Short-seller reports are rare events that happen when a prominent short investor publishes reports on their next targets. In most cases, when this happens, the stocks tend to either have a violent move up or down.

In this article, we will look at the best strategies of trading prominent short seller reports.

What is a short in finance

To better understand short-seller reports, we need to understand the concept of shorting. Ideally, there are two main ways you can make money in the financial market. You can buy an asset at a lower price and wait for its price to rise. This is the most common approach partly because the maximum loss you can have is zero.

Shorting, on the other hand, is the process where you want to benefit when the price of an asset falls. Here’s how it works.

Short Sell Example

Assume that the stock price of a company A is trading at $20. After your research, you find that the stock is overvalued and that it will drop to $10.

So, you go to the market and borrow 1,000 shares at the current price and then you sell them. In this case, you will have $20,000 in cash. If your thesis works and the stock drops to $10, you can buy it back. In this case, you will spend $10,000 and return the shares to the original owner.

While the shorting process seems complicated, implementing it in the market is usually relatively easy. You just press a button and leave the rest to your broker.

The only additional cost you go through is the borrowing cost, which can differ from one company to another.

Related » Profitable short selling strategies

What is a short-seller report?

Short-sellers are those market participants that make their money by identifying shorting opportunities. In their research process, their overall goal is usually to identify situations where companies are getting more expensive. They also aim to identify specific problems and highlight them to other investors.

As such, a short-seller report is a document that they publish in the market with the goal of making their case. Their hope is that the stock will then drop.

Many short-sellers are usually small participants in the market while others are large hedge funds. The most notable such fund is Kynikos Associates that is managed by Jim Chanos.

Other short-sellers are small researchers who are paid by hedge funds to explain their case.

Notable short sellers

Most short-sellers are relatively unknown. In fact, most of them don’t publish these reports. The most visible ones are:

- Citron Research – This is a company run by Andrew Left. It is famous for highlighting problems with Valeant Pharmaceutical that moved from $250 to $10.

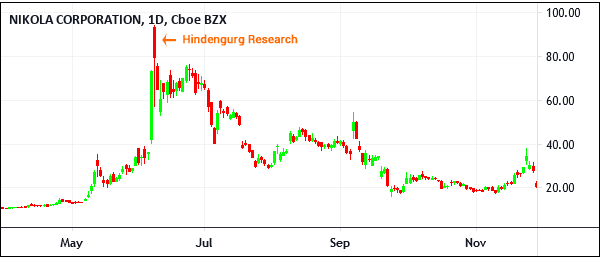

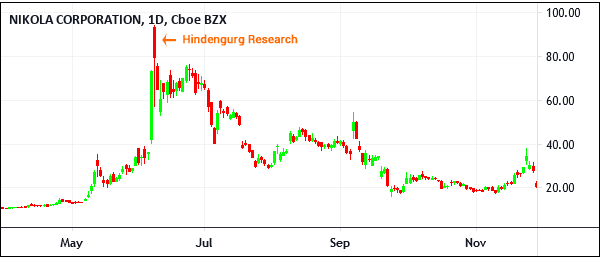

- Hindenburg Research – This is a company well-known for the collapse of Nikola, the hydrogen truck-maker.

- Muddy Waters Research – This is a hedge fund that is well-known for highlighting short opportunities from China.

- Kynikos Associates – This is a hedge fund with more than $1 billion in assets. It is run by Jim Chanos and is short Beyond Meat and Tesla.

- Harry Markapolos – He is a well-known investigator who has covered accounting scandals in General Electric and Enron.

The short-sale rule

The short-sale rule is an outdated rule in the market that expired in 2007. At the time, the rule stated that short-sellers could only place short trades at a price above the most recent trade. The rule was replaced by the alternative uptick rule in 2010.

The new rule states that short-selling is forbidden when a stock is down by 10% in a session. In that period, shorting is only permitted when the price is above the current best bid price.

How to trade short seller reports

How then do you trade these short-seller reports? Let’s go through some simple but efficient tips.

Always be up to date

First, you need to have information on when these short sellers publish their reports. That’s because you want to be the first person to receive information about their documents.

To do this, we recommend that you follow them on Twitter and set notifications on. Also, you should have a trading dashboard that gives you access to the latest information.

Take time to understand

Second, to trade these reports, we recommend that you take time to study them and validate the information. That’s because, at times, the short-sellers are usually wrong.

For example, in a report few years ago, Markopolos published an in-depth report accusing General Electric of accounting issues. While the stock dropped after the report, it bounced back after the company issued its rebuttal.

Check the overall company

Third, look at the overall company being shorted. In most cases, short reports on penny stocks and other small-cap stocks tend to be misleading. Since these companies have a very small following, it means that a short-seller can publish a report to just to push the report lower.

As we have seen, this is unlikely to happen for established companies with a lot of data available to analyze.

What is the Short seller’s reputation?

Further, always look at the reputation of the short-seller. At times, investors place their trust to several short sellers who have gotten it right in most cases. Therefore, you should never apply the same weight to all short sellers. Always look at their track record.

In addition, look at the other investors in the company. A good example of this happened a few years ago when Bill Ackman started his short position on Herbalife. At the time, he hoped that the stock would collapse and make billions in profit.

However, Carl Icahn, a richer investor was in the other side of the trade. In total, Bill Ackman lost more than $1 billion in that trade.

Short interest

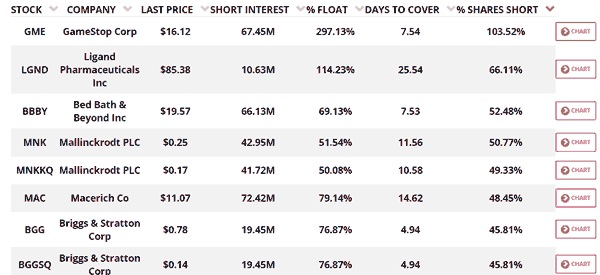

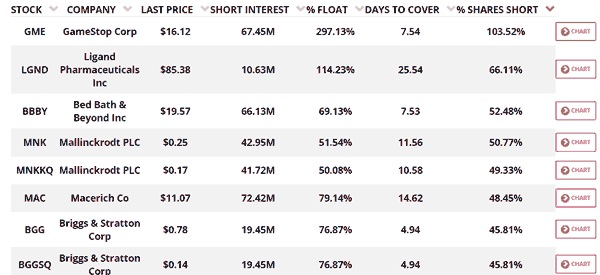

Another way is to look at the short interest of the company. Short interest simply shows the percentage of the outstanding shares that are being held by short investors. The table below shows the most shorted stocks in the market.

There are many websites that provide a list of the most shorted stocks in the market. Some of the most accurate ones are MarketWatch, Yahoo Finance, Benzinga, and Finachill among others.

Visiting these websites and finding the most shorted stocks will help you know those companies to either short or go contrarian on.

Always look at charts!

Finally, always look at the chart and identify potential useful locations. There are several approaches to do this.

For example, you can identify potential Fibonacci retracement levels. Also, you can use moving averages and significant support levels to put your support and resistance levels.

Summary

Short seller reports provide an excellent time to short or even buy a stock. They tend to be high-volume periods where market participants start to reposition their investments.

In this report, we have looked at what shorting is, how to identify short-seller reports, and how to day trade these situations.

External useful Resources

- The Thing You Need to Know About Free Short-Seller Research Reports – The Fool