Supply chain analytics is an important concept in the financial industry. In particular, it is a process that is widely used to analyze stocks. The idea is that looking at the performance of key suppliers of a company will help you make better investing and trading decisions.

For example, when conducting supply chain analysis on Apple, you can look at some of its biggest suppliers like Foxconn, Lumentum, and Corning. If Foxconn publishes weak results, it is a sign that Apple ordered fewer products.

Commodities are also useful in supply chain analysis. For example, if prices of key commodities like nickel and lithium rises, it can have an impact on electric vehicle stocks like Tesla and Nio. Similarly, higher lumber prices could have an impact on the housing sector.

In this article, we will look at how to do supply chain analysis when trading and investing.

What is a supply chain?

Supply chain refers to a process in which an item moves from a raw material to a manufactured product. For example, to manufacture an iPhone, you need several things. For example, you need a lithium battery.

To come up with a battery, you need raw materials like lithium, aluminum, nickel, and sulfur. These minerals are mined around the world. An iPhone also has other parts like glass, chip, and cameras among others.

Therefore, to conduct a comprehensive supply chain analysis for the company, you need to identify these parts. You also need to know their manufacturers.

Related » SWOT analysis for traders

Why these informations are important for traders

As a stocks trader, it is very important for you to understand the supply chains for companies that you invest in. This is because by understanding how they are performing, you can easily predict how the companies you are following are doing.

For example, General Electric is one of the biggest suppliers of engines to Boeing. Therefore, if General Electric’s aviation business announces a slowdown in business, it means that Boeing has some problems as well.

Similarly, if companies like Intel and NVIDIA announce slow sales, hardware companies like Dell, Apple, and HP will be expected to go down.

Therefore, the role of supply chain in making investment decision is very important. This is because it has the ability of influencing the stock performance of other companies. A boost in sales in one supplier could mean more orders while a reduced supply could affect other companies.

In the past, we have seen share prices of companies fall or soar by association. For example, as mentioned above, Apple shares tend to react to the performance of some of its key suppliers like Corning, Samsung, Hon Hai Precision, and Broadcom, among others.

» Related: How to Conduct Fundamental Analysis

How to trade Supply Chains

To trade using this model, you need to understand a few things. First, you need to understand the companies that supply the company that you invest in. You can gain this information by going through the annual reports of the companies.

You can also get this information from the business-related news websites like Bloomberg and Wall Street Journal. If you can afford paying a software provider like Bloomberg Terminal, you can get access to this information.

Raw materials and currencies

The supply chain is not only about companies. It is also about the raw materials and currencies.

For example, when the price of crude oil jumps, chances are that the stocks of oil exploring companies like ExxonMobil and Chevron will rise as well. Similarly, when the price of gold rises, that of gold mining companies will rise too.

On the other hand, when prices of raw materials rise, the result is that the margins of the companies will be squeezed.

For example, if the price of cotton rises, it will squeeze the margins of companies like Adidas leading to their stock price to decline. Therefore, as a trader, you should always pay a closer attention to these issues.

How to find supply chain data

Ideally, at the basic level, supply chain is a relatively simple process. For example, when trading in commodity-reliant companies, looking at their prices can help you predict where the shares will go.

For example, when commodity prices rise, some companies like Boeing and Caterpillar tends to be affected. On the other hand, the share prices of commodity miners usually rise.

However, looking at the supply chain of some companies can be difficult.

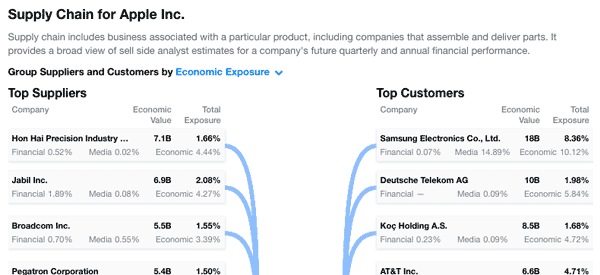

Fortunately, there are some companies – as stated above – like Yahoo Finance that have features to simplify the process. For example, in the chart below, we can see some of the biggest Apple suppliers and buyers.

What can affect supply chains

There are many factors that could impact supply chains. Some of the most notable ones are:

- Strikes – A strike in a supplier could lead to significant supply chain challenges. For example, a strike at Foxconn could impact Apple.

- Weather – Weather-related events like severe rain could impact a company’s supply chain. For example, a drought could lead to weak supplies of agricultural products.

- Pandemic – A major pandemic could have an impact on supply chains. For example, the Covid-19 pandemic led to the most severe supply chain challenges in decades.

- Geopolitics – Geopolitical events like the invasion of Ukraine and trade wars could have an impact on supply chains.

- Tariffs – Tariffs and sanctions imposed by a country could hit supply chains. For example, in 2022, the US barred chip companies from supplying products to Chinese companies.

Summary

Conducting a supply chain analysis can be a helpful process for you as a day trader. Knowing the raw materials that go into a product and the top suppliers for a company can give you an edge in making good decisions.

However, this process does not always work since there are other things that move a company’s share price. For example, Apple’s suppliers may release strong earnings because of other external factors such as incorporating an acquired firm.

Therefore, you should use this process to complement your other analysis methods.

External useful Resources to trade Supply Chains

- Learn more on Nerdwallet