The Chande Momentum Oscillator (CMO) is a relatively rare technical indicator that helps to measure the overall momentum of an asset.

It was developed by Tushar Chande, a technician and scholar with more than two decades in the money management industry. He has developed other trading systems and written several books like Beyond Technical Analysis.

In this report, we will look at how the Chande Momentum Oscillator works, how to use it, and some of the alternative indicators.

What is the Chande Momentum Oscillator

The CMO is a technical indicator that helps traders see whether a stock or any other financial asset has momentum behind it. Ideally, many traders love to buy assets that have a bullish momentum and short those that have weak momentum.

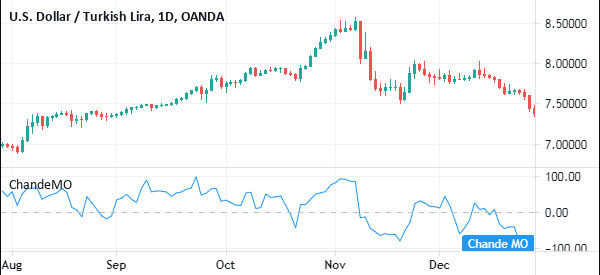

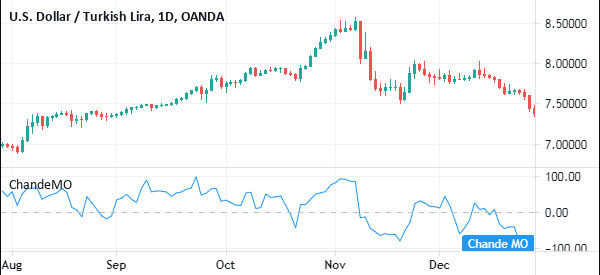

When applied in a chart, the CMO is usually a single line that moves up and down. It has a zero line, which is often the most important part of the indicator. It ranges from minus 100 to positive 100.

The chart below shows a CMO that is applied in a daily chart.

The CMO is available as a built-in indicator in the TradingView. However, it is not built-in in MetaTrader 4 and 5, meaning that you need to download and install it directly from the marketplace.

How this oscillator is calculated

All technical indicators are calculated using mathematical calculations. However, as we have written before, as a day trader, you don’t need to know how to calculate these indicators. Instead, all you need to know is how to apply the indicator and how to interpret it in a chart.

The formula for the CMO is:

| (Su – Sd) / (Su + Sd) X 100 |

The Su is the sum of the difference between today’s close and yesterday’s close. Sd, on the other hand, is the difference between today’s close and yesterday’s close on down days.

How to use the Chande Momentum Oscillator

Using the CMO is a relatively easy process. First, you need to ensure that the chart is trending upwards or downwards. This is important, because, like many oscillators, it does not work well when the price of an asset is ranging.

Second, you need to select the indicator and add the period you want to study. The default in most platforms is usually 9 days.

However, as a trader, we recommend that you spend a substantial amount of time testing different periods to see the one that works well for you. Some will find using a longer period being better than a shorter period.

The chart below shows the 9-period and 28-period Chande Oscillator applied in a EUR/USD chart.

Identifying overbought and oversold levels

The first approach of using the Chande Momentum Oscillator is to identify overbought and oversold levels. An asset is said to be overbought when the oscillator nears 100. In this case, it can be ideal to place a short trade.

Similarly, when it dips substantially, the asset is usually said to be oversold.

However, while this is a popular strategy, at times, it will produce the wrong outcome. In fact, many day traders prefer buying when the MCO is nearing the overbought levels and vice versa. That’s because, when it is in extreme levels, it means that there is a strong momentum behind it.

The zero line

Another approach of using the Chande Momentum Oscillator is to identify the zero line. In this, if the price of an asset is rising and the CMO crosses the zero line, it is usually a sign that momentum is building-up. Therefore, it is a sign to either buy or continue holding the asset.

However, if there is a reversal and the indicator moves below the zero line, it could be a sign to exit a trade.

Similarly, if the price of an asset is falling and the CMO crosses the zero line, it is a sign that the sell-off is gaining steam.

The chart below shows that the USD/TRY pair remained in a bullish trend when the price was above zero. It was also below zero when the price was in a bearish trend.

CMO and EMA crossover

Another way of using the CMO is to combine it with a moving average. In TradingView, you can easily overlay a moving average on top of the Chande Oscillator. It is relatively difficult to achieve that on the MT4 or 5.

The idea is to add an exponential moving average on top of the CMO and identify the crossover levels. In the chart below, we see that the price dropped when a bearish crossover happened and vice versa.

Final thoughts

The Chande Momentum Oscillator is an important tool to use in the market. Some of its advantages are that it is easy to use and that it tends to be relatively accurate. The top cons are that it is not included as a default in most trading platforms like the MT5 and 5.

In addition to the CMO, other momentum indicators you can use are Momentum, the Average Directional Movement Index, Momentum Acceleration, and the Relative Strength Index (RSI).