Every weekday, traders buy and sell financial products like stocks, bonds, commodities, and indices in their trillions. They trade in the spot market and also in the futures market.

In spot, they exchange the real-time price. In the futures market on the other hand, they pledge to buy or sell assets at a certain price.

The financial market is usually very regulated, something very important to protect the retail traders. The regulators in the US include the Securities and Exchange Commission (SEC), Commodities Futures Trading Commission (CFTC), and the Federal Trading Commission among others.

Today we are going to analyze in detail the CoT Report (Commitment of Traders), one of the most important reports of the CFTC, and how it can help us in trading.

What is a COT Report?

The COT report is a weekly report published by the Commodity Futures Trading Commission (CFTC) on Friday, with the data obtained by the close of business on Tuesday.

The report uses data provided by reporting firms like clearing houses and forex brokers. It publishes the overall holdings of different assets by commercial traders, non-commercial traders, and retail traders to promote the transparency in the commodities and futures market.

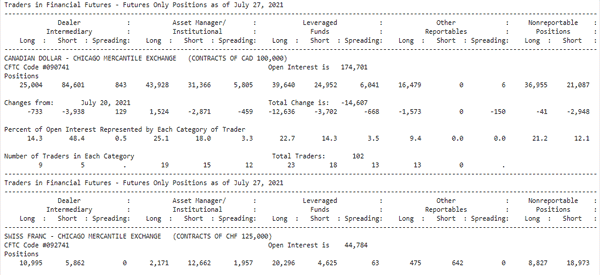

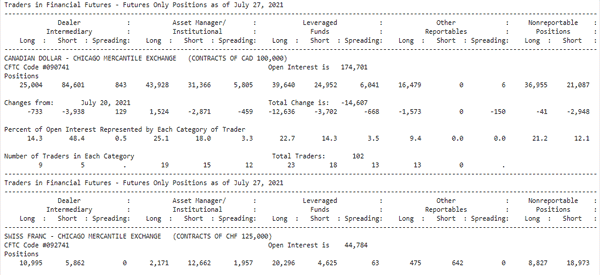

Here’s how a Commitments of Traders report looks like.

Therefore, as a trader, you can use this information to determine whether to buy or sell an asset.

Types of Commitments Of Traders reports

There are basically four main types of COT reports.

- There is a legacy report that is broken down by an exchange. This report breaks down the reportable open interest by non-commercial traders and commercial traders.

- There is the supplemental COT report. This one is made up of the 13 agricultural commodity contracts. It is made up of the commercial, commercial, and index traders.

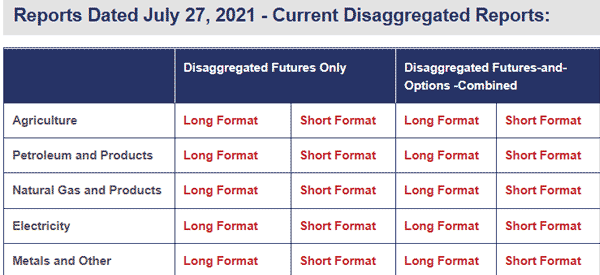

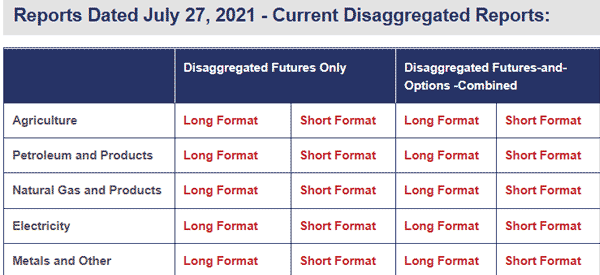

- The third type of COT report is known as disaggregated COT report. It is made up of more assets like agricultural, petroleum, natural gas, electricity, and other products,

- Finally, there is the Traders in Financial Futures includes contracts like currencies, Eurodollars, stocks, VIX, and the Bloomberg Commodity Index (BCOM).

