Bear and bull traps are popular events in the financial market. They refer to sudden moves that entice traders to short and sell and then lead to another sudden reversal.

In this article, we will explain a bear trap, how it works, how to identify it, and how to position yourself well.

What is a bear trap?

A bear trap, also known as a bear trap pattern, is a situation where a financial asset suddenly crashes, lures short-sellers, and rebounds.

A short-seller is a trader who seeks to benefit when an asset’s price is falling. It involves borrowing shares, converting them into cash, and waiting for the price to drop.

Therefore, when a bear trap happens, it usually leads to a loss. In an extreme situation, this trap can lead to a margin call, where the broker requires additional capital to cover the loss. If no additional capital is added, the broker will just stop the trade.

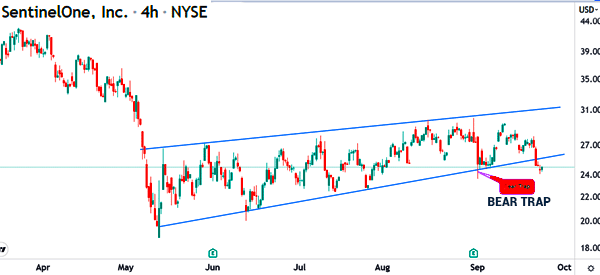

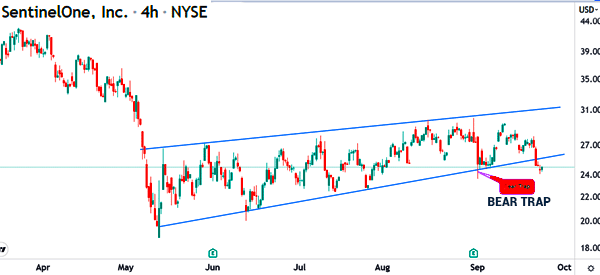

A good example of this is shown in the chart below. As you can see, the stock made a strong bearish breakout and then resumed a short bullish trend within a short period.

Related » How to Identify False Breakouts in Day Trading

How this trading trap works

A common question among many traders is on how a bear trap works. This happens when a stock is either in a consolidation phase, when it is in an upward trend, or when it has formed a pattern like a descending triangle or a double bottom pattern.

In this case, the stock will have a strong dip and then lure many traders who will believe that a new bearish trend has started. After this, the stock then makes a sharp turnaround and starts a new bullish trend or continue with an existing one.

Bear trap vs bull trap

The opposite of a bear trap is a bull trap. A bull trap refers to a situation where a financial asset like a stock or a cryptocurrency spikes, and then turns around and resumes a bearish trend. As such, people who buy the initial pop are usually left with substantial losses to deal with.

Bull and bear traps happen in different market periods. For example, the traps can happen when a stock is moving in an upward or downward trend. They can also happen when an asset is in a consolidation phase or when it is forming a chart pattern.

A good example of a bull trap is shown in the chart below. As you can see, the stock made a strong bullish gap, tempted some people to buy, and then had a strong reversal.

Related » Do You Fall For These Day Trading Traps?

Bear trap vs short selling

Another common question is on the difference between a bear trap and short-selling. The former happens when a stock makes a bearish breakout and then makes a u-turn suddenly.

On the other hand, short-selling is the process of selling a stock and waiting to profit as its price drops. It is the opposite process of buying a stock and benefiting as its price rises.

As can be easily guessed, short sellers should definitely avoid falling into a bear trap. Or they must be good enough to anticipate the reversal (not so easy task) of the bearish trend.

Causes of a bear trap

This situation can be caused by several factors. In most cases, a bear trap happens when there is a major event or economic data in the market.

For example, in stocks, it can happen after a company publishes earnings, makes a major acquisition, and launches a new product.

Stocks

For example, if a company publishes strong earnings, the theory is that its stock should rise sharply. Why shouldn’t it? After all, the results are positive.

However, in most cases, a stock can decline since institutional traders look for several things like forward guidance.

Other assets

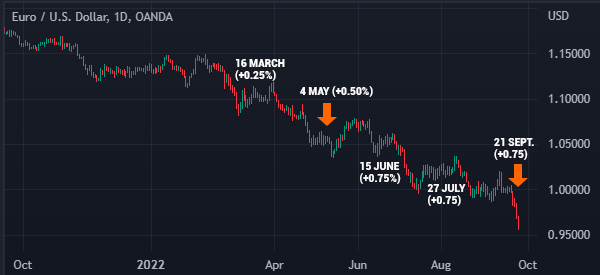

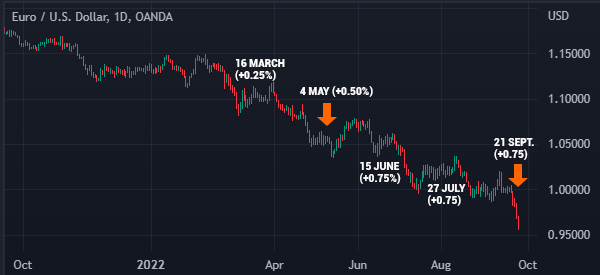

Similarly, in currencies, the EUR/USD pair can rise after the Fed delivers a hawkish interest rate decision. In commodities, the price of crude oil can drop after the US publishes high inventories build up.

Break key levels

Another cause of a bear trap is when a stock moves below a key support and then starts a new bullish trend instead of continuing with the bearish trend.

A bear trap can also happen in a period when a stock is in a bullish trend. In this case, the stock will dip sharply and briefly, and then resume the bullish trend.

How to identify a bear trap

In all fairness, identifying a bear trap is a relatively difficult process since an asset can continue with a bearish trend after it happens.

Still, some traders use several approaches to identify these patterns.

Spot divergences

For example, some traders use indicators to identify divergences. Divergence refers to a situation where the price of an asset moves in the opposite direction of an indicator (or other type of data).

Some of the top divergence indicators to use are the Relative Strength Index (RSI), MACD, and the Relative Vigor Index (RVI).

Market volume

Another approach is to use market volume to identify a bear trap. Most brokers provide tools that show volume of assets.

A closer look at this data can show you whether a bearish breakout will continue. In most cases, if a bearish breakout is not supported by volume, it is most likely a bear trap.

You can also use tools like Fibonacci Retracements and Andrews Pitchfork to predict whether a breakout will stick or not.

Strategies to avoid it

There are several strategies you can use to avoid a bear trap. First, you can embrace patience when there is a bearish breakout. Instead of rushing to short-sell, you can wait for a confirmation of the breakout.

In most cases, a breakout is usually accompanied by a break and retest pattern. As such, it is ideal for you to wait before you execute a short trade after a bearish breakout.

Second, you can avoid short-selling when trading volume is low. Further, since short-selling is riskier than being long, you can avoid doing it altogether.

Related » Short Selling in a Bear Market

Summary

Bear traps are common occurrences in the market. And in most cases, both experienced and inexperienced traders are often caught up in them.

In this article, we have looked at what a bear trap is, what causes it, and how to identify it in the market. So, you should have understand the risks (and benefits) of these types of traps.

Our advice would be to avoid entering the market at such times unless you are 100% sure because the consequences can be painful.

External useful resources

- Is a bear trap the same as a short squeeze? – Quora