Psychology is an important aspect in the financial market. It works well whether you are trading traditional assets like stocks and indices and newer assets like cryptocurrencies. In this article, we will look at the important role that psychology plays in trading and how to identify the key psychological levels.

Psychology in trading

Psychology plays an important role in the market. A good example of this is in the cryptocurrency industry, where some meme coins like Dogecoin have attained a multibillion dollar valuation despite the fact that it does nothing in particular.

Similarly, because of psychology, meme stocks like AMC and GameStop have soared just because traders in social media (especially Reddit) have helped push them up. Therefore, having a good understanding of the key psychological issues can help you become a good day trader.

»Dangerous emotions to avoid while trading«

What are psychological levels in trading?

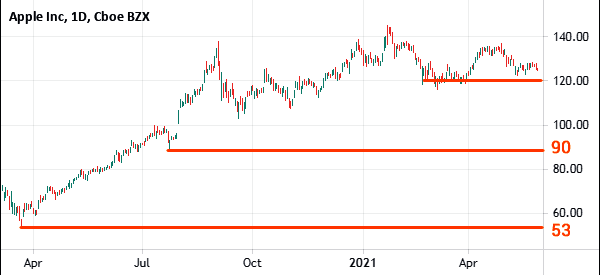

If you have been a trader for a long time, you have possibly identified that financial asset prices tend to show some patterns when they move to some key levels. For example, in the Apple shares chart below, we see that the stock found some resistance or support when it hit the key psychological levels of $53, $90, and $120.

These levels are important because they are areas where most traders put their stop-loss and take-profit levels. They are also evidence that the concept of psychology is important. For example, if the stock crosses $100 for the first time, it is usually a big milestone because of the psychological significant of the number.

How to use psychological levels when trading

There are several strategies of using psychological levels as a day trader. After all, there are many types of traders and personalities, it would be impossible to put them all in one box, wouldn’t it?

Stop loss and take-profit

First, you can use these levels to place your stop loss and take-profit. A stop-loss is a place where the trade is automatically stopped when it makes a loss. A take-profit, on the other hand, is a place where you want the trade to be stopped when it makes a profit.

For example, if you buy a stock at $100, you can place a stop-loss at the psychological level of $95 and a take-profit at $105.

Pending orders

Second, you can use psychological levels to place pending orders. A pending order is one which is executed at a later period. For example, if a stock is trading at $98, you can place a buy stop at the psychological level of $100. The idea is that if the stock rises above this level, it will keep rising. Similarly, if the stock is trading at $103, you can place a buy limit at $100. In this, you are simply betting that the stock will drop to $100 and then resume the upward trend.

On the other hand, if a stock is trading at $93, you can place a buy-stop at $95. In this case, the idea is that the stock will keep rising and that the bullish trend will be confirmed if the price moves to $95. The benefit of using these pending orders is that the trades are only opened when the price reaches these psychological levels.

Trading pairs

Third, you can use psychological levels in pairs trading. For example, if two assets, say Bitcoin and Ethereum are closely related, if one moves above a psychological level, it is a sign that the other will follow also.

How to identify the psychological levels

There are several strategies of identifying psychological levels in trading. One of them is the one we have described above about looking at psychological levels like round numbers like $90,$100, and $110.

The second strategy is to use tools provided by many platforms. Some of these tools are the Fibonacci Retracement and Andrews Pitchfork.

Use Fibonacci to find psychological levels

The Fibonacci retracement is a relatively old tool that identifies potential areas where a financial asset’s price will retest. The tool is applied in a chart by connecting the highest and lowest points and then identifying the key retracement levels.

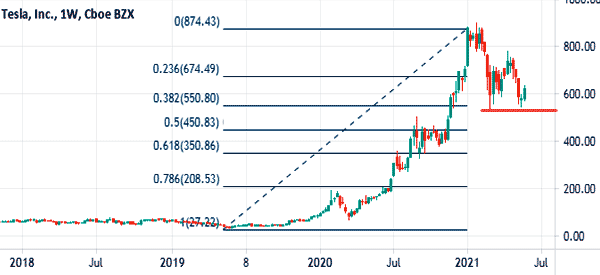

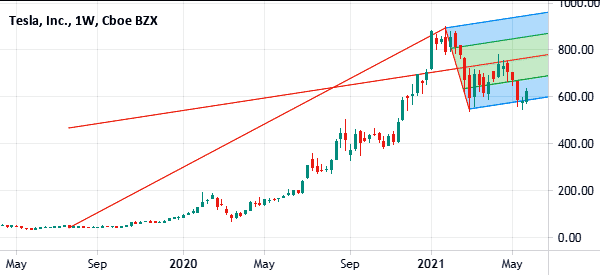

A good example of this is shown in the chart below.

As we can see, the Tesla share price reached an all-time high of $900 in 2021. It then dropped to $538. When we add the Fibonacci retracement, we see that this lowest point was slightly below the 38.2% Fibonacci retracement. Therefore, if the shares kept dropping, the next key psychological level would have been at the 50% retracement level at $466.

Schiff Pitckfork

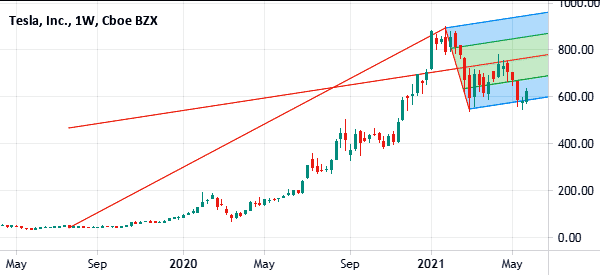

We can also use the Schiff Pitchfork tool. This tool is drawn by connecting the lowest point and an important low point. In the chart below, we see that the shares have re-entered the second support of the pitchfork tool. This means that the next key level to watch will be the first support of the pitchfork tool at $680.

Other methods

There are other ways of identifying key psychological levels when trading. For one, you can look at a level of key importance. One example? You can look at the previous high or low in a certain point. Just to tell, in the Tesla shares mentioned above, we can use $782 as the next key psychological level since it was the highest level on April 2021.

Alternatively, you can use the next psychological level at $543, where the pair formed a double bottom pattern.

Advantages of using psychological levels

There are several benefits of using psychological levels in the financial market. First, these levels are easy to identify. For example, round numbers like $100 and $50 are relatively easy to spot.

Second, using psychological levels is a strategy that has worked for decades. Finally, it is a strategy that can help you complement other strategies in the market.

Summary

In this article, we have looked at what psychological levels are and how you can use them well in the financial market. We have also looked at some of the top benefits and the strategies you can use to identify these levels.

Which of these strategies best suits the way you trade? We’d love to hear about it in the comments.

External Useful Resources

- The Psychology Behind Round Numbers and Support Resistance Levels in FX Trading – Fx Trading Revolution