The chart below shows links to the disaggregated COT reports. As you can see, there is a short and long format for each report. The long format provides more data.

How to read a Commitments of Traders report

As you can see, the report may seem very complicated among new traders. However, as you advance your skills, it will become relatively simple. The data used in the report is supplied by a number of organizations like clearing houses, brokers, and exchanges.

- Non-Commercial: these are a mixture of organizations. They include ordinary traders, hedge funds, and other financial institutions. In most cases, these are traders who are involved in the market for speculation purposes.

- Commercial: these are big companies that use the market for hedging purposes. These include large organizations like airlines, international commodities traders, and other large international traders.

- Long: These are the net long positions that have been reported to the CFTC.

- Short: These are the net short positions that have been reported.

- Open Interest: These are contracts that have not been exercised or delivered.

- Number of traders: The number of traders that are required to report to the CFTC.

- Reportable Positions: The number of of options and futures positions that are required to be reported.

- Non-reportable positions: these are the number of open interest positions that don’t meet the reportable requirements of the CFTC.

CoT report in Forex

To explain this section, We will use the chart below.

To start, We recommend that you ignore the commercial and the retail traders since their actions are not very significant for FX. From the chart, it is clear that the EUR-USD pair was on a steady decline in the beginning part of 2008.

At the same time, when the increased short positions from the non-commercial traders reduced, the currency pair also decline.

Mid-September, the net short positions of the pair went to a 1-low. Afterwards, investors went bullish as the non-commercial traders started buying the pair. In the middle of November, as the net short positions hit the extreme level of 45,650, investors started to buy the EUR futures. As this happened, the EUR/USD pair started to go up.

On the other hand, in early November 2009, the net long positions hit an extreme. Since there were no more buyers, the pair started to move downwards.

In conclusion, it is important to note that the sentiments from the non-commercial traders will not always be correct. Many times, the market has gone against their opinions.

Example: The Swiss National Bank

A good example happened early in 2015 when the Swiss National Bank (SNB) removed the currency peg. This was a sudden move, one which nobody had anticipated.

The market reaction was severe to most investors who had traded the Swiss dominated currencies. Therefore, the key to success when using the COT model is to understand when the extremes have been reached and then make the entry or exit decision.

You should use stop losses to limit the losses you make.

CoT report trading strategy

Now the big question is: how to trade the CoT report? To use the Commitments of Traders report, as just mentioned, an ideal way is to find the extreme net long or net short positions.

When you find these positions, it could be a signal that a market reversal is around the corner. This is because, if everyone is long a currency or a commodity, who is left to short? Similarly, if everyone is short a currency, who is left to sell? The answer to the two questions is no one.

› Some Short Terms you must know

While the COT report is a useful tool, it is, unfortunately not all that important to many day traders. For one, the report provides lagging data since it is published every Friday. Therefore, you should only use it to get an overview of the state of the market.

In most cases, you should only look at the data from speculators, who include hedge funds. This data is important because it shows how these funds are positioning themselves for the future.

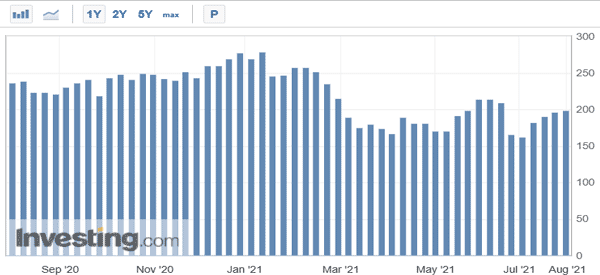

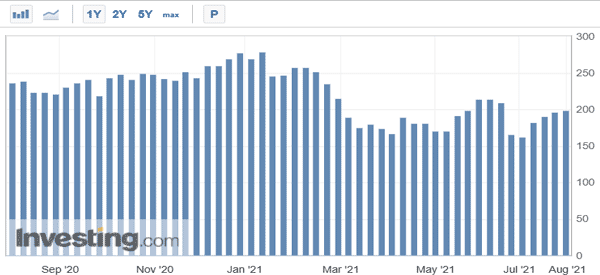

For example, the chart below shows the speculative net positions for gold. As you can see, the net positions were relatively stable in the past 12 months.

