Analyst upgrades and downgrades are popular in the financial market. On every trading day, analysts will publish their ratings on certain stocks and assets. As a result, traders use this information to buy or exit the mentioned companies.

In this article, we will look at how you can trade stocks with a fresh upgrade and downgrade.

How analysts upgrades and downgrades work

Before we look at how you can trade such events, let’s look at how analysts come up with their updates.

Most investment banks like JP Morgan and Goldman Sachs have a team of analysts that track several companies. Large firms have analysts tracking a sector and others tracking specific companies.

Therefore, as part of their work, these analysts are required to come up with their target of share prices of a company. These targets are usually changed depending on new information like mergers and acquisitions (M&A) and news.

Analysts estimates explained

In general, analysts usually set a specific target for a stock and the overall thesis. Here are the meanings of these analysts calls:

- Overweight (strong buy)- This means that the stock will outperform the overall sector in the near term.

- Buy – This is a recommendation to buy a stock at the current price.

- Hold – This is a simple recommendation to hold a stock. If you have bought it, you should continue holding it.

- Underperform – This means that the stock will likely underperform the overall stock market.

- Sell – This rating means that you should sell shares of a company.

- Reiterating – When they reiterate, analysts are basically emphasizing that their previous rating stands. It is also known as maintenance.

It is worth noting that all analysts upgrades and downgrades are not created equal. Investors will often listen to big companies like Goldman Sachs and JPMorgan more than that of small boutique companies.

Also, many traders pay close attention to ratings of respected analysts.

But remember, not all companies have analysts coverage. In general, many investment banks follow large companies, most of which are in the S&P 500. Obviously, it does not make sense for a bank like Goldman Sachs to track a small-cap company with a market cap of less than $50 million.

Related » How to Day Trade Small Cap Stocks

How analyst ratings impact stocks

Investors and day traders constantly look at analyst upgrades or downgrades. In most cases, a stock will typically rise when an influential analyst upgrades or downgrades the stock.

Stocks react to these ratings because investors see these Wall Street analysts as the smart money. They also believe that they have conducted in-depth research on the companies they cover.

However, not all analysts move stocks. In most cases, analysts who move stocks are from leading Wall Street companies like Goldman Sachs, Morgan Stanley, and JP Morgan.

How to identify stocks with fresh upgrades and downgrades

Many day traders react to analysts’ outlooks that are in the media. For example, fresh upgrades and downgrades of major companies like Microsoft and Alphabet will always make it in the media.

However, most ratings never make it to the press.

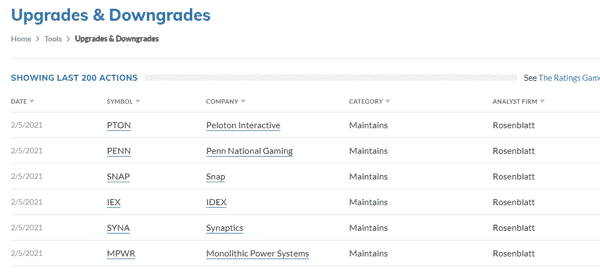

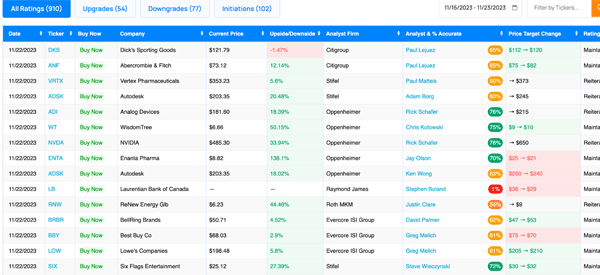

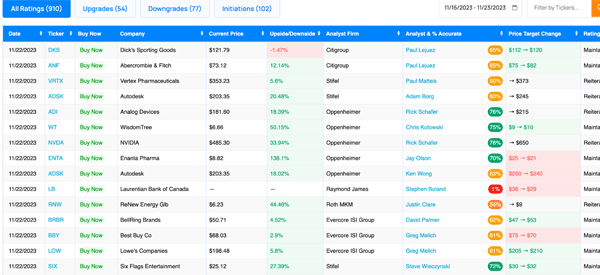

Still, there are many free platforms that can give you these analyst ratings. One of the best is MarketWatch, which keeps track of these upgrades and downgrades. The chart below shows the most recent analyst calls.

