Gold has a long history as a precious metal and alternative currency. The metal has long been viewed as a safe-haven and an important hedge against inflation. It is bought in large quantities by investors, central banks, and sovereign wealth fund.

As a result, these long-term holders have benefited from its upward trend. For example, gold price has jumped by more than 28% this year and by more than 70% in the past five years.

What moves gold prices?

Before we look at the best gold stocks to trade, it is important to have an overview of what moves gold prices in the first place. Unlike other metals like copper and aluminium, gold price tends to move according to the US dollar and the overall interest rates or monetary policy in the United States.

Interest Rates

As mentioned above, gold is used mostly as a hedge against inflation. Therefore, when interest rates in the United States are extremely low, market participants tend to believe that it will boost inflation.

Obviously, when money is not yielding any interest, people tend to buy things like cars and entertainment. This tends to push inflation high, leading to demand for gold.

US Dollar

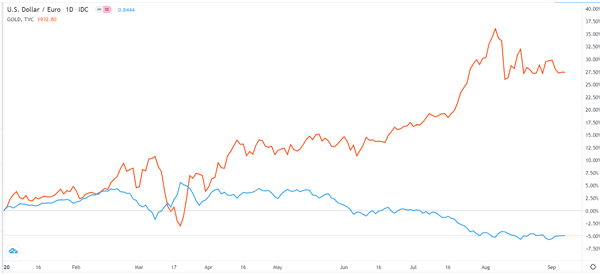

Gold price also moves according to the US dollar. Since gold is usually priced in dollars, its price tends to rise when the dollar weakens. A good example of this is shown in the chart below, which shows that gold price reached an all-time high as the dollar tumbled.

Multiple ways on how to trade gold

There are three primary ways in which you can trade gold. First, you can trade gold that is offered by various brokers such as Robinhood and Schwabb. At Real Trading, you can also find gold that is offered as an asset.

Second, you can trade gold futures and options that are offered by these brokers. Third, you can trade gold mining companies. Ideally, the thinking is usually that gold stocks do well when gold prices is rising.

Finally, you can trade gold ETFs. These are exchange-traded funds that track gold prices or gold mining companies. Examples of the most popular gold ETFs are SPDR Gold Trust (GLD), iShares Gold Trust (IAU), and Van Eck Vectors Gold Miners (GDX). Trading gold mining ETFs can expose you to more than one gold mining companies.

Top 10 gold companies to day trade

So, do you want to trade gold stocks (rhetorical question, you are here for this)? Let’s break down at the best five companies and take a look at five other very good ones to consider.

Newmont Mining

Newmont is the biggest gold mining company in the world with a market cap of more than $52 billion and annual revenue of more than $9.7 billion. The company has grown rapidly owing to its large mines in the United States and Canada.

It has also grown through acquisitions. In 2019, it acquired Goldcorp in a transaction worth more than $10 billion. Newmont is listed at the New York Stock Exchange and its stock has risen by more than 70% in the past 12 months.

Barrick Gold

Barrick Gold is a Canadian gold mining company with a market cap of more than $50 billion and annual revenue of more than $9 billion. The company has mines in more than 10 countries.

Like Newmont, it has grown both organically and through acquisitions. Its biggest acquisitions to date are the acquisition of Acacia Mining and Randgold. The company’s stock has gained by more than 65% this year.

Franco Nevada

Franco Nevada (FNV) is a large Toronto-based gold investment company that makes its money mostly from royalties. Unlike Newmont and Barrick, the company does not operate any gold mine and also does not conduct any exploration projects.

It is listed in the Toronto Stock Exchange and the New York Stock Exchange. It has a market capitalisation of more than $27 billion and annual revenue of more than $844 million.

Holders love it because of its huge profits. For example, it generated more than $344 million in profits from its revenue of $844 million. The stock is up by more than 55% in the past 12 months.

Sprott (SII)

Sprott is a relatively new Canadian gold company that was started by Erick Sprott, a billionaire. Unlike Barrick Gold and Newmont, the company does not operate any mines or conduct exploration services.

Instead, the company provides gold investing services like wealth management, resource management, and wealth management. It also owns several gold ETFs. The has more than $1 billion market cap and its stock is up by more than 80% in the past 12 months.

Wheaton Precious Metals (WPM)

Wheaton Precious Metals is another Canada-headquartered company that does gold streaming services. It does this by agreeing to buy all or some of the gold found in most mines. It does very limited mining itself.

The company is listed in the New York Stock Exchange (NYSE) where it has a market cap of more than $23 billion. The stock is up by more than 70% in the past 12 months.

Notable gold stocks of mining companies

In addition to these five companies, there are other gold companies that you can consider. These are:

- AngloGold Ashanti – This is a South-Africa headquartered gold mining company that is traded in the NYSE and the Johannesburg Stock Exchange (JSE).

- Kinross Gold – This is a Canadian gold and silver mining company that has a market cap of more than $14 billion.

- Kirkland lake gold – This is another Canadian gold mining company with a market cap of more than $14 billion.

- Newcrest Mining – This is an Australian company that explores and mines gold around the world. It has a market value of more than $17 billion.

- Agnico Eagle Mines – This is a Canadian gold miner that is valued at more than $24 billion.

Final thoughts

Gold has been in use for centuries and today, it is one of the best-known safe-haven assets. In this report, we have looked at what moves gold prices, how to trade or invest in gold, and the best gold companies that you can trade in.

We recommend that you conduct a fundamental and technical analysis before you trade any gold stock.

External Useful Resources

- What is an effective strategy for day trading gold? – Quora

- List of Penny & Gold Company Stocks 2020 – Bullishbears