The housing market is one of the most important sectors in an economy. In fact, it is a major component of the GDP calculation. It was also major cause of the 2008/9 Global Financial Crisis (GFC).

In this article, we will look at the importance of housing data and how you can use it as a day trader.

Housing data and GDP

The GDP of a country is calculated using the following formula:

| C + I + G (X – M) |

In this calculation, C stands for consumer spending, I for Investments, and G for gross investments. X stands for exports and I for imports. Therefore, the housing data is a major component of consumer spending and investments.

In fact, the housing sector has been credited for the strong emergence of China. To boost its GDP data, the country invested strong resources to building millions of housing units. At the same time, the construction of new housing units is a very important indicator of the health of the consumer.

Furthermore, since a home is the most important thing that a customer will buy, purchasing it typically needs a lot of confidence. At the end of the first quarter of 2021, the value of real estate had risen by more than $34 trillion.

As a result, several private sectors and government agencies periodically release several key economic numbers that are important to investors and traders. These organizations are the National Association of Realtors (NAR) and the Census Bureau.

Before we look at these economic numbers, let us detour and talk about the housing bubble.

Housing bubble

The housing bubble is an important example of how important the housing sector is important to the market. After the dot com bubble of 2000, investors shifted their focus on the housing sector. Furthermore, it is often said that house prices can only go higher.

As a result, banks like Lehman Brothers and Bear Sterns provided subprime loans to anyone who borrowed. They then packaged these loans into the so-called mortgage-backed securities (MBS) and collateralized debt obligations (CDO) and then sold them to investors.

Therefore, as people started defaulting on their obligations, the banks started to report higher provisions for bad debt. As a result, investors started to sell these stocks, leading to the collapse of institutions like Lehman Brothers and Bear Sterns. Other companies like AIG and General Motors were then bailed out.

Types of housing data

There are several types of housing data that is regularly released by the agencies mentioned above. The most important are the building permits, housing starts, and pending home sales.

Building permits

To build a home in the US, it is mandatory to receive permits from local officials. Therefore, every month, the Census Bureau sends surveys to these officials about the number of permits that they issued in a given period. It then compiles these numbers and publishes it to the market.

Ideally, a higher number is usually a good thing since it means that the builders are confident about the labour situation.

Housing starts

The housing starts refers to building constructions that excavation has started. This is an important number since many developers start building after they have received commitments from their financial institutions about the financing of the projects.

Pending and existing home sales

Other important housing numbers are pending home sales and existing home sales. The pending home sales is a number published by the National Association of Realtors (NAR). It simply measures the contract activity in the housing sector. That’s an important number since it shows the strength of home purchases in the country.

The existing home sales, on the other hand, measures the sales and prices of existing single-family homes nationally. The numbers also include condos and co-ops.

New home sales

Finally, there is the new home sales, which is a data that measures the situation of new homes that have just been built.

Impact of housing data on stocks and forex

The housing data is important for all assets, including stocks, currencies, and bonds because it has an impact on how interest rates are set.

Ideally, strong numbers mean that the economy is doing well. As such, it is a sign that the Federal Reserve could start thinking about tightening of its policies. Other important details that are involved in this decision are inflation and employment numbers.

Impact on forex

Therefore, stronger housing numbers tend to have a positive impact on the US dollar and vice versa. However, since too many details are involved in Fed’s decision, these numbers have a relatively less impact on the dollar. The key numbers that move the currency are inflation, retail sales, GDP, and employment.

Housing stocks

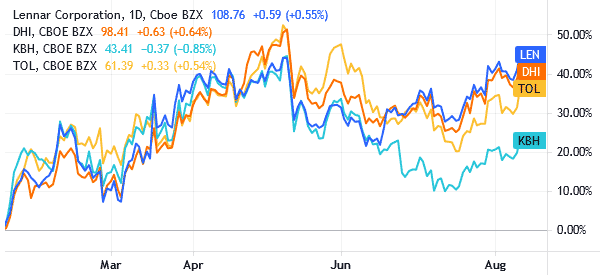

Meanwhile, strong numbers have an impact on housing stocks. Some of the biggest players in the home construction industry are D.R Horton, Lennar Group, Pulte Group, KB Home, and Toll Brothers. The chart below shows how these stocks performed between January 2021 and August 2021 as the housing sector rebounded.

Still, it is worth noting that these shares are also affected by other factors. For example, their stock prices could decline even after strong housing results. The most important external factor is commodity prices. If lumber prices surge, it means that they will have a lower margin.

Other companies that are affected by housing data are mortgage providers like Wells Fargo and Rocket Mortgages. Strong numbers signal that the mortgage industry is doing well.

Summary

The housing data is important to both traders and investors. In this article, we have looked at the several types of numbers that are typically published in the US. We have also looked at how the housing bubble happened and some of the key housing numbers to look at.

Also, we have looked at the most popular home builders in the US.

External Useful Resources

- House Prices: How Much is My House Worth? – PropertySolvers

- Housing Statistics – Realtor