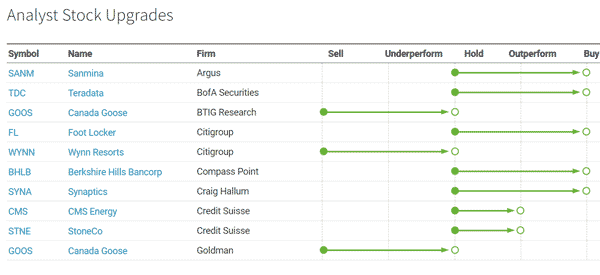

Below is another list by Briefing.com.

What can influence analysts’ recommendations?

Wall Street analysts change their recommendations or ratings periodically. These ratings are usually impacted by several factors, including:

Quarterly earnings

Publicly traded companies in the United States are required by law to publish their earnings every quarter. In these results, they provide their quarterly results and then provide their guidance for the next quarter and year.

In this case, therefore, analysts look at the results and then incorporate their models to upgrade or downgrade the companies.

New product launch

At times, analysts look at a company’s new product or service and then make a prediction of what will happen.

A good example of this is Apple, which releases new iPhone brands every year. When this happens, analysts can look at the new product and then predict if it will be successful or not.

Competitor analysis

The other factor that influences analysts’ estimates is competitor analysis. For example, if a company’s competitor launches a superior product, there is a likelihood that analysts will provide their upgrades or downgrades.

Stock price movement

Further, an analyst can upgrade or downgrade a company because of its price movement. For example, if the shares hit the initial target, the analyst can come up with an upgrade.

Also, if a stock drops sharply, they can upgrade or downgrade it to the new normal.

How to trade stocks with latest upgrades and downgrades

In general, a stock will either rise or fall after a fresh upgrade or downgrade. However, as mentioned above, these ratings are usually not the same. In fact, many stocks will not react violently to analyst’s ratings from smaller firms.

First, you should look for companies that have been upgraded and downgraded, as shown above.

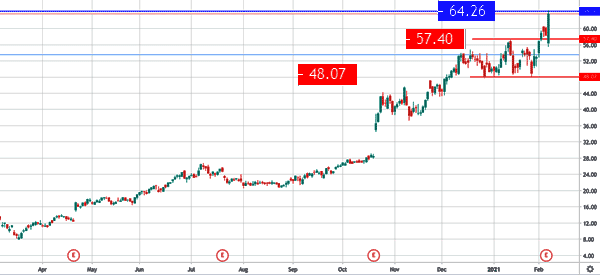

Second, you need to look at the catalyst for the upgrade or downgrade. For example, in the charts above, we see that analysts upgraded stocks like Snap and Pinterest because the two firms delivered relatively strong corporate earnings.

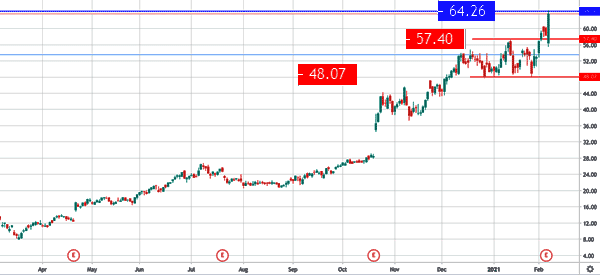

Third, you should look for specific technical levels. For example, when Snap was upgraded, the stock rose to an all-time high of $64.2. This means that the price was slightly below the psychological level of $65.

