An economic calendar is one of the essential resources for traders, especially the day traders. It contains a schedule of data releases and news that relate to various sectors and economies.

The economic calendar is an important tool for a trader when conducting a fundamental analysis. That way, the trader lowers the risk of making uninformed decisions that could result in hefty losses.

Brokers understand that the economic calendar is one of the essential tools for profitable trading. As such, most of them avail the resource for free. Bloomberg and Investing.com are some of the sites where you can find an updated economic calendar.

Besides, if you are using TradingView or MetaTrader 5 (MT5), there is an economic calendar integrated into the system.

Components of an economic calendar

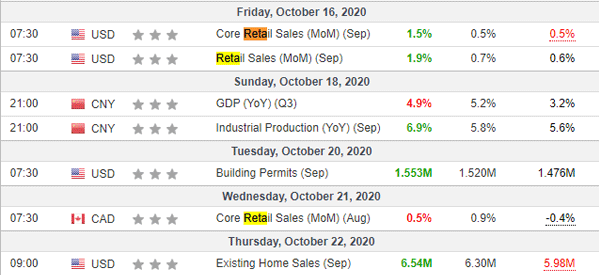

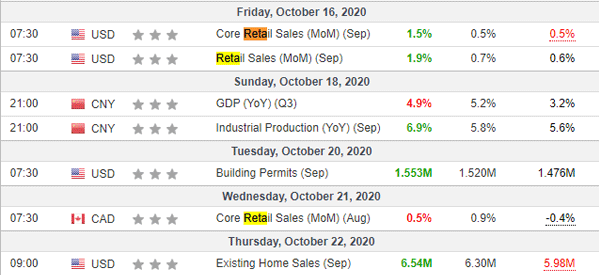

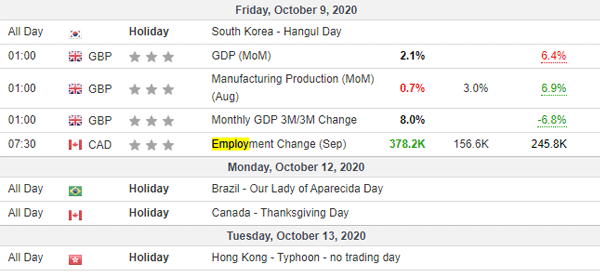

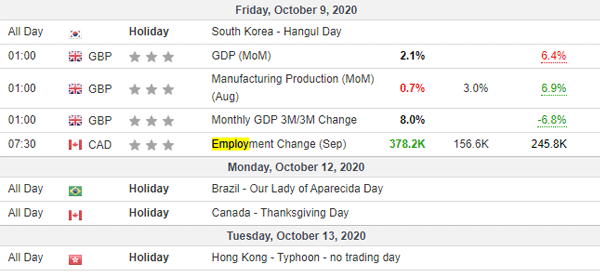

The figure below is an example of a typical economic calendar. It indicates the expected events and the exact time when the data will be released. Besides, you get to see the analysts’ forecast and the previous data. As soon as the data is released, it is included under the ‘actual’ column.

The stars under the ‘Imp.’ section indicate the expected impact of the event. For instance, one star shows that the entity will most likely result in low volatility in the market. On the other hand, three stars are an indication that the event will probably cause high volatility.

An economic calendar has an array of data ranging from events that are industry-specific to those affecting a country’s or global economy. As a day trader, some of the data that you should be keen on are listed below. These are easy trading tips to take advantage from economic calendar.

Types of economic events in a calendar

There are many economic events in a calendar. However, broadly, these events are usually divided into two:

- Lagging indicator – A lagging indicator is one that measures the output that has already happened in the market. For example, an economic data like inflation is a lagging indicator because the inflation has already happened.

- Leading indicator – A leading indicator is one that is used to predict the future. For example, consumer confidence can help to predict consumer spending and even the economic output.

Related » Leading Vs Lagging Indicators

In addition to the economic calendar, there are other types of calendars that are useful to traders including:

- Earnings calendar – This one gives a schedule of when companies will publish their results.

- Dividend calendar – It shows when a company will start distributing its dividends to shareholders.

- IPO calendar – It shows a schedule of when companies will go public.

- Splits – This calendar gives an overview of when companies will split their shares.

Economic activity data

These numbers show an economy’s performance. It can include data released by the government, key research companies, or industries. Some of the information embedded in the economic activity data include PMI, Retails Sales and Central Bank meetings.

Purchasing managers index (PMI)

Various private firms usually conduct surveys on the performance of the construction, manufacturing, and service sectors. The resultant data shows the expansion, or lack thereof, of these industries.

The index is represented as a number between 0 and 100. For instance, at the peak of COVID-19, the US manufacturing PMI hit a record low of 36.1. This was an indication that the pandemic had triggered the contraction of the US economy. On the other hand, a figure above 50 represents an expanding economy.

Retail sales

One of the main reasons why retail stats are important to a day trader is because the retail sector assimilates a large number of employees in most developed countries. For instance, in the US, there are over 4.7 million workers in the industry. As such, high retail sales are a sign of a growing economy.

At the same time, an increase in shoppers often results in the rise of different product prices. Subsequently, a central bank may use the scenario as the basis to increase interest rates.

From this perspective, retail sales are an indirect measure of a country’s interest rate and inflation. Eurostat and the Census Bureau are responsible for releasing the retail sales data in Europe and the US respectively.

Central bank meetings

A central bank is an influential financial institution in any country. It makes key decisions such as the need to print more money or amend the interest rate. Quantitative easing, the release of minutes, and speeches by key officials also make up the crucial information that a day trader should look out for from a central bank.

