Testing is an important part of day trading and investing. It is a process where you test whether your strategy is working or not. If it is not working, you will move ahead and tweak it to improve it.

There are several ways to test the efficiency of our ideas: we can use historical data to see how the strategy behaves under certain conditions, or we can rely on real-time market data.

In this article, we will look at the latter: a concept known as forward testing.

What is forward testing in trading?

Forward testing, also known as incubation, is an important process where you subject your trading strategy to the live market.

Here, the goal is to ensure that your strategy is working or not. Also, you simply want to simulate what will happen when you start trading. For example, it can help you see how profitable your trades will be.

There are several approaches to forward testing. First, you can use live data in a demo account to test your strategy. This is the most popular approach because anyone can do it.

Second, advanced traders create models to simulate the future price action of an asset. After simulating future data, the trader will conduct a forward testing to see how profitable the strategy will be.

Forward testing vs backtesting

Forward testing is not as popular as backtesting. Backtesting is the process where you use historic financial data to test how a strategy or a trading robot would work in the future. Many trading software like MetaTrader 4 and 5 and TradingView have their in-built back-testing tools.

In them, you simply need to enter the backtesting rules and the software will run it well. You can manipulate this data to mirror what will happen in the future. As such, if the trading software or strategy works out well in backtesting, you can assume that it will do well in the future.

Backtesting differs from forward-testing in that backtesting uses historical data while forward-testing uses current or future data.

Why forward testing matters

There are two main reasons why forward testing matters. First, while backtesting strategy works out well, the reality is that it has some gaps.

In many cases, backtesting can produce stellar results and then it underperforms in the real market. Therefore, it is usually recommended that you combine both backtesting and forward testing to determine whether the strategy or indicator will work out fine.

Second, forward testing is important because it removes the historical bias and focuses mostly on what is happening now and what will happen in the future.

For example, if your forward testing is based on demo trading, then you will be deeply immersed in the market. As such, you will even factor in the current environment, including the latest news and economic events in your testing process.

Steps of forward testing

There are several steps that you need to follow in forward testing. While the first two can be done once, the others may be repeated in a loop until you get the outcomes you want. Let’s go through these steps.

Find a trading software to use

The first step in forward testing is where you identify the trading software that you will be using to trade. There are numerous tools that you can use in all this, including MetaTrader 4 or 5, NinjaTrader, and TradingView.

At Real Trading, we have a trading software known as PPro8, which is widely used by thousands of traders every day. We highly recommend using it.

Create a demo account

The next stage is where you create a demo account. At Real Trading, we provide our traders with a tool known as TMS, which provides them with access to the live market. The demo account will provide you with all information and data you need in the market.

You should take some time in this demo account, testing the strategy, and determining whether it will be successful. There are several things to consider when backtesting:

- The timeframe – Test the strategy on different timeframes like daily, weekly, and hourly. At times, you will find out that a strategy works well in either of these.

- Assets – At times, the strategy can work well in continuous assets like crypto compared to those with gaps like stocks.

- Track your results – You should forward-test the strategy over a long period and subject it into different market conditions.

- Run the strategy in real market conditions.

Create a strategy

The next stage is where you create a trading strategy. There are numerous approaches to this. First, if you are good in programming, you can create a trading bot that will automate your trading.

You create such a bot by using your experience in technical analysis to do it. For example, you can create a simple bot that opens a bullish trade when the 50-period and 25-period moving averages make a crossover.

Alternatively, you can rely on consolidated strategies such as trend following or the use of chart patterns and technical indicators.

Backtest the strategy

After creating a strategy, your next stage is to backtest it. This is where you subject it to the market using historical data.

The goal is to ensure that you see whether it works using the past data. This is an important step to follow even when your ultimate goal is to forward test the indicator or the bot.

This step is so important because it allows us to refine our strategy, if the original idea was wrong. But, as we have already told you, this alone is not enough.

Track the results and improve

The final stage is where you track the results in forward-testing and improve them. For example, if the results are unsatisfactory, you should work to ensure that you solve the issues first.

You can do that by tweaking a few things. For example, if you are testing using the moving average, you can tweak the period from 20 to 25 and see the results.

One of the best ways to do this task is to use a trading journal, pointing out each time what we used in our test and what was the purpose.

Pros and cons

Pros

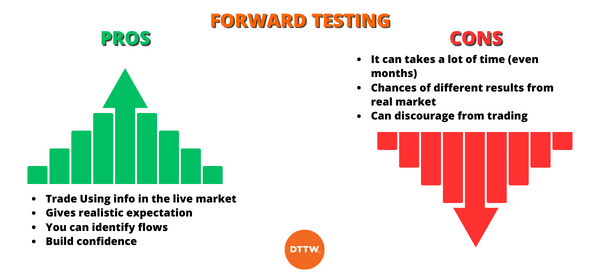

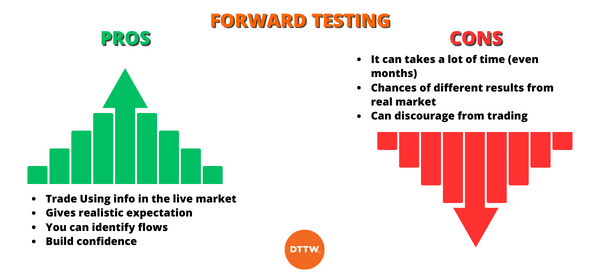

Forward testing has a number of benefits. First, it lets you trade using information in the live market. This is in contrast to backtesting, which involves using historical data.

Second, it gives you a realistic expectation of what to expect. Third, the strategy lets you identify flows in your trading strategy so that you can fix them. Finally, it helps you to build confidence in the financial market.

Cons

There are several cons when you are using forward testing. First, in most cases, forward testing takes a lot of time. At times, it can take months to complete and validate the process.

Second, at times, the results in forward testing may be different from what you see in the real market. Finally, forward-testing can discourage a trader from trading.

Summary

In this article, we have looked at the concept of forward testing and why it matters in the market. Also, we have assessed the benefits and cons of using the approach to test your trading strategy.

As we have seen, all traders should always take time to forward-test before they move to their real account.

External useful resources

- Forward Testing Your Trading Strategy to Success – Broker Explorer