The US dollar is the world’s reserve currency making it the most important currency in the world. Therefore, policymakers and traders are always watching the performance of the currency.

A weaker dollar benefits some companies like American exporters and financial assets like cryptocurrencies and commodities.

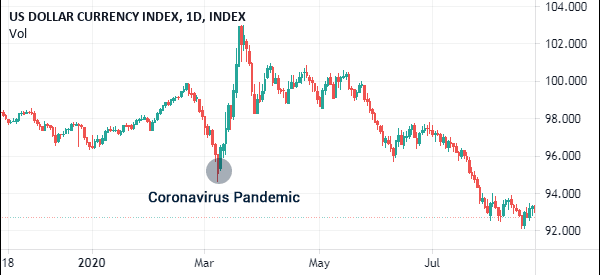

For example, the US dollar index declined sharply during the Covid-19 pandemic in 2020.

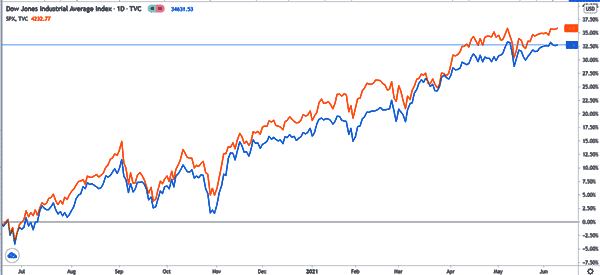

As it did that, cryptocurrencies like Bitcoin and Ethereum and stock indices like Dow Jones and the S&P 500 rose to record highs.

So, in this article, we will explore the causes of a weaker dollar and how to benefit when it happens.

Causes of a weaker dollar

There are several main causes of a weaker US dollar, including:

- Federal Reserve policies – The Fed is the most important player that affects the US dollar. The dollar tends to decline when the Federal Reserve adopts a highly expansive policy. For example, it declined sharply when it lowered interest rates and adopted an open-ended quantitative easing policy in response to the pandemic.

- Fiscal policies – The dollar tends to decline when the American federal government adopts lose monetary policies. For example, it declined during the pandemic when the government announced trillions of dollars in stimulus.

- External central banks – The US dollar could decline when other leading central banks like the European Central Bank (ECB) and the Bank of England (BOE) turns hawkish when the Fed is dovish.

- Geopolitics – The US dollar does well when there are risks in the market because of its role as a safe haven. When risks decrease, the dollar tends to decline.

Who benefits from a weaker US dollar?

In the next section, we will look at some of the top beneficiaries of a weaker US dollar. In summary, the biggest beneficiaries of a weaker dollar are American exporters.

This happens because these companies’ goods become a bit cheaper when the dollar declines. Some of the companies that benefit are firms like Lockheed Martin and Boeing.

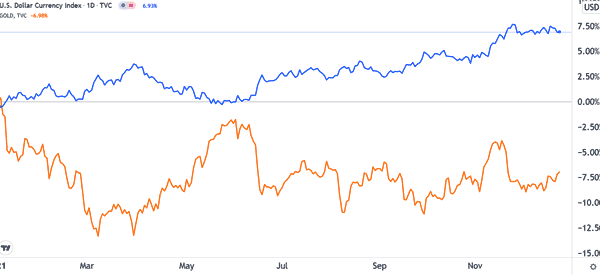

Another top beneficiary of a weaker dollar is investors in general. A decline of the US dollar tends to lead to a better performance of other assets like gold and cryptocurrencies.

As You see, a weak dollar is not necessarily bad. So, how do you trade the weak dollar? And which benefits come from? Here are some simple tips to help traders.

» Related: Reasons For the Strong Dollar

How to trade a weak Dollar

Short the Dollar

As a trader, you can short the dollar and benefit from its weakness. The concept of being short an asset is simple: you are simply borrowing an asset, selling it and waiting for its value to depreciate. When it falls, you buy back and return the same amount of the assets to the person you borrowed from.

You can short the dollar by selling the dollar index. This is an index that weighs the total value of the dollar against the top liquid currencies. It is usually provided by most brokers.

The second way is to find other dollar currency pairs and short them. To do this, you need to look carefully at the other fundamentals of the other currency and the underlying economy.

Buy Crude Oil

The weakening dollar has also led to a surge in crude oil. To new traders, the relationship between the dollar and crude oil seems farfetched.

However, you need to know two things.

First, crude oil is the most traded commodity in the world, and it is quoted in dollars. Therefore, when the dollar falls, crude oil tends to go up as more people move to buy the crude oil.

This also applies to other dollar-quoted commodities like corn and soybeans.

» Related: 4 Steps to really Improve Crude Oil Trading

Buy Gold

Another way to trade the weak dollar is to buy gold. As We have explained multiple of times before, gold is mostly bought by central banks. For investors, it is used as a store of value.

Therefore, when the world seems to come to an end, they rush to buy gold, which they consider the safe haven. As a result, a weaker dollar often leads to a stronger gold.

Therefore, as a trader, you can invest in gold and benefit with weaker dollar.

Buy Stocks

As We have mentioned, investors tend to value gold as a safe haven. When the dollar is weak, and at a period of low interest rates, a weak dollar opens trading opportunities to many American stocks.

Exporting companies like Boeing, Caterpillar and Proctor & Gamble, do well in periods of a weaker dollar because their products become cheaper. As we have seen in the past year, Caterpillar, Boeing, and Apple have performed very well aided by a weaker dollar.

Be Contrarian

Another way to trade the weaker dollar is to go against the wave. By this, we mean that you should take the long-term perspective and invest in the dollar. This applies to when you strongly believe that the dollar is undervalued.

By being contrarian, you will definitely experience some losses. But, if your thesis is correct, you will be rewarded by a surging dollar.

In other words, the dollar is the most important currency in the world. Questions about its dominance have puzzled investors for decades. Some people have written books questioning the hegemony.

If you believe the end of the dollar is near, then you should use the four steps we have outlined. If you like swimming against the tides, you should not be afraid of trying the final idea.

External tips to help you in trading a Weak Dollar

- Strong Dollar vs Weak Dollar – TheBalance;

- Watch Out for a Weakening U.S. Dollar – Morgan Stanley