As a day trader, you have many advantages against the long term investors. This is simply because you are not interested in the long term growth of an asset such as a company, index, or a commodity.

You are interested in the short term situation of the asset (Day Trading vs long term). As such, you can easily tell how the particular asset will perform in a few days’ time.

Difficulties of long term trading

In the 70s, Warren Buffet bought Coca-Cola shares. His was a long term bet that people will always buy coca-cola because of the moat the company had established.

True to his prediction, the company is one of the largest in the world today, and he has made billions of dollars from it. However, now coca-cola faces many challenges because of the health implications its products have on people.

20 years ago, Kodak was the largest imaging company in the world. Investors who had a 40 year prediction on the company has long failed as the company nears liquidation!

IBM was once the leader in computing. Today, the company is facing many challenges and its investors have lost billions.

These examples show that no one can tell the future of companies. The big Facebook and Google we see today might be a thing in the past years to come.

As a day trader, you can avoid these long term issues by looking at the short term details of an asset.

How to short a company

To explain what a short squeeze is, let us first look at how shorting a company is and how it works.

In the past, this was rather a complex transaction to do because you had to enter into an agreement with another investor. Today, you can short a company at the comfort of your trading platform.

Examples

Assume company A is trading at $10 per share. After conducting some analysis, you forecast that the company’s real value is $5 per share, so you decide to short it.

In this, you go to a trader B who owns 1000 shares of the company. The real value of these shares is $10,000 (1000 shares X share price). You enter into an agreement with him where you borrow his shares and sell them.

In reality, if the shares of the company hits $15 a share, you will be in a negative because you will need to pay the investor, $15,000.

After borrowing the shares, you sell them for $10,000 and hold the money. If the shares goes down to $5 which you had predicted, you can now buy them back and return the 1000 shares to the investor.

In reality, you will have made $5,000 in this transaction.

Related » How to Identify Short Covering as It Happens!

What is a short squeeze

A short squeeze refers to a situation where a stock you have placed a short bet on rises spectacularly. When it happens, many traders lose more money than what they have traded in initially.

There are two good examples of explaining what a short squeeze works.

First, a few years ago, Bill Ackman placed a short bet on Herbalife, a company that sells products through a multi-level approach. He accused the firm of being a pyramid scheme. After shorting the stock, Carl Icahn, his rival, entered a large buy position. At the end, Bill lost more than $1 billion.

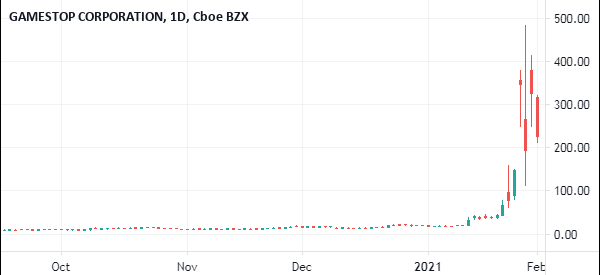

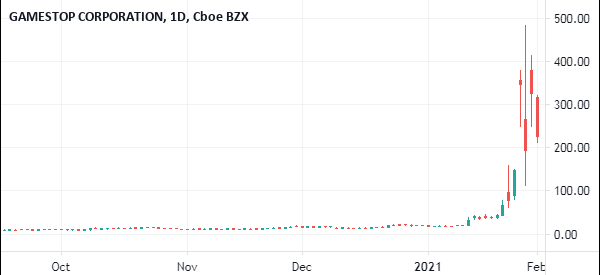

Gamestop and AMC Squeeze

Second, early 2021, traders ganged up in social media (Reddit) and decided to buy shares in some of the then hated companies like GameStop and AMC Entertainment. This led to these stock prices to jump by more than 400% within a short period. Many investors who had shorted these companies lost billions of dollars.

What happens after a Short squeeze?

As a trader, if you buy a company A for $10 per share, the maximum loss you can make is 100% loss of your money. This is because a company’s shares can never be a negative.

However, if you go short a company, the maximum loss you can make is infinity. This is because a company’s shares can go up to any number.

This is a serious problem that a certain trader made times ago by shorting a biotech company known as KaloBios. After shorting the trade, the trader went for a meeting. After the meeting, he found that his account was $-300,000.

Related » Another key concept is the SSR (Short Sale Restriction)

How to avoid short squeeze

To avoid a short squeeze, one is supposed to do a few things. However, it is necessary to know that there are also some methods to detect and exploit these squeeze situations.

Avoid trading small caps

While it is possible to have a short squeeze in companies of all sizes, they are usually common among small cap and penny stocks. That’s because these companies are mostly owned by retail investors, not institutional ones.

The latter type of investors tend to hold stocks for a long time. Therefore, reduce your exposure to small cap and penny stocks especially those in the biopharmaceutical industry.

Always have a stop loss

For starters, a stop loss is a tool that automatically stops your trade once it reaches a key pre-determined level. For example, if a company’s stock is trading at $10 and you short it, you can have a stop loss at $13.

In this case, if there is a short squeeze, the trade will be stopped automatically when it hits $13. Therefore, if it climbs to $20, you will be safe.

Keep an eye to your trade

Try to limit the amount of short trades you initiate. That’s because shorting a stock is usually riskier than buying one. When you short an asset, you are using borrowed money, meaning that you can lose more money than what you shorted in the first place.

Limit your exposure to overnight risks

These are risks that emerge when the market is closed. For example, if you have shorted a company, a takeover offer may be announced at night. As such, when the market opens, you will not have the time to shift your orders.

Therefore, avoiding these overnight risks can help you stay safe.

Final thoughts

Short squeezes are relatively common in the financial market. These squeezes became well-known during the Wall Street Bets short squeeze. In this article, we have looked at how shorting a stock works and how you can avoid a squeeze.

External Useful Resources

- Short Squeeze: In-Depth Guide On How to Profit from one – TymothySikes

- An interesting discussion about it on Quora