Blue-chips are companies that are well known and those that dominate their industries. In most cases, these companies have a substantial market capitalization, pay dividends, buy back a vast amount of their shares, and have a steady business.

In this article, we’ll look at the key characteristics of blue-chip stocks and how you can trade them effectively.

Characteristics of blue-chip stocks

Blue-chip stocks have several characteristics as we have mentioned above. Here are some of these qualities.

- Large market share – Most blue-chip companies have a substantial market share in their industry. For example, a company like Intel has the biggest share in the computer processor industry while Procter and Gamble has a strong share in fast-moving consumer goods.

- High revenue – Blue chips have a high revenue because of their market share. For example, Apple generates more than $200 billion of revenue every year

- Diversified – Most of these companies tend to have multiple businesses. Some of their business comes from acquisitions while others are organic. Again, a company like Apple makes money from selling iPhones, iPads, MacBooks, and Apple Music, among others.

- Dividends and buybacks – Most blue-chip firms use their cash to buy back their stocks and pay dividends.

- High share price – Blue chips tend to be popular among large and long term investors. Also, because of their size, most of their shares trade above $100.

There are other characteristics of blue-chip companies like their slow growth and well-known brands.

In addition to blue chips, there are other popular types of companies, which include:

- Momentum stocks – These are relatively young companies that have fast revenue growth and little profits. Most of them usually target to disrupt large industries. Examples of these companies are Shopify, Okta, and Asana.

- Small-cap stocks – These are companies that have a small market capitalization and market share. Typically, their market cap is usually below $1 billion.

- Penny stocks – These are companies that have a very small market share and a tiny market capitalization. Most of them trade at less than $5.

Example of top blue-chip stocks

There are thousands of publicly traded blue-chip stocks you can trade in the United States. Some of the best known are:

- General Electric – Industrial company with a market cap of more than $105 billion.

- Boeing – An industrial company known for its airplanes.

- Microsoft – A tech giant that offers tens of products like Azure and Teams.

- Visa – One of the biggest financial companies that offers debit and credit cards.

- Molson Coors – A popular beer manufacturer

How to day trade blue-chip stocks

It is worth noting that blue-chip stocks are not created equal. For example, Apple is both a blue-chip and a growth stock because of its services segment. The same is true with Microsoft, which has a fast-growing cloud business.

On the other hand, other companies have little or no growth at all. Examples of these are companies like International Business Machines (IBM) and General Electric (GE). Therefore, you need to view blue chips with different lenses.

Also, because of their nature, most of these companies tend to be relatively boring and therefore, not suitable for day trading.

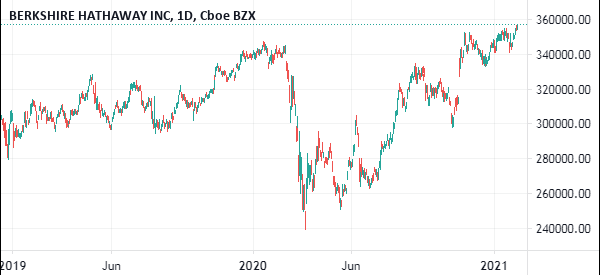

A good example of this is Berkshire Hathaway, a company that has a market cap of more than $500 billion. The firm’s class A shares trade at more than $200,000 and they tend to be relatively passive because most of their holders are institutional investors.

Why are they not always a good option?

Further, because of their sizes, these firms have relatively high share prices. For example, Amazon’s shares trade at more than $3,000 while Visa’s shares are at $190. Therefore, for an ordinary trader, these companies tend to be relatively unprofitable.

For example, if you have a $5,000 account that is unleveraged, it will not make sense to trade Amazon’s or Berkshire’s stock.

In this case, you can select large companies that have a small stock price. And there are many. For example, a company like SiriusXM is a global juggernaut with a market cap of more than $25 billion. But shares trade at just $5! Similarly, General Electric shares trade at less than $10.

Also, you can use brokers that offer fractional shares. This is where you trade only small parts of a share. For instance, if you have $1000, you can buy $0.005 shares of Berkshire Hathaway.

Blue chip stocks volatility

Day traders prefer volatile stocks because of the vast opportunities they create. In most cases, large blue-chip companies are not known for their volatility. For example, in most cases, big firms like Berkshire Hathaway see modest gains every day,

However, it is worth noting that blue-chip companies are not always created equal. Some tend to be highly volatile, especially when there are major events. Some of the most important news that tends to move stocks are earnings, management changes, dividend cuts or hikes, or an analyst upgrade or downgrade.

Therefore, it is still possible to day trade blue-chip stocks using various strategies that don’t rely on volatility. For example, you can use the trend-following strategy, which involves buying or shorting a position and holding it for a while.

Blue-chip stocks trading strategies

There are numerous strategies you can use to day trade blue-chip companies. Some of the most notable approaches are:

- Trend-following – This is a strategy where a trader buys and holds a stock and holds them until a reversal forms.

- Swing trading – This is a strategy that involves either buying or shorting a stock and holding it for a few days.

- Scalping – In this, you simply buy or short stocks and hold them for a few minutes. The goal is to make small profits several times per day.

- Price action – This is a strategy that focuses on an asset’s chart patterns. You can use chart patterns like head & shoulders and rising and falling wedges.

- Breakout trading – This is an approach that focuses on breakouts. Some of the strategies to do this are using the VWAP or moving average. Also, you can use patterns like rectangles.

- Pairs trading – This is an approach that uses correlations. For example, you can buy Chevron and short ExxonMobil and benefit from the spread.

Trading the news

Unlike most momentum stocks, many blue chips are not always in the headlines. For example, companies like Raytheon, CoreCivic, and H&R Block rarely make headlines. Still, some do make headlines every day.

Have a Watchlist

Therefore, to trade them, we recommend that you be on the lookout for blue-chips in the headlines. You can subscribe to our watchlist to identify companies that are making headlines every day. Also, you can use platforms like Investing.com, Market Chameleon, and even TradingView to find blue chips making moves especially in the premarket.

M&A

Most importantly, you can trade blue-chip mergers and acquisitions (M&A). To find growth, most blue chips tend to be relatively acquisitive. For example, recently, AMD announced that it would buy Xilinx while. Salesforce said it would acquire Slack.

These deals tend to be excellent trading opportunities.

Ex-dividend

Another important news common with blue chips is when they go ex-dividend. When this happens their shares usually go up since most participants want to receive the payouts. You can check the ex-dividend company to identify the companies going ex-dividend.

Final thoughts

Blue-chips are excellent companies. Most of them tend to pay dividends and buy back a lot of shares. They also have a substantial market share in their industries.

However, for ordinary day traders, most of these companies are usually not the best to trade-in. That’s because, as mentioned, they have high share prices and they have little in terms of news.

Therefore, we recommend that you trade momentum and other growth companies that tend to have a lot of volatility.

FAQs

Which are some of the best blue-chip stocks to trade?

Is it okay to trade blue-chip ETFs?

What are the blue-chip trading risk management strategies?

External useful resources

- The Benefits of Owning Blue-Chip Stocks – The Balance