Day trading is defined as the practice of buying and selling financial assets with the goal of generating a profit. It differs from investing in that day traders believe in exiting their positions by the end of the day to avoid the substantial overnight risks.

It is possible to day trade numerous financial assets, including stocks, currencies, cryptocurrencies, exchange-traded funds (ETFs), commodities and bonds.

There are thousands of assets that you can day trade. For example, in digital currencies, there are over 20,000 cryptocurrencies in the industry. Similarly, in the stock market, there are thousands of American stocks that are listed in major boards like the Nasdaq and the New York Stock Exchange (NYSE).

Internationally, the number is much higher. Therefore, in this article, we will look at some of the best things to consider when picking stocks to trade.

Identify a sector to trade

As mentioned, there are thousands of stocks listed in the US. These equities are usually put into different sectors based on their industry. Some of these sectors are communications, consumer discretionary, real estate, technology, utilities, industrials, financials, materials, consumer staples, health care, and energy.

All these sectors have different characteristics. For example, technology stocks like Meta Platforms and Snap tend to be more active than sectors like materials. Similarly, health care stocks, such as those in the biopharma sector tend to show some volatility often, when there is an issue with the FDA.

Therefore, you should be careful on the sector you want to trade. In most situations, you should trade companies in sectors that you have a good understanding in.

Pay Attention to Liquidity

It’s very difficult to day-trade equities that lack large share floats. However, highly liquid firms tend to trade at lower multiples than less-liquid names. Accordingly, look for equities that split this difference.

When you purchase liquid stocks, the cost is generally cheaper than other stocks. Furthermore, a liquid stock may be easier to sell.

Ideal short-term trading candidates have ample share floats and trade at high multiples relative to their peers. Even if you find yourself on the wrong side of the trade, these equities usually offer an easy exit strategy that can reduce your losses.

Volatility Is Key

Experienced day traders tend to favor volatile stocks. A stock becomes volatile when the distributing company’s available cash is inconsistent.

As a day trader, you can take advantage of the cash discrepancy and earn a profit. In fact, when the market is uncertain, it could turn into a good day of trading for you.

There are many different types of market volatility. For day traders, firms that have been mispriced due to macroeconomic factors or external events offer particularly attractive opportunities.

During much of 2011 and 2012, the Eurozone crisis caused a prolonged, largely artificial volatility spike that overrode the rational instincts of even the most seasoned traders.

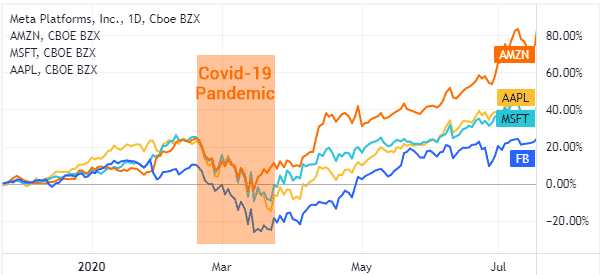

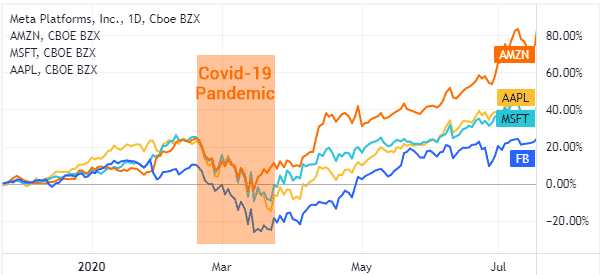

Another resounding and much more recent example is the Covid-19 pandemic in early 2020.

Unfavorable events caused quick downside moves that allowed enterprising day traders to buy fundamentally sound names at steep discounts.

Likewise, volatility within specific firms can be brought on by unpredictable cash flows or surprising earnings reports. Look for companies with unsteady balance sheets and a history of earnings beats or misses.

Alternatively, examine the Trade Volume Index for specific firms. For various reasons, trading volume often spikes before big upside or downside moves.

Related » How to deal with market volatility

Trade Volume Index

When the financial community refers to a stock’s volume, it is measuring the number of times that the financial instrument has been bought and sold over a certain timeframe.

If the stock has a large volume, then more traders have been interested in it. In addition, a volume increase usually means that the stock price is about to change.

You can use the Trade Volume Index to decide whether you should purchase a stock.

Look to the Banks

Ironically, many public firms that earn tremendous profits through short-term trading operations make for excellent trading targets. Companies like Citigroup, Bank of America and J.P. Morgan Chase are highly liquid and often track broader-market indexes.

Even better, these firms tend to be sensitive to macroeconomic reports and news headlines. In the wake of the financial crisis, many day traders made a killing off of unsteady banks’ volatile price swings.

Related » How to Analyze and Day Trade Bank Stocks

Find Social Media and Web 2.0 Gems

The rapidly evolving technology sector has a checkered past, but the relatively recent emergence of viable social media and Web 2.0 stocks offers a real opportunity for day traders.