Also, a closer look at the daily chart shows that the jump was actually a bullish breakout since the stock was previously in a triangle channel whose support and resistance was at $48 and $57.40, respectively.

Predict key possible levels

Therefore, it is clear to predict the key possible levels for the stock. First, the stock could continue rallying because of the rating. Alternatively, it could go through a pullback as bears target the support at $57.40.

Another recent upgrade was Wynn Resorts, a company that suffered substantially because of the virus. The company was upgraded by Citigroup analysts, pushing it from $108 to $119 within a session. Looking at the hourly chart shows nothing important in the stock.

However, looking at the daily chart shows that the stock had actually managed to move above the important resistance level at 117.23. Therefore, it means that in the long-term, the stock will possibly continue rising after clearing this resistance level.

Multi time-frames analysis

Therefore, after a company receives an upgrade or a downgrade, it is usually important to conduct a multi-timeframe analysis. That’s because it will provide you with a clear picture about what is happening.

The overall chart pattern

Also, it is essential that you look at the overall chart pattern. For example, in the hourly chart above, we see that Wynn Resorts is forming a bullish consolidation pattern. Therefore, there is a high possibility of a bullish continuation in the future.

Finally, you should always embrace the best risk management strategies when trading companies with fresh upgrades and downgrades. You should use tools like stop loss and take profits to reduce substantial losses.

Tips for trading analyst calls

Here are some of the important tips to trade analyst calls.

Always react fast

In most cases, you will miss the initial reaction of an analyst rating since stocks either rise or fall after it happens. Therefore, your trading strategy should focus on trading immediately after the initial move of the financial asset.

One of the best things that will help you is a website that has analyst upgrades and downgrades. Benzinga has a tool that lists analyst upgrades, downgrades, and initiations.

Evaluate the recommendation

The other part is where you use your expertise to evaluate the recommendation. Here, you should look at the case the analyst is making and assess whether it makes sense.

In some cases, some of their rating reports are usually easy to refute. This explains why a stock can rise after an upgrade and then retreat shortly afterward.

In this case, also look at the counter-argument. If an analyst argues that the stock is overvalued, look at other aspects of this valuation such as the company’s growth.

Determine the time horizon for the trade

In addition to this, you should work to determine the time horizon for the trade. If you are a scalper, you should aim to benefit from the short-term movements that emerge. For example, if a stock pops after an analyst upgrade, you can buy and exit shortly after that with a profit.

If you are a swing trader, you can buy or short the stock and exit after a few days. On the other hand, if you are an investor, you can buy or short the stock and exit it after a few weeks or months.

Analyze the market sentiment

Another tip that will guide you is to read the mood of the market. There are two main sentiments to consider: risk-on and risk-off. In short, a risk-on sentiment happens when stocks are rising and vice versa.

In most cases, a stock will rise after an upgrade and then resume the downtrend if the overall market sentiment is risk-off. Some of the causes of these sentiments are actions by the Federal Reserve, crude oil prices, and black swan events like the Covid-19 pandemic and the Global Financial Crisis.

Pros and cons of using analyst ratings

It is possible to make substantial sums of money when using analyst ratings. Some of the most popular pros and cons are:

- First, using these ratings can expand your knowledge of companies since these analysts provide a justification for their actions.

- Second, analyst ratings can lead to volatility, which is a good thing when day trading. Most day traders love volatile markets because of the opportunities that come up. Further, ratings can provide a signal for when to buy or short a stock.

There are several cons.

- First, some analyst ratings are not all that good. Therefore, you should always do your research before you enter your trade.

- Second, in most cases, you will miss the initial move of the asset since the market reacts in milliseconds.

- Third, some analyst estimates are usually based on the wrong models.

Final thoughts

Analyst upgrades and downgrades play an important role in the financial market. They are usually key catalysts for volatility. Using the tools and strategies mentioned in this article can help you make profits while reducing risks.