This is because, such pronouncements may affect the performance of a currency in the market.

The central banks that a day trader should monitor with a forex trading calendar include:

- Swiss National Bank (SNB)

- Bank of Canada (BOC)

- European Central Bank (ECB)

- Bank of England (BOE)

- Bank of Japan (BOJ)

- Federal Reserve

Inflation data, PPI & CPI

Inflation has a close connection with monetary policy measures such as interest rates. For instance, a central bank will increase the interest rates when inflation is high and vice versa. Usually, low interest rates act as an economic stimulus as individuals and businesses are able to spend more money.

In an economic calendar, the Consumer Price Index (CPI) and Producer Price Index (PPI) are the key types of inflation data. The CPI is a measure of price changes for foodstuff, vehicles, fuel, and other consumer goods. On the other hand, the PPI (factory-gate index) measures the price changes for items bought by producers.

Additional inflation data that you will find in an economic calendar include export & import price index and the house price index. In the US, inflation data is released by the Bureau of Labor Statistics (BLS) while the Eurostat bears that responsibility in the EU.

Employment data

This kind of data shows an economy’s strength. Besides, a country’s central bank will use it to determine if it needs to amend the interest rates. For instance, when the country records low unemployment rate and high wages, its central bank may decide to increase the interest rates.

What to watch as a day trader

As a day trader, it is important to look out for the employment data from different countries. However, most people are more interested in the US nonfarm payrolls, which are released by the BLS on the first Friday of every month.

As a trader, you should look at the employment numbers with several considerations in mind. To start with, look at the previous month’s employment statistics. It will also help to identify the number of people in their formative years who are unemployed.

Wages, as well as the participation rate, are also crucial aspects that a day trader should look at when analyzing the presented data.

Other highlighted information

Other than the highlighted information, there are other events that you can find in an economic calendar. This includes, but is not limited to:

- GDP data

- Consumer confidence

- Crude oil inventory

- Car sales

- Housing starts

- Industrial production

Benefits of an economic calendar

There are several benefits of an economic calendar. First, it helps them not to be caught by surprise when events come out. Without the calendar, many traders would be caught by surprise when important events like NFP and Fed decision happen.

Second, it helps you set your strategy. If you combine multiple strategies, having a calendar will help you determine the strategy to use.

For example, at times, if there is a major economic data, you can use the scalping strategy. If there is no major data, you can use swing trading strategy.

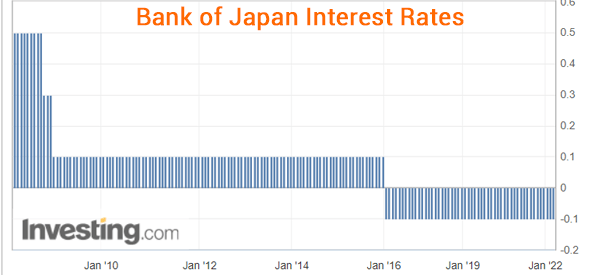

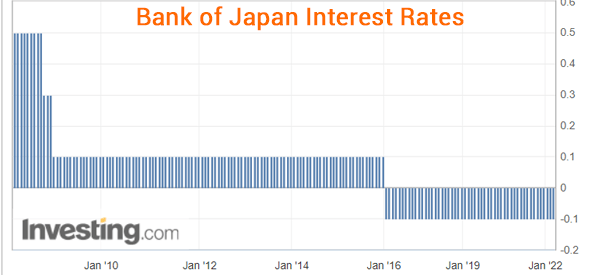

Third, it can help you analyze data. For example, as shown below, you can use data in the economic calendar to understand the trend. In this image, we see that the Bank of Japan has maintained negative interest rates since 2016.

Risks caused by high-impact data

There are multiple risks that are caused by high-impact data. For example, if the data or event comes against the expectation, there could be a lot of volatility. Some of these risks are:

- Panic selling – This happens when investors dump an asset because of the disappointing data. Because of fear, the sell-off could be severe.

- Market sell-off – At times, data could lead to a major market sell-off across asset class.

Strategies to use when using the economic calendar

There are multiple strategies that you can use when using the economic calendar. Some of these are:

- Scalping – This is a strategy where you open and close trades within a few minutes. Therefore, you can use this approach when important data comes out. The idea is to open multiple trades as the volatility intensifies.

- Pre-data trading – Another approach is to trade before the data comes out. In some cases, you will find that some assets behave someway before the data comes out. You can take advantage of these movements.

- Pending orders – Further, you can use pending orders to trade the economic calendar. The goal is to take advantage of the volatility that happens after the data comes out. For example, if the EUR/USD is trading at 1.1200, you could set a buy-stop at 1.1230 and a sell-stop at 1.1180. You should then protect these trades with a stop-loss and a take-profit. Therefore, when the data comes out, your pending order will be triggered.

- Position trading – You can also use the calendar to set long-term trades. If the Fed sounds hawkish, you could sell the EUR/USD pair and vice versa.

- Buying the rumor, selling the news – This is a strategy where a trader goes against the actual data. For example, if the NFP numbers are strong, you could sell the US dollar if the data was in line with expectations.

Final thoughts

The economic calendar is one of the essential tools for a day trader. It is important to look at the scheduled events before trading. With that, you will have the information needed to implement your trading strategy and avoid uninformed decisions.

External Useful Resources

- MarketWatch’s calendar

- Why Using an Economic Calendar is Important? – Tradingpedia