical reasons – A stock can move into a bear market because of technical reasons such as when it moves to an overbought level.

- Monetary policy – A stock can decline sharply after the central bank decides to raise interest rates.

Other reasons why a stock can move into a bear zone are rising cost of doing business, management change, and slowing growth.

Phases

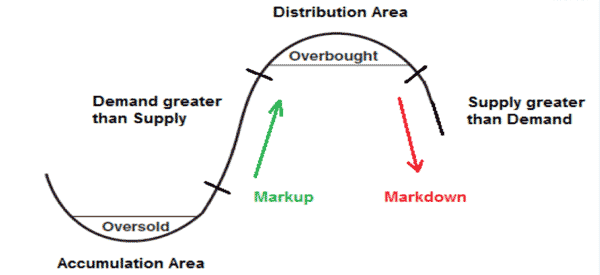

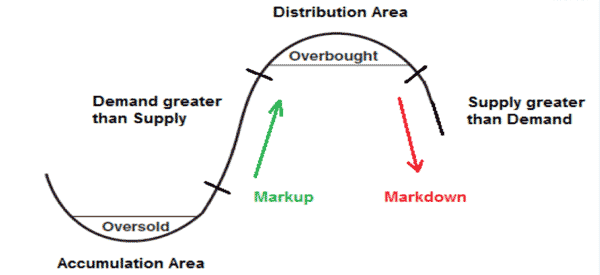

The Wyckoff method is one of the best methods that explains how a bear market forms. The model describes how bull runs happen and how they reverse into a bear market. At first, a stock starts rising while it is not getting a lot of attention. It then moves into a phase of accumulation when build starts to build.

In the third phase, the stock starts to become a bit volatile. As this happens, the smart money starts to exit the trades. Finally, it moves into a distribution phase where panicked investors start to sell their holdings. The chart below shows how this happens.

Trading Strategies for Bear Markets

#1 – Pairs Trading

No one really knows when the market has entered a bear market. If they did, then investors would not have made the losses they made in 2007/08.

The best way to remain protected when trading is to hedge every trade that you make. Pairs trading is the art of buying and selling at the same time.

For instance, gold and the dollar have an inverse correlation. Therefore, opening a buy and sell position of gold and dollar will help you limit the losses you make. However, it is important to note that pairs trading will not always work.

» The Best Currency Pairs to Trade

#2 – Multi-Sector Diversification

Diversification is another important strategy to beat the bear market. Diversification is the process of buying ‘assets’ in various sectors.

For instance, if you are an equities trader, you can buy financials, defense, and utilities. This will help you remain protected if one sector underperforms. Also, you can diversify by trading various items such as commodities or currencies.

However, you should do intensive research before you buy or short any item. Doing this will put your account at risk.

» The Power of Diversification in Day Trading and How to Diversify a Currency Portfolio

#3 – Quantitative Trading

In 2008, many investors lost money and more than 700 hedge funds went down. In 2015, more than 900 hedge funds went down driven by increased market volatility and low oil prices.

Ironically, these two years have been the best for James Simmons the founder of Renaissance Technologies. In 2008, he returned 82% while in 2015, he returned 17% net of fee when many funds posted negative returns.

Ken Griffin, the founder of Citadel, one of the largest high-frequency trading companies was the best performing hedge fund manager according to Institutional Investor magazine.

Most trades these days are implemented using quant strategies. Therefore, it is important to learn how to implement quant trading strategies.

#4 – Day Trade

In the financial market, you can do three things. One, you can day trade where your estimated duration of a trade is less than one day. Second, you can swing trade where you open trades to last for a few days. Finally, you can decide to become a long-term trader where you open trades to last a few weeks or months.

» What type of Trader are you?

To make money in a bear or a highly volatile market, we recommend that you use a day trading strategy. This is because it will shield you from huge market moves.

For instance, if there is a huge data coming out such as the non-farm payrolls, day trading will help you avoid being caught up in a trade. Also, day trading will help you trade on the news.

#5 – Move with the Trend

As a day trader, the trend is your friend. The goal of any trader is to enter a buy position when a new up-trend is developing and exit once the trend is reached (learn how).

Unfortunately, no person can accurately predict when the new trend is forming. However, using a number of tools such as the Average Directional Index (ADX) and the Moving Average one can tell whether the trend formed is strong or not.

If you believe the trend has formed in either way, you should enter and take profits as soon as possible.

How to trade stocks for bear market

Reasons for the rout

Nowadays there are many conditions that could facilitate this. One, China is seen as the lead reason why world markers have fallen to the bear territory. As the second largest economy in the world, the Chinese market is very important in terms of production and consumption.

China is the leading producer and consumer of all the world’s commodities. Therefore, a slow down on the economy has significant impacts.

The second main factor is oil. In past years, the global oil prices gave fallen by more than 10%. Crude oil was traded at the lowest levels in last 15 years. This has therefore impacted the oil producing countries.

Last but not least, the fed decision to hike interest rates has contributed to the uncertainty in the financial markets.

Strategies available

While these underlying issues have led to major losses in the financial markets, the fact is that wise day traders have not suffered these losses. This is because day traders have an opportunity to trade in either directions.

They are also in a good position to open and close trades within a very short duration. This is a key advantage to bring a trader than to investing for the long term (value investing).

Using the Asian markets

As a day trader, you can trade various instruments. These instruments include: commodities, stocks, currencies, and indices.

Global financial markets on the other hand open during different times of the day with the Asian markets being the first to open. These markers are very correlated such that what happens in Asian markets usually has spillover effects to the American and European markets.

For instance, if the Asian markets fall, American and European markets will also fall. Therefore, a day trader can easily short the Dow, S&P or the NASDAQ.

Also, a day trader can easily buy gold or treasuries with the expectations that the two will rise. It would be wise to work out a correlation study to establish which asset classes have these correlations and allocate capital accordingly.

Technical analysis

For intraday traders, technical analysis is very important. Luckily, there are hundreds of technical indicators that can help you identify positions to enter and exit trades. Even in a bear market, there will always be opportunity open buy positions. The vice versa is also true.

The best technical indicators we recommend you to use are:

- moving averages (exponential averages in particular)

- parabolic SAR

- relative strength index

- stochastic.

There are however more indicators that a trader can use to determine when to enter and leave positions.

» How to master Technical Analysis

Summary: is it possible to gain in a bear market?

Bear market is a situation where stocks fall sharply in a short period of time. This is very unfavorable for investors, but can be exploited by day traders to generate profits.

We have seen some strategies and data that can help us; however, we recommend to switch to the demo platform to avoid some mistakes due to high volatility.

External Useful Resources

- Discover the meaning of Bear Market on Investopedia

- Differences between Bull and Bear Market on MoneyInstructor