Fear and greed is a common concept in the financial market. Fear is characterized by concepts like exiting a trade early or avoiding the market altogether. Greed, on the other hand, mostly refers to the process of buying when everyone is buying and selling when everyone is selling.

These approaches are also associated with the concept of following the crowd. In this article, we will look at how you can follow the crowd profitability.

What is following the crowd?

Ideally, as the name suggests, following the crowd is the simple trading strategy of doing what most people are doing. This could involve buying companies that everyone is buying and shorting those that most people are shorting.

Surprisingly, this is one of the most common and profitable strategies in the world. Indeed, some of the most-followed companies like Tesla, Apple, and Microsoft have outperformed the underfollowed companies like Occidental, Coty, and Regency Apartments, among others.

Related » Herd Behavior of the Investors Increase Risk in Trading?

Following the trend does not only happen in stocks. It happens in other assets like cryptocurrencies like Bitcoin and Ethereum. Indeed, in recent months, the price of cryptocurrencies has been rising, mostly because of following the crowd strategy.

Also, currencies like the US dollar have been dropping partly due to the strategy.

Psychology of the crowd

The concept of following the crowd is baked into the idea of fear and greed and the fear of missing out (FOMO). Ideally, when stocks or cryptocurrencies are in a bull market, everyone wants to participate.

As such, because of greed, people will often buy all assets that other people are buying since they don’t want to be left behind. Similarly, because of fear, they will often dump all assets that are in a steep freefall.

This idea can also be described as the herd mentality, which is a process where people are more influenced by the majority. In this, they assume that the majority is always correct.

How to follow the crowd effectively

Following the crowd is a relatively simple strategy to use in the financial market. As the name suggests, you just need to identify a market that is moving in a similar direction and then follow it. If the stock is moving higher, you buy and hold and if it’s moving lower, you short and hold.

The first strategy of following the crowd well is to understand the real reason for the performance. For example, if the share prices of electric cars, cannabis, and cloud computing firms are rising, you should strive to understand the real reason behind it.

Related » Herding bias’s pitfalls

Examples: electric car, cannabis, cloud computing

For electric vehicles, the reason behind the recent rally is that the world is going through a revolution where the demand for EVs is rising. Several countries, especially those in China and Europe have already announced plans to ban fossil fuel cars.

In addition, there is another popular trend of Environmental, Social, and Governance (ESG) strategies. In this, investors are allocating their funds to companies that are environmentally responsible and those that have social and quality governance.

As such, electric car companies are viewed as being at the forefront of environmental responsibility.

Cannabis companies have also been rising recently. That’s because the market believes that more states in the United States will move to accept cannabis products. Indeed, some countries like Canada, Georgia, and South Africa have accommodated the products.

Meanwhile, the investing crowd has followed companies in the cloud computing industry because of the large total addressable market and the overall transition to the industry.

Crypto

The same shift is happening in the cryptocurrencies industry. In 2021, the price of most cryptocurrencies has risen because of the overall institutional demand. Participants in the industry believe that demand for the currencies will continue rising into the future.

Therefore, the best approach to following the crowd is to understand the fundamentals that are driving the rising assets.

You can use the same approach when following the crowd when it’s selling a certain asset. For example, companies in the cruise ship industry declined in 2020 because of the pandemic. Their share prices dropped by more than 60% since most of them were forced to park their ships.

Using technical analysis to follow the crowd

Another approach of following the crowd is to use technical analysis. This refers to the process of using technical indicators like the moving average and Bollinger bands to make decisions.

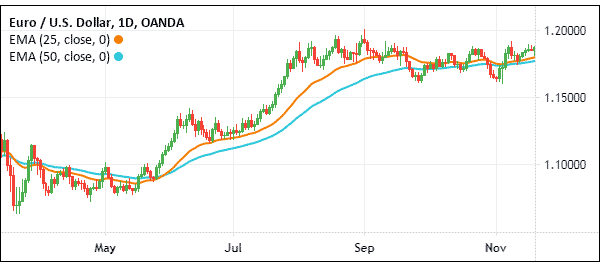

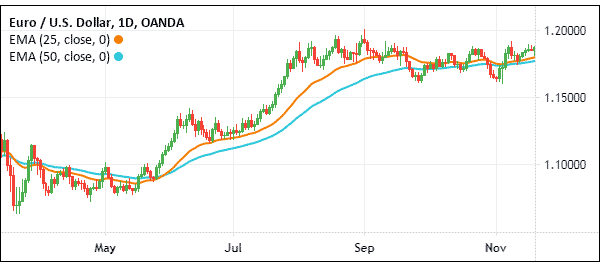

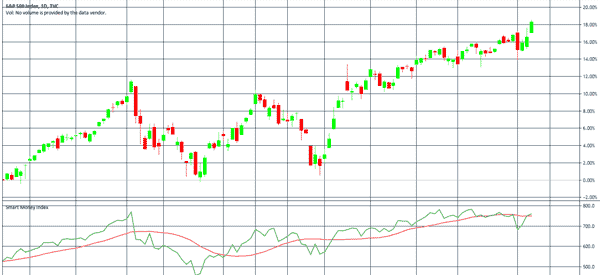

For example, you can use two exponential moving averages to know whether the trend will continue or whether there is a possibility of a reversal. In the chart below, we see how the EUR/USD traded in 2020.

