No one in day trading can achieve good results (or become rich) without understanding the importance of Risk Management. This is one of the most important things that traders and investors should always focus on! It refers to a situation where people reduce their risks while maximizing their returns.

The global financial environment has achieved massive growth in the last decade. Today, people all over the world are able to participate in the financial market which in the past was a reserve of the large banks and hedge funds.

The introduction of the high frequency trading (HFT) has democratized the financial market and as a result, many careers have been made (or destroyed). While a number of people have achieved unparalleled success as traders, most people have lost significant amount of their investments.

To achieve their success, the former group has also experienced losses. Therefore, risk management is a very important aspect of trading that no trader can achieve success without.

In this article, we will explain how you can manage risks in trading, the tools you can use to achieve this, and some of the top things to consider.

What is risk management

Risk Management is the concept of forecasting and evaluating financial risks, and then identifying the key mitigation procedures to reduce the impact. Failure to grasp this concept will most likely lead you to make big losses.

In normal businesses, traders anticipate the demand of their products and the supply. They then balance the two to serve the customers better. In forex trading, a trader must always use risk management strategies to ensure that they don’t put their accounts at risk.

Related » Top Mistakes You Should Avoid as a Trader

We want to give you a tip often underestimated: do not leave your risk management strategies unchanged.

Starting from a solid baseline is critical, but your actions to mitigate/prevent drawbacks must evolve over time. For example, when you learn something new or when market conditions change.

If you are unable to do this, your strategies may even backfire!

Risk management by trading styles

Broadly, there are three main types of participants in the market: day traders, swing traders, and investors. Day traders hold their trades for a few minutes and ensure that they close them within the day. Swing traders, on the other hand, hold their trades for a few days while investors hold them for a long period.

For example, one way in which day traders manage their risks is to keep looking at their screens, using short-term charts, and be quick in their decision-making. And avoiding overnight trades.

Swing traders, on the other hand, set wider stops, focus on both technical and fundamental analysis, and mostly use the trend-following approach.

Investors use several risk management strategies like dollar cost averaging, diversify their holdings, and set wider stops.

Different techniques

When we talk about risk strategies, we often tend to generalize and lump them all together. But these, as well as by trade level, can also be divided by typology.

Avoidance: The best way to manage risk is to entirely avoid it. Some traders make their decisions by trying to exclude volatility and risk completely. This leads them to choose the safest assets with little or no risk.

Retention: This strategy involves accepting the risks that arise and recognizing that they are part of each trader’s business. In this, developing a good deal of resilience can be very helpful.

Transfer: Risks can be transferred from one party to another. For example, health insurance provides risk transfer of coverage from the customer to the insurer, provided the customer is current on premiums.

Sharing: This technique involves two or more parties taking on an agreed portion of the risk. For example, reinsurers cover risks that insurance companies cannot handle alone.

Loss prevention and reduction: Rather than eliminating the potential for risk, this strategy means finding ways to minimize losses by preventing them from spreading to other areas. Diversification can be a way for investors to reduce losses.

Advantages of risk management

There are many advantages of embracing risk management in the financial market. Some of the most important ones are:

Reduced losses

The most important advantage of having the best risk management strategies is that it ensures reduced losses in the market. A good example of this is the case of Bill Ackman, who lost over $4 billion when Valeant Pharmaceuticals collapsed.

Another example is the collapse of Archegos in 2021. At the time, the home office used substantially high leverage, which caused him to lose over $20 billion in a few days.

Peace of mind

The other benefit of risk management is the peace of mind it brings. For example, when you open a trade and set your take-profit and stop-loss, you have peace by knowing what you can make or lose.

These stops should always be applied after conducting a good risk/reward analysis and not placed blindly.

Avoid unexpected losses

Another benefit of risk management is that it helps to reduce unexpected loss in the market. There are many examples of this. For instance, ensuring that all trades are closed overnight will help to prevent major events that you don’t have control over.

Key Elements of Risk Management

Risk management strategies can be classified as basic or advanced. Let us look at the basic management approaches first.

Risk-Reward Ratio

When entering or exiting any trade, a trader needs to consider the amount of risks in it and weigh it against the reward. If the risk of entering a trade is very high, then there is no importance of entering it in the first place.

On the other hand, if the risk of entering a trade is low, then it would make a lot of sense for a conservative trader to enter it.

The challenge is on how to balance the two because the higher the risk, the higher the reward.

As a trader, the key foundation to achieving success is to try to minimize the amount of exposure in any trade that you make. The recommended risk-reward ratio for a day trader is 1:2 (if you are to make $50 in a trade, you should be comfortable to lose $100).

This will prevent you from making trades that will expose your entire account to risk.

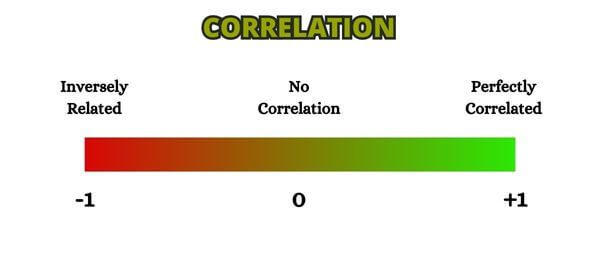

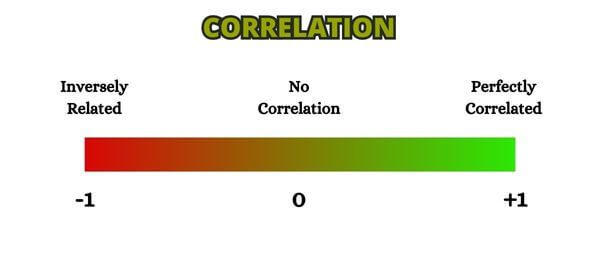

Diversification and correlation

An important aspect of risk management is known as diversification. Investing in one stock can lead to major losses when it collapses. For example, in the chart below, we see that Mullen Automotive stock price plunged from over $900 to less than $1. As such, investors saw their funds disappear within a few months.

