In January 2021, something interesting happened for the first time in history. Social media users banded together and started to focus on companies most hated by Wall Street. Subsequently, companies like GameStop, Blackberry, and Nokia bounced back, leading to one of the biggest short squeezes ever.

In this article, we’ll look at how you can use Reddit and other social media platforms in day trading.

What is Reddit?

Reddit is a major social media platform that was started in 2005 and acquired by Conde Nast, the magazine publisher. The company has raised more than $550 million at a more than $3 billion valuation. The platform has more than 300 million active users from around the world.

Reddit is relatively different from other social media platforms like Twitter and Facebook. Different because it focuses on content sharing and user interactions. In it, people follow groups they love and participate in their commentaries.

Why (and how) to use subreddits as an info source

Trading subreddits are some of the most interesting communities online. And the information you can find on them is as varied as it is plentiful: tips to increase the effectiveness of your strategies, news pulled from different sources that can help you evaluate securities, and discussions where users try to dispel myths, prove their theories, and arrive at trading truths.

That’s very nice and all, but just like everything else, there’s also a dark side to reddit. These are the trolls, spammers, and even scammers who try to bend the rules and mess with new members. Just as in any other social network, remember to avoid these shady types.

It’s not always easy to build a solid feed, such as a watchlist or a list of accounts to follow on Twitter. But the sheer quantity of information online is extremely high, and if properly filtered, it can prove to be an invaluable source of data.

For this reason, we recommend starting with these channels, and then doing your own research within subreddits. The subreddits in this list are ordered by total number of members, from most to least.

The 20 Best Day Trading and Financial Subreddits

- /r/wallstreetbets. (15M+ members, or ‘degenerates’ as they relate to themselves, increased a lot after the gamestop short squeeze)

- /r/stocks (6 M members. Here they are called investors/traders)

- /r/investing (2.4 M members)

- /r/StockMarket (2.9 M members)

- /r/pennystocks (1.9 M members, but they are called ‘astronauts’ in the community)

- /r/AlgoTrading (1.7 M members)

- /r/options (1.1 M members)

- /r/economy (1 M members)

- /r/daytrading (2.1 M traders)

- /r/technews (726K members)

- /r/Forex (340K Traders)

- /r/SecurityAnalysis (190K Security Analysts)

- /r/IndiaInvestments (554K members)

- /r/Stock_Picks (84.9K members)

- /r/trading (138K members)

- /r/ausstocks (64.9 K members)

- /r/TheWallStreet (38.1K day traders)

- /r/FuturesTrading (58.8 K Futures Traders)

- /r/MasterTheMarket (6.3K members)

- /r/TradeVol/ (3.4K members)

The GameStop short squeeze explained

GameStop is an old school company that sells physical computers and video games. The firm has been in a decline for years as more people started to focus on cloud gaming. Its profit has dropped from more than $9.4 billion in 2011 to more than $5.1 billion in 2020. It has also moved from making a profit of more than $400 million to a loss of more than $275 million.

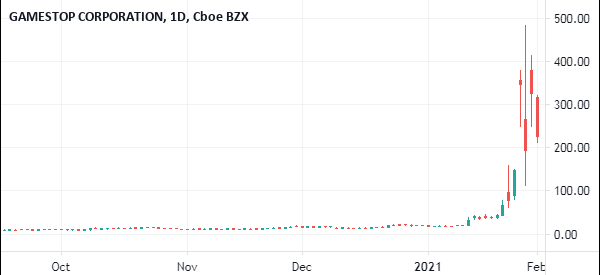

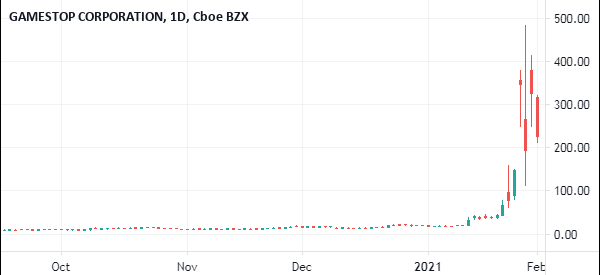

As a result, GameStop’s share price has been on a steep decline for years as more large shareholders avoid the firm. It has also been squeezed by short-sellers who believe that the shares are expensive and that they will decline.

It is easy to understand why GameStop has been failing. While gaming has been on a steady increase over the years, in reality, more people have avoided GameStop. They have instead preferred downloading games from the popular stores. Also, with Google Stadia, there is a general transition from physical games to the cloud.

Therefore, in January 2021, disappointed with Wall Street, many day traders in the Wall Street Bets (WSB) and Day Trading forums started to pump some of the most shorted companies. GameStop was one of them.

As a result, the once-boring stock became a darling in the market and rose from less than $20 to more than $475. Its market value reached more than $25 billion.

In the aftermath of the Wall Street Bets, many short-sellers went through a short squeeze. A squeeze happens because when a stock is shorted, the maximum loss that can be made is infinite. In contrast, when you buy a stock, the maximum loss you can make is zero.

Other meme stocks

GameStop was not the only company targeted by Wall Street Bets. In fact, these companies received a name known as meme stocks. In general, this refers to companies whose share price is influenced by social media.