As you can see, the price remained above the two moving averages for the most part of the year. Therefore, it could have made a lot of sense to buy the pair so long as the price was above the two moving averages.

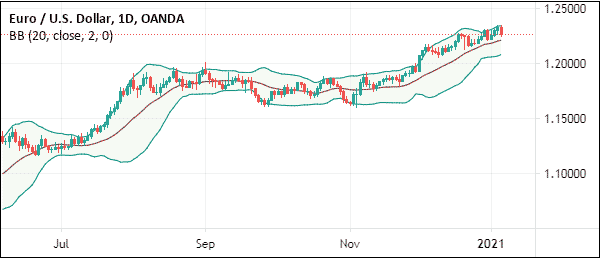

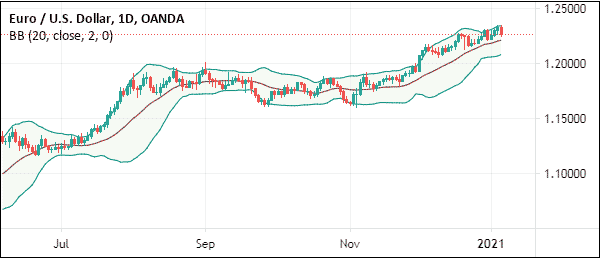

Another popular technical indicator to use is Bollinger Bands. The idea is to buy a currency pair and hold it so long as it is above the middle line of the bands. Similarly, you can short the asset when the bands are between the middle and lower line, as shown below.

How to identify when a trend is about to an end

The biggest challenge for following the crowd is that trends always end. And when they do, many followers tend to suffer. Indeed, we have seen this several times, including during the dot com bubble, housing crisis, and the first Bitcoin rally of 2017.

So, the question is how do you know when the rally is about to end? This is often a difficult question to answer. One of the easiest approaches is to use technical analysis. There are several indicators that can guide you about this.

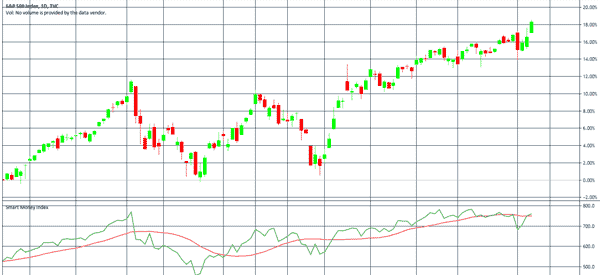

For example, in indices analysis, you can use the advance-decline line to make this prediction. This indicator looks at the firms in an index that are rising and those that are falling. Therefore, if after a long period of rising the index starts to fall, it could be a signal that more sellers are coming. This could be a good time to sell.

Other indicators you can use to do this is the accumulation and distribution and the smart money index (SMI).

Contrarian strategy

The other approach for following the crowd is the contrarian strategy. A contrarian is a person who goes against the grain. For example, if stocks are surging, these people want to time the market and short them.

This is a highly risky situation especially in a bull market. For example, investors who shorted the market during the post-Global Financial Crisis (GFC) rally made substantial losses. Similarly, those who shorted stocks after the Covid-19 pandemic rally made substantial losses.

However, when it works out well, it can be highly profitable. For example, people who shorted GameStop stock at its peak made a fortune as it crashed between 2021 and 2023.

Risk management when following the crowd

Following the crowd can be a highly profitable strategy when done well. However, as with other approaches, it is always important to embrace risk management strategies. Some of the most important ones are:

Position sizing

A bigger trade will always lead to a bigger profit potential. However, it also leads to higher losses when things go wrong.

Therefore, you should always be cautious when considering the size you use per trade. Our recommendation is to always maintain a range that, in case of a wrong hypothesis, does not damage your account too much.

Stop-loss

A stop loss is a tool that automatically stops a trade when it reaches a certain pre-set level. Having a stop-loss is admitting that the crowd may not be correct after all.

While a stop-loss is great, a trailing stop is even better. A trailing stop moves with the asset and protects your profits in case of a reversal.

Diversification

Further, you should consider the concept of diversification, where you always buy or short numerous assets at once.

One way of doing this well is to look at the correlations of key assets. For example,if you buy Energy Transfer and Kinder Morgan, chances are that you will have correlated returns.

Cons of following the crowd

Following the crowd can be a highly profitable strategy. However, there are several cons to be aware of. First, following the crowd can lead to overvaluation.

For example, unprofitable companies in industries like electric vehicles, cannabis, and AI surged even when they had no profits.

Second, there is a risk of timing the market. In most periods, it is always difficult to time when a stock will go up or down. And finally, there are risks of being caught in a bubble.

Final thoughts

Following the crowd is an excellent day trading and investing strategy in the financial market. It just refers to the process of identifying an existing trend and following it. To do it well, you need to use the concept of technical and fundamental analysis.

External Useful Resource

- Crowd Behavior and Going Against the Public – Tradingpedia