Diversification is so important, which explains why many people prefer ETFs rather than individual stocks. If you are an investor, we recommend that you focus on having several companies and bonds in your portfolio.

In this regard, you should always think about the correlation of the assets that you invest in. For example, creating a portfolio with companies like Chevron, ExxonMobil, Shell, and BP will expose you to a big risk if oil prices drop.

Therefore, you should consider investing in the best companies across all sectors like finance, technology, healthcare, and utilities.

Diversification and correlation are also useful when day and swing trading. Placing a buy trade on companies like Tesla, Nvidia, and Google will often work when things are going well. These stocks will often decline when the market retreats.

Overnight trades

Another important risk management strategy that is ideal for day traders is to ensure that all trades are closed in the overnight session. The benefit of doing this is that it protects you from sudden events that happen when you cannot trade.

For example, companies release their earnings after the market closes or before the open. When this happens, it leads to a major dip or pop in the stocks. Also, companies tend to make major news when the market is closed. All these events can lead to substantial losses.

Size your trades

Always have under control the size of the transactions or trades that you initiate. In all trades, you should always ensure that you risk only a small portion of your account.

In other words, you should risk a slight portion of your account in all trades that you do. The benefit of doing all this is to ensure that you lose only a small amount of money if all things fail.

For example, if you have an account with $10,000, you should not risk more than $500 per trade. In fact, you should always risk less than $200 per trade.

Doing this will help you lose the amount of money you can lose comfortably. If you have this account, it means that losing just $200 will not be very heartbreaking.

Stop loss orders

As a trader, a stop loss is a very important tool to manage risk that should be applied in all trades you enter. The essence of a stop loss is to protect your account from huge and unsustainable losses.

You should always strive to ensure that all your trades are protected. This is a very important thing for you because anything can happen even when you least expected it.

In January 2017, the Swiss National Bank (SNB) removed their currency peg from the Euro, days after a senior official assured traders that this would not happen. As a result, the volatility in the market increased significantly and many traders made huge losses.

For traders without a stop loss, the losses were huge.

In fact, trading companies such as FXCM went bankrupt. Traders with stop losses lost money but at a less scale. The challenging part for new traders is on where to put a stop loss order to maximize any trade. A number of strategies have been suggested: the two-day low method and the parabolic stop and reversal (SAR) strategy.

Advanced Risk Management Approaches

Scenario analysis

Before entering any trade, it is very important to conduct a scenario analysis for the assets or instruments you want to trade with. In this, fundamental and technical analysis are very important.

For instance, if you are considering a USD dominated trade, you need to be aware of the existing economic environment. If there is any economic data being released, you need to allocate your trading with this in mind.

Technical analysis will help you identify a ranging or a trending market thus helping you to make good business decisions.

Two-day low strategy

With this strategy, a trader is advised to put a stop loss approximately 10 pips below the two-day low location. It has been assumed that if the two-day and the ten-year lows are passed, a downward trend can be experienced.

A good example for a long position is this: Suppose EUR/USD is now trading at 1.1200, and the previous candle low was 1.1100, then you should place the stop at 1.1090.

The parabolic stop and reversal (SAR)

This is an indicator (one of the easiest) many traders use to identify the stop loss position. The indicator indicates a small dot at the position where the stop loss should be placed.

A good example of this is: enter a long position and establish the support and place a stop loss 20 pips below it. Assuming that the stop loss is placed 60 pips from the entry point, if you profit 60 pips, close the position and then move up the entry point. While doing this, use a trail stop 60 pips below the moving market price.

If the SAR goes up above the entry point, you can move the SAR to the stop level. By doing this, you will be experiencing sweet returns while mitigating the amount of risk exposure.

Other stop loss strategies are: using the moving average, using the support and resistance technique, and using the percentage method.

The secret for any trader is to identify and master a good stop loss technique, back testing, and applying it in every trade he enters. Without a stop loss, chances of losing all the invested capital are very high.

Risk management mindset and psychology

Risk management is closely tied to a trader’s mindset and their emotional wellbeing. In most cases, the mistakes that traders make are usually tied to their emotions.

The most common emotions you need to handle are fear and greed. Fear is manifested in a number of ways when trading. For example, fear can make you avoid entering trades or exit with a smaller profit than your target.

Greed, on the other hand, can see you overtrade, execute bigger trades than normal, hold them for longer, and embrace fear of missing out.

You can minimize these approaches using proper risk management strategies. For example, as mentioned, some of the rules of risk management are limiting the sizes of your trade and using small leverage.

Other emotional disciplines to remember are having patience and being disciplined. In patience, you should ensure that you take time to learn to trade before you move to a live account.

Most importantly, you should take note of the popular biases in the market. The most popular of these are:

- anchoring

- optimism

- herding bias

- loss aversion bias.

External useful resources

- Risk Management Techniques for Active Traders – Investopedia

- 5 Simple Rules for Risk Management – Bullsonwallstreet