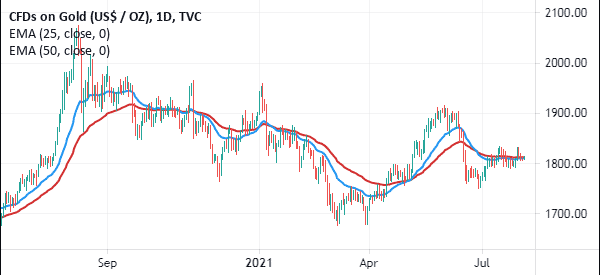

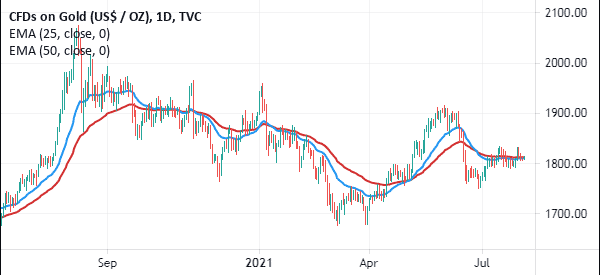

This view is reflected on the chart of the same period that is shown below.

Why sentiment is important for commitments of traders

In trading, sentiments offered by other investors and traders are very important in determining the market moves. This is simply because any person trading the market has his own opinion on the future price of the shares, currencies, or commodities.

At times, the majority of the traders might be wrong while at other times, they might be correct.

These market participants include:

- the commercial traders (hedgers)

- non-commercial traders

- retail traders

These sentiments are important but not always satisfactory to traders. For instance, assuming that 80% of the market participants believe in going long EURUSD, and then something significant such as an interest rate decision is announced, then the minority will have their say.

The key thing here is for investors and traders to believe in their analysis and their opinions.

Conduct your analysis

Before entering, exiting or holding a particular asset, it is important to conduct a good analysis, based on the fundamental or technical indicators. If you believe that the EUR/USD will go up, then you should go long regardless of what the Commitments of Traders report says.

In fact, many investors have lost a lot of money by following these sentiments.

Hedgers

In COT, hedgers, who are also known as the commercial traders’ intention is to shield themselves against a sudden unexpected price movement on an asset (including those caused by exceptional events).

For instance, if a sudden interest rate decision is made, the fact is that the market will react suddenly and many people will lose money.

To avoid this situation, the commercial traders will always put in place measures to protect their money. In many cases, the hedgers are usually very bullish when the market is at the lows and very bearish when an asset is trading in the highs.

When it’s at the lows, they believe that chances are high that the market will undergo a reversal. Investment banks and large hedge funds are also put in this category because they want to protect themselves from these sudden changes.

Speculators

On the other hand, large speculators or non-commercial institutions are never interested in holding an asset. Their goal is to enter a market, make a good profit and exit immediately. They are different from hedgers who want to hold an asset for a few months or years. The goal of the large speculators is to identify a trend and then bet that the trend will go on and then enter the position.

These individuals and companies mostly participate in the futures markets because they have huge sums of money. For this reason, in checking the Commitment of Traders, the decisions that they make are critical and have a huge chance of moving the market.

In addition, they commonly use the moving averages to study the trend.

Retail Traders

Finally, the retail traders are the smaller market participants who are mostly on the wrong side of the market. Their sentiments are never all that essential to the market meaning that they can’t move the market.

Summary

The COT report is a relatively popular document used by many investors and traders. However, you cannot use it successfully alone. You need to combine its data with other fundamental and technical analysis techniques.

External Useful Resources

- How to follow big players in Forex Trading- Commitment of Traders Report – FTMO