Fundamental analysis is an important concept in market analysis. It involves looking at news events and economic data and using this information for analysis. The process is widely used in trading all assets, including cryptocurrencies, forex, stocks, and commodities.

In this article, we will look at the concept of buy the rumor, sell the news, a fairly well-known strategy among traders relying on fundamental analysis.

What is buy the rumor, sell the news?

There are two key players in the financial market: buy side and sell side. Buy side refers to people who execute trades while sell-side are analysts who come up with models and estimates.

For example, in the economic and earnings calendar, you will often see sell-side work in the estimates section.

The concept of buy the rumor and sell the news is relatively simple. It refers to a situation where a stock rises ahead of a major news or events and then it declines sharply when the event happens.

For example, a company’s shares can rise sharply as investors wait for it to publish strong results. The company’s shares will then decline when it releases these strong results.

Similarly, the US dollar can gain sharply as investors wait for a hawkish Federal Reserve. It will then decline even when the Fed decides to sound hawkish.

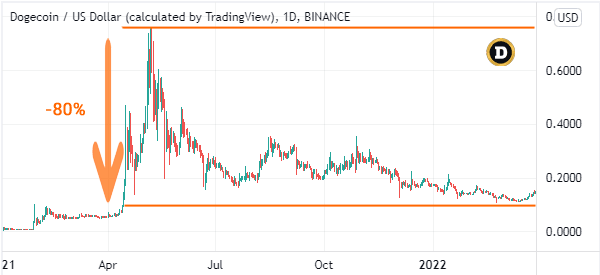

A good example of this situation happened in the cryptocurrencies industry in 2021. The price of Dogecoin jumped sharply as investors waited for Elon Musk to appear on the Saturday Night Live (SNL). The coin then declined sharply after the SNL event.

Sell the rumor, buy the news

Sell the rumor and buy the news is the exact opposite of buying the rumor and selling the news. It happens when an asset price declines towards a major event and then rises when it happens. In most cases, this happens when there is a positive surprise.

How do rumors affect stock market?

Rumors have a major impact on the stock market. They are important because market participants are always attempting to forecast the future.

In the past, we have seen some spectacular rumors that have had important impacts on the market.

First, there is the issue of electric vehicles. With the success of Elon Musk’s Tesla, many investors started focusing on other EV stocks. This explains why shares of companies like Nio, Xpeng, and Lucid Motors did well in the early days.

Second, during the Covid pandemic, vaccine makers like Novavax and Moderna did well. They then started to underperform as vaccine administration started.

There are other examples of when rumors led to a frenzy in the financial market. For example, there are the dot com bubble and the housing crash.

How buy the rumor, sell the news works

Buying the rumor and selling the news works in a very simple way. Buy and sell-side analysts will typically identify a key catalyst of an asset and start coming up with projections.

For example, ahead of earnings, these people will use their experience to predict whether companies will publish strong results. If there was strong merger and acquisition during the quarter, they will believe that companies like Goldman Sachs and Morgan Stanley will do well.

Now, if their prediction is accurate, these traders will sell on the news, which will start a new bearish trend the moment the news event comes out.

The same is true with monetary policy. Ideally, the US dollar index will likely keep rising if investors believe that the Fed will hike interest rates. If it goes ahead and does that, the index will then have a pullback.

These pullbacks happen since the rumor has been confirmed and that they are now shifting to future analysis.

How to apply buy the rumor, sell the news

So, how do you trade using the buy the rumor, sell the news approach? The process is relatively simple. First, identify an asset whose chart is rising. It could be a stock, commodity, cryptocurrencies, and indices,

Second, establish why the asset is moving in an uptrend. In most cases, you will find that there are rumors that are moving the asset. For example, there is a possibility that they expect the firm will publish strong results or the Federal Reserve will sound hawkish.

Now, if you have invested in some of these companies, you can decide to exit before the news comes out. Alternatively, you can place a sell-stop ahead of the news or calendar event.

How traders exploit the situation

Traders use several approaches to buy the rumor and sell the news. One way is to buy an asset towards a major economic event and then exit before the event happens. Another approach is to use pending orders, especially ahead of a major event like earnings.

For example, if a stock is trading at $10 ahead of earnings, you could place a sell-stop at $9 and a take-profit at $6. Another approach is to always add a take-profit and stop-loss for all these trades.

Related » The threat of information overload

Popular buy the news, sell the news events

There are many buy the news, sell the news events in the market. Some of them are:

- Interest rate decision – Assets like stocks and currencies tend to rise or fall ahead of interest rate decisions by the Fed, ECB, and Bank of England.

- Earnings – Shares tend to do well ahead of corporate earnings and then retreat when the data comes out.

- Stock splits – In most cases, companies tend to do well ahead of a split and then lag when the split happens finally.

- Economic events – At times, stocks can do well ahead of key economic events like unemployment rate and manufacturing data.

Summary

In this article, we have looked at what buying the rumor and selling the news is. Also, we have identified some of the strategies to use when trading with the approach.

External useful resources

Buy The Rumor Sell The News: Commodities Pointing Lower After Biden Announces Ban – Forbes