- Nokia – Nokia was a well-known maker of smartphones until it made a mistake by using Windows operating system. Today, the company is known for selling telecommunication equipment. Due to Wall Street Bets, the stock rose from about $4 to $8.7 within a few days.

- Bed Bath and Beyond – BBBY was a favorite retailer a few years ago but recently, it has been disrupted by companies like Amazon. This has made it heavily shortened. Because of the Wall Street Bets, the stock jumped from $17 to $52.

- Blackberry – Like Nokia, Blackberry was once a popular company until it lost its market share to companies like Huawei and Apple. It was also highly shorted and during the Wall Street Bets, the stock rose from $6.58 to $28.

- AMC – The biggest movie theater company in the US was hurt by the pandemic. As a result, it attracted a lot of short interest. During Wall Street Bets, the stock rose from $1.92 to $20.

The other popular companies during the meme stock era were GameStop, ContextLogic (the parent company of Wish.com), Mullen Automotive (MULN), Canoo, and Clover Health.

While the meme stock craze has died, the Reddit and StockTwits community is still alive and well. Some of the top companies that are still popular among these traders are Palantir Technologies, Mullen Automotive, Genius Group, AITX, and Beyond Meat.

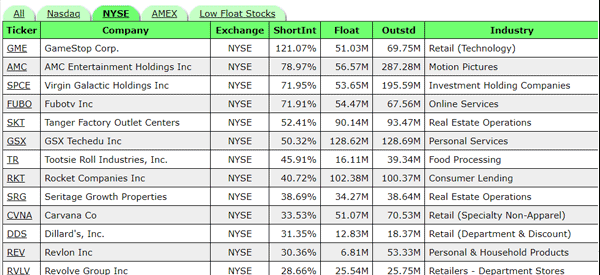

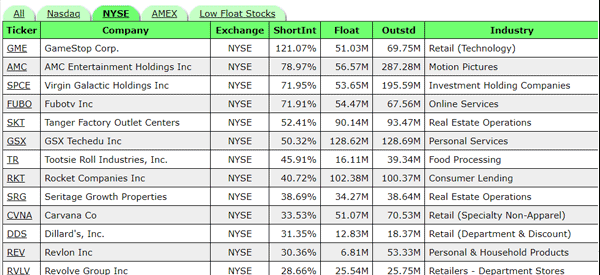

Below are the most shorted stocks in the New York Stock Exchange.

How to trade meme stocks

In all fairness, the concept of meme stocks is a relatively new one. In fact, many experienced traders were caught off-guard when companies like GameStop and AMC became the talk of Wall Street.

However, drawing from these lessons, we can identify some of the best strategies for trading these stocks.

- Be active on social media – Before you start your trading day, we recommend that you look at the Reddit pages mentioned above. Other pages you should pay attention to are in Discord and Twitter (we suggest you to build up your own feed).

- Fundamentals don’t matter – Today, with interest rates so low, it seems like traditional valuation metrics like valuation no longer matter. That’s why a company like Tesla is now valued more than all other automakers, combined.

- Avoid overnight risks – In times of high volatility, we recommend that you don’t leave your trades open overnight.

- Use pending orders – Use pending orders like buy and sell stops and buy and sell limits. Market orders can be relatively risky.

- Look at your leverage – While leverage can help you make a lot of money, it is usually risky. So, limit the leverage you use.

- Stop-loss – Always have a stop-loss to limit your losses. A trailing stop loss can be better.

- Don’t short – While some shorting opportunities will emerge, don’t short stocks to avoid being in a short squeeze.

Types of news you can find in Reddit

While the meme stock craze has died, Reddit, X (Twitter), and StockTwits are still great platforms for day traders and investors. They are great places to find the latest news about companies, cryptocurrencies, and other assets. Some of the top news you will find in these social media platforms are:

- Breaking news – In most cases, it is possible to find breaking news about a company or other assets on Reddit. At times, Reddit users can find news that is not in the mainstream media.

- Rumors – Another important news you can find on Reddit is rumors. This is where users publish rumors that could move an asset.

- Expert opinion – Further, it is possible to get expert opinion on assets in social media platforms like Reddit.

- Technical analysis setups – Also, it is possible to find some technical analysis setups when using social media platforms.

- Fake news – Most importantly, it is possible to find fake news on social media. Therefore, you should always verify the news that you find on these platforms.

How to use Reddit in your watchlist

A watchlist is a good tool that you should always use when either day trading or investing. It is a tool that lists the most active stocks that you are focusing on and highlights some of the reasons for that.

One way to boost your watchlist is to use Reddit, which is a good source of news for day traders. For example, you can use it to research the top movers or stocks that are making headlines. You can also use it to find hidden treasures in the market. This refers to some undercovered stocks that are either doing well or bad but are not in the spotlight.

Final thoughts

The concept of meme stocks is a relatively new one. In this article, we have looked at how the Wall Street Bets social media craze broke the investing world as we know it. We have also looked at how you can trade these stocks and some of the risk management strategies that you can use to reduce risks.

External Useful Resources

-

How Reddit day traders are using the platform to upend the stock market and make money in the process – Business Insider