A bear market is defined as a period when a financial asset such as an index, stock, or cryptocurrency price has slumped by 20% from its highest point. This period can be a difficult one especially for investors who are long the asset.

In this article, we will look at some of the best bear market strategies to use as a trader and investor.

What is a bear market?

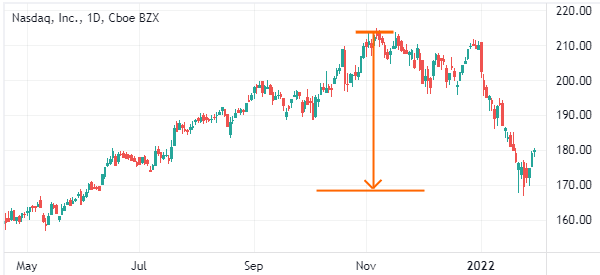

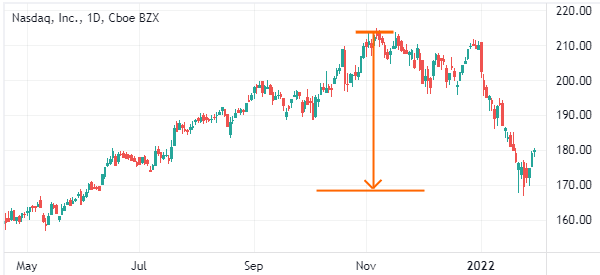

As mentioned, a bear market is a situation where a stock or any other asset has declined by 20% from its highest point in a certain period. A good example is shown in the Nasdaq stock below. As shown, the stock surged to an all-time high of $215 in 2021 during the bull market.

However, in the first month of 2022, the stock crashed to a low of $167, which was a 22% decline from its highest level in 2021. As a result, this situation can be described that the stock is in a bear market.

Another common situation is known as a correction. It is a situation where a stock or any other asset declines by about 10%.

So, let us look at the main reasons why assets move into a bear market and then identify the common strategies to use.

Related » What is a bull market

Why do assets move to a bear market?

There are several reasons why a financial asset could drop to a bear market.

Earnings

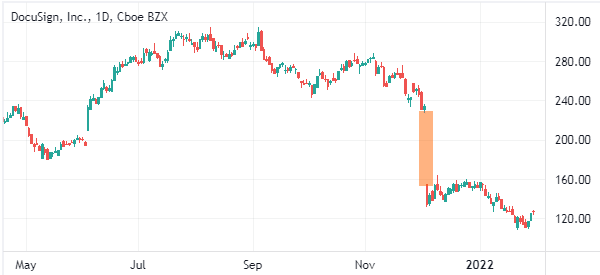

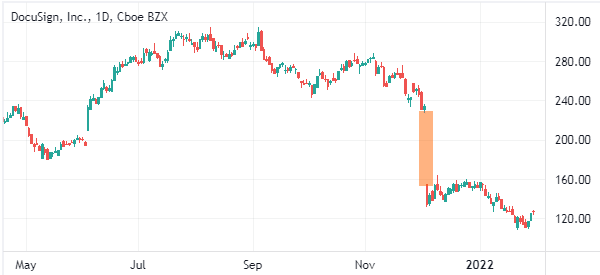

At times, a stock could drop to a bear market after it delivers weak quarterly results. The situation is usually more severe when analysts had higher hopes or expectations that a company will have strong results.

The chart below shows that the DocuSign stock declined by over 30% in a single day after it published weak results.

Federal Reserve

The Fed is an important player in the financial market. At times, the financial market tends to decline sharply if the Fed suddenly changes its tone about the market.

Historically, investors love it when the Fed has embraced an easy-money policy. Therefore, when the bank changes its tune, they tend to exit risky growth stocks.

Management change

At times, a company could sink to a bear market after it announces a change in management. For example, if a company’s CEO dies or when a beloved executive dies, investors could sell shares in the firm.

Sector challenges

A company or the broader market could sink to a bear market because of sector issues. For example, in 2020, oil and gas shares declined sharply as the price of crude oil declined sharply.

Similarly, in early 2022, electric vehicle companies like Rivian and Lucid sunk into a bear territory as investors started to worry about valuations.

There are other reasons why a financial asset could sink to a bear market. For example, a product challenge and an investigation could push a stock to a bear market.

Bear market strategies

Now that you have understood the causes of a bear market, let us shift focus to some of the strategies that you can use as a trader or investor.

Find value

One approach when investing in a bear market is to look at good companies whose shares have declined sharply recently. For example, in early 2022, the Nasdaq 100 index dropped sharply as investors started to price in a more hawkish Federal Reserve.

At the time, a closer look at its constituent companies showed that most stocks were down by more than 10%. However, a closer look at specific names showed that some quality companies had declined sharply.

These include companies like Microsoft and Salesforce that are known for their high cash flows. Therefore, if you are a long-term investor, buying into these stocks will be a good strategy.

Dividend stocks

Another approach to use in a bear market is to simply hold companies that pay a good dividend. Ideally, when dividend stocks decline, their yield usually goes up. Therefore, you can hedge your risks by investing in good quality companies that pay a good dividend.

Shorting assets

The best thing about the financial market is that you can make money when stocks are rising and when they are falling. In an upward market, you buy an asset and wait for its price to rise. On the other hand, in a bear market, you short an asset and wait for its price to decline.

Therefore, if you believe that the bear market will continue, then you can take advantage of the situation and short them. There are several ways of doing that. The most common these days is to use leveraged exchange-traded funds (ETFs). These are ETFs that use derivatives to amplify profits.

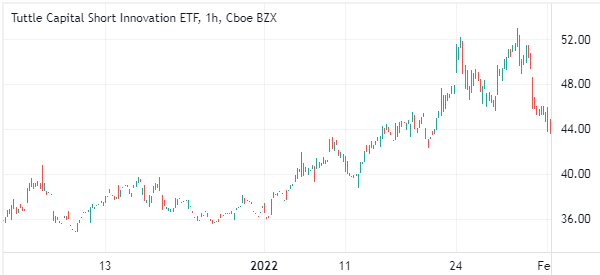

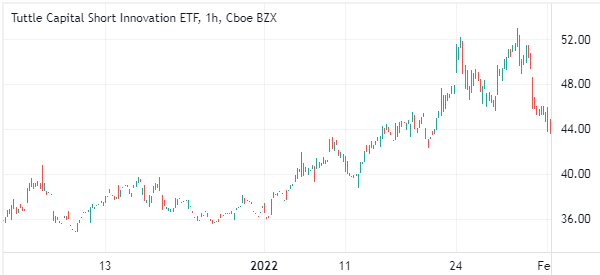

There are also inverse leveraged ETFs that benefit when the price of the main ETF declines. For example, Cathie Wood’s flagship fund is the Ark Innovation Fund. While the fund did well during the pandemic, its price crashed in 2021 and 2022. As it dropped, the Tuttle Capital Short Innovation ETF (SARK) jumped to an all-time high.

Using technical analysis

The next key strategy to make money in a bear market is to use technical analysis. This involves using technical analysis tools like moving averages and Relative Strength Index (RSI) to determine when to enter.

For example, you could use the trend-following strategy and embrace the moving average to determine what to sell and when to exit.

Other tools that will help you out in a bear market are the Fibonacci retracement. This tool will show you some of the key levels to watch out.

Final thoughts

In this article, we have looked at what a bear market is and its causes. We have also looked at some of the best strategies to use when the situation happens.

As we have seen, this situation is very hard for long term investors, while day traders can make a profit by being careful. But always with an eye on the risks involved.