Firms like Facebook, Groupon and LinkedIn tend to move in response to news and events that affect the broader technology sector. Additionally, their ongoing struggle to monetize their services has produced a slew of unpredictable earnings reports and cash flow figures.

Since they’re relatively liquid and trade at high multiples, these companies tend to offer wider spreads for profit-hungry day traders.

Not all equities are suitable for day trading; Use these tips and your own original research to choose exciting names that minimize the risk of your chosen short-term trading strategy.

How to identify stock picks of the day

So, as a trader, how do you identify top stock picks to trade in a certain day? There are several approaches to handle this.

Identify the most active stocks

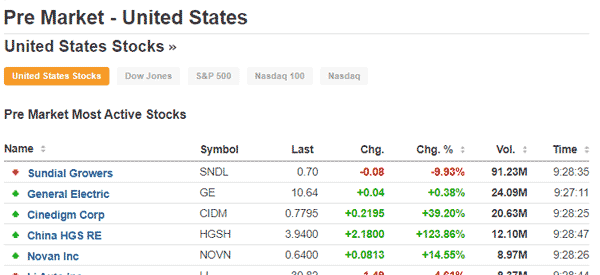

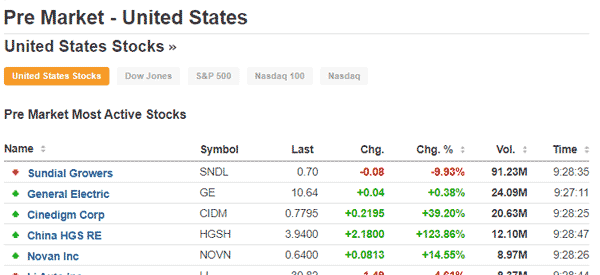

First, you can use several tools to identify the most active stocks in premarket trading. Ideally, this will help you narrow down the stocks that are set to have significant volatility during the day.

Some brokers provide this information. If yours does not, you should use a tool provided by Investing.com, as shown below.

Headlines

Second, as you start your trading day, you can check out the companies that are making headlines. In most trading days, there will be such companies.

For example, there are firms that have announced a merger deal. There are others that have announced management changes or restructuring opportunities. Also, there are those firms that have just announced or are about to release their earnings.

These are some of the stocks that you should focus on in a given day.

Set up your Watchlist

Third, you can also use a watchlist to identify such trading opportunities. While you can create a watchlist by yourself, you can use watchlists that are provided by other companies.

At Real Trading, we provide a daily watchlist that you can use in your trading journey.

Level 2 and Time & Sale

Fourth, you can identify stock picks based on the level 2 and time and sale tools that are provided by most brokers. Ideally, level 2 is an order book that lists how orders are being placed in the stock market.

Time and sales, on the other hand, displays the volume of such orders. You can use this information to find trading opportunities.

Analysts’s picks

Another important approach of identifying stock picks is to focus on analysts’ picks. In most days, many analysts from banks like Morgan Stanley, JP Morgan, and Goldman Sachs. These picks tend to have significant market action during the trading day.

Market sentiment

The other thing to consider when taking stock picks to day trade is the overall market sentiment. There are several things that are used to measure the market sentiment. For example, you could look at the VIX index, which is commonly known as the fear gauge.

Also, you could look at th fear and greed index, which is made of several sub-indexes like the VIX, stock market breadth, and stock market strength.

How to Day Trade Stock Picks

There are several strategies you can use to trade these stock picks.

Be a Scalper

First, you can decide to be a scalper, where you buy or short and then exit within a short period at a profit.

This is what many day traders do especially now that most brokers are offering trades at no commissions. The goal of a scalper is to make small profits per trade multiple times a day.

Identify Market Opportunities

Second, you can use both the level 2 and time and sales to identify market opportunities. In most cases, buy signals emerge when more people are buying a stock. Sell signals emerge when there is strong volume in the downside.

Normal Trading

Third, you can use your normal trading strategies, including algorithmic, to initiate and close trades.

The normal trading strategies include conducting technical and fundamental analysis on stocks. In technical analysis, you use indicators like moving averages, Relative Strength Index (RSI), and MACD to determine whether to buy a stock or not.

It also includes price action analysis, which is mostly made up of chart and candlestick patterns. Chart patterns include triangles, rectangles, head and shoulders, and wedges among others.

In fundamental analysis, you look at the news of the day and interpret how it will impact stocks. Some of the most important news are earnings and management changes.

Related » Traders Should Believe in Analysis, not Forecasting

Final Considerations

The pros and cons of day trading include its potential for risk and opportunity to make a profit. You should prepare yourself for losses. Furthermore, the investment technique can be stressful due to its changeable elements.

External useful resources for Day Trading Stock Picks

- How to Pick Stocks: 7 Things All Beginner Investors Should Know – US News Money