Diversification is an important part of both trading and investing. It simply refers to the process of allocating capital across different assets in a similar or different industry. For example, investors like Warren Buffett diversify their holdings by holding tens of companies.

This approach is highly useful for mitigating possible crashes in some sectors, and thus can be traced back to risk management best practices.

In this article, we will look at the concept of diversifying as a forex trader.

What is diversification?

Diversification is simply a process where a trader (or investor) buys a number of assets (not correlated) to caution a downward trend.

For instance, in stock trading, an investor can buy shares of Apple, Nestle, and Blackrock. The hope of the investor is that the shares will all go up. However, in case one or two company falls and the other company rises, then the loss will be mitigated.

Many day traders prefer to trade a single currency pair. For instance, there are those traders who believe in trading the EURUSD pair. The benefit of this is that it gives the traders an opportunity to study and understand well the pair movements.

Investing in a single pair can give the traders a chance to avoid making simple mistakes. As we have stated in a previous articles, currency charts are moved by many factors which a single trader might not be able to follow on a daily basis.

If focusing on a single pair has these benefits, why should we understand and take advantage of diversification? Because you can achieve all these pros only if your trades go as you hoped during your analysis!

If you are wrong, you will be heavily exposed to the whims of the market and can seriously damage your account.

Related » Value Investing Portfolio for Day Traders

Keep the portfolio small

In creating a diversified account, we recommend that you keep a small portfolio. Having a small portfolio will give you a chance to mitigate risks and have a heads on in your portfolio. To the maximum, we recommend that you have a diversified portfolio of three or four instruments.

For instance, you can short EURUSD, buy GBPJPY and sell AUDCAD. There are a number of advantages of keeping such a small portfolio.

- It gives you a chance to monitor the portfolio and act on it accordingly.

- Having such a portfolio gives you an opportunity to assess the general environment, study the fundamentals and the technical details of the trades.

There are several reasons for keeping your portfolio small. For example, it will help you keep track of your portfolio well.

Further, it will reduce the situation where you buy or shot the same currencies, as explained in the following section about correlations.

Forex pairs correlation

An important fact about diversifying in the forex market is the concept of correlation. Like other assets, currency pairs tend to have some correlation features.

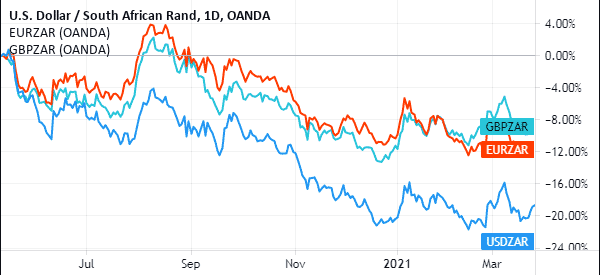

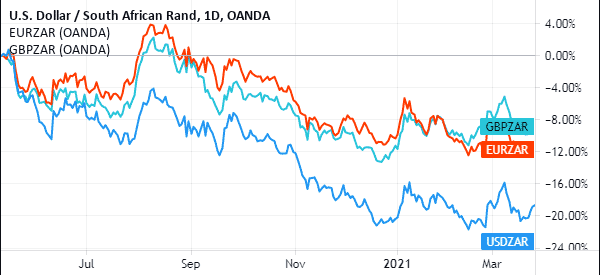

For example, as shown below, the GBP/ZAR and USD/ZAR pairs have a close correlation because the counter currency is the South African rand. Therefore, if you are long the two pairs, there is a risk of losing money if the South African rand strengthens.

The same correlation happens in other currencies, including majors like the EUR/USD and GBP/USD since the two have a common denominator. Therefore, if the dollar strengthens, there is a likelihood that the two pairs will move in sync.

How to check currency correlation

There are numerous ways to check more about currency correlations. The simplest way is to use charts such as the ones shown above.

On the other hand, you can take the long route to identify currency correlations. This involves downloading data and then conducting currency correlation using Excel.

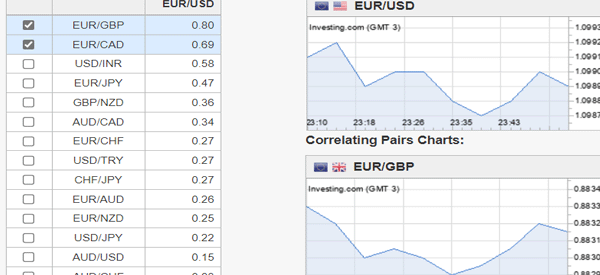

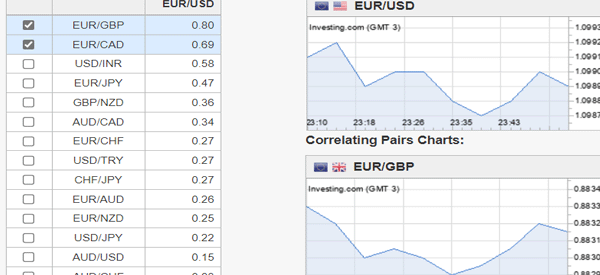

Alternatively, you can use free online tools such as those provided by Oanda and Investing.com to find these correlations. A good example of this is shown in the chart below.

As you can see, the EUR/USD pair has a closer correlation with the EUR/GBP than the AUD/USD.

Due diligence

Before making an entry or exit of a diversified portfolio, the first thing you must always do due diligence by studying the fundamental analysis of the currency.

In this, you should use the economic calendar and all the news sources available to you to study the market. You should do a lot of research before you enter a trade. Some of the top things to consider are:

- Always have a catalyst – Before you enter a trade, ensure that you have a reason for doing this.

- Mitigate your risks – Use several risk-management streategies to reduce your risks. These include having a stop-loss and reducing your trade sizes.

- Have a trading journal – Another way to do your due diligence is to use your trading journal.

Understand macro factors

For instance, if you are making a dollar purchase, you must understand the macro economic factors in the United States. For example, the likelihood that at the next FOMC meeting interest rates will either remain unchanged or increase.

Now, before making the dollar purchase, you must be aware of these issues and how they will affect your portfolio.

Technical analysis

In addition, you must combine your fundamental knowledge on each pair with the technical analysis. Technical analysis is simply the study of the charts using mathematical models.

This analysis helps you to determine the exact position to buy or sell an instrument. Anyway, remember not to blindly trust one tool. If the indicator gives you mixed signals, backtest with another one…or avoid entering the trade!

Managing the diversified account

As stated above, the goal of managing a diversified account is to mitigate risks of one currency pair. However, at times, all the currency pairs might disappoint!

Using the above example, the EURUSD might go up, the GBPJPY low and AUDCAD high. In this situation, you should watch your account carefully to avoid the margin call situation.

Risk exposure

To reduce risks, the first thing you should do is to calculate the risk exposure of the account and place stop losses where appropriate. As a rule, you should risk only 2% of the total funds in your account.

A stop loss will help you prevent further losses up to the place where you can take losses.

Lot size

The next thing you should do to mitigate risks is to use small lot sizes. The fact is that you can make a lot of money by putting a higher lot size. However, a high lot size exposes you to insurmountable risks.

This is a key point, because many traders tend to underestimate the size of their trade and then have to deal with large (and unexpected) losses.

Don’t be greedy

Finally, you should always get out of the trade once your target has been reached. Continued stay in a trade can lead to losses.

It is okay for you to maximize your efforts and make as much profit as possible from your trades, but market conditions can change abruptly and affect your earnings. If you intended to earn $10 from a trade, then do not wait until you reach $20.