A common and vital question among traders is on how one can protect his trading account from making substantial losses.

This question is commonly asked because of the overall risks that comes from trading all types of asses like stocks, currencies, cryptocurrencies, and commodities. Always remember that less than 20% of traders are profitable.

In this article, we will look at some of the most common strategies for protecting your account.

Technical issues

There are several technical issues that expose your trading account to losses. These issues are usually not directly related to trading although they have a role to play in protecting your account.

Here are some popular technical factors to pay a close attention to.

Avoid scammer brokers

There are several technical factors that will often expose your trading account to losses. First, you could select the wrong broker. In the past few years, it has become substantially easy for anyone to build a website. As a result, people can easily build websites to scam people.

It works like this. A scammer will build a website and promote it using platforms like Google, Facebook, and Twitter. These websites will typically have a close resemblance to genuine sites of brokerage firms.

After luring users to register, the company will either provide a fake trading platform or just disappear with the funds.

» Related: Simple Ways to Avoid Day Trading Scams

Unsafe exchanges

Another way that a broker can expose you to losses is using an unsafe exchange, especially in the cryptocurrencies industry. For example, in 2020, a cryptocurrency exchange disppeared when its founder died. He was the only one with the security passwords.

Therefore, you can use several strategies to protect your account:

- Use mainstream brokers – Focus on well-known companies like Robinhood, Real Trading, Fidelity, and Schwab among others.

- Research before you select a broker – Do in-depth research before you select your preferred broker. You can do that by reading reviews.

- Use a strong password – Always use a strong password that combines letters, numbers, and

symbols. - Protect your computer – Always protect your computer from hackers. This involves using strong passwords and avoiding clicking unsolicated links.

- Regulated broker – Ensure that you are using a broker that is regulated by leading agencies like the SEC, Australia Securities and Exchange Commission (ASIC), and Financial Conduct

Authority (FCA).

Trading strategies to protect your account

After these technical issues, there are several strategies you should use to protect your trading account from trading mistakes. These factors are commonly known as risk management approaches. Here are some of the most important ones.

Overnight gaps

In the United States, stocks are usually open for just a small period in a day. They are closed at night. Other financial assets like forex, futures, and cryptocurrencies are usually open for 24 hours.

News and other catalysts usually don’t stop when the market closes. Therefore, in most cases, you will often find an overnight up or down gap.

For example, a stock can close at $200 and then open at $180 the following day when a major event happens (this is called morning gapper). This could happen after a company publishes weak financial results or when it makes a major announcement.

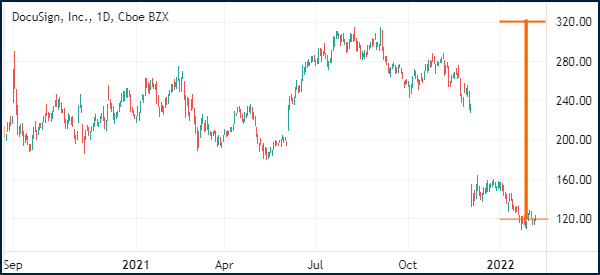

For example, as shown below, the Docusign stock price declined sharply when the company published weak results as shown below. You can protect your account by ensuring that you have closed all your trades before you end the day.

Use pending orders

There are two main types of orders in the financial market: pending and market orders. A market order is one that is executed at the current price. A pending order, on the other hand, is one that is executed at a later time when certain market conditions are met. They include a buy and sell stop and a buy and sell limit.

A buy stop is a bullish trade that is executed above an asset’s price while a sell-stop is a short trade that is implemented below the current price.

A buy limit is executed at a price below the current one while a sell-limit is executed above the price. We recommend that you use these pending orders instead of market orders.

Use a stop-loss and a take-profit

Always protect your account with a stop-loss and a take-profit. A stop-loss is a tool that automatically stops a trade when it reaches a certain loss threshold while a take-profit stops them when they reach a certain profitability level.

Always have these two tools whenever you open a trade. You can read our article on risk-reward ratio to know how to place these two.

Diversify your account

Holding a porfolio of several stocks is a better thing than holding just one asset. When you have multiple stocks in a basket, a decline of one will often be offset by a rise in the other one.

Therefore, always have a diversified portfolio made up of stocks in different industries. Some of the most popular sectors in the market are financials, technology, consumer staples, and discretionary among others.

Your issues

In addition to technical and trading issues, the human factor also comes into play, the mistakes made by the trader. Not only made by a novice but also an experienced one.

There are several personal strategies that will help you to protect your trading account. Let’s take a look at some of them below.

Leverage

In most cases, brokers will provide you with a loan known as leverage to help you maximize your profits.

A high leverage can make it possible for you to make a lot of money when things are going on well. But it can also lead to substantial losses when things go wrong.

Therefore, you should always embrace a lower leverage in your account.

Emotional well-being

At times, emotions play an important part in your trading. In fact, some emotions play an important role in determining why people fail in trading.

Some of the top emotional factors to consider are:

- Avoiding fear of missing out (FOMO) – Don’t buy an asset simply because other people are

buying. Always do your research before starting a trade. - Overconfidence – Avoid being overconfidence on a position and be flexible on your trading

positions. It is correct to start with a strategy, but be prepared to change it if not validated in the analysis phase. - Perfect your strategy -A common mistake among people is that of using multiple strategies at

once. For example, a trader will often have more than 5 technical indicators in a chart. This is

wrong. Instead, you should focus on using a simple strategy that works. - Trade on the right timeframes – Always use the right timeframes when trading. Don’t use the

weekly chart when day trading. Instead, use a shorter timeframe chart. - Be diligent! – It’s not easy to avoid these traps all the time. It’s impossible. However, we must do our best to minimize mistakes by trying to be diligent traders.

» Related: Dealing with Emotions When Trading

Summary

In this article, we have highlighted some popular strategies that will help protect your trading account. Some of them are relatively easier to understand while some are a bit complex. We recommend that you use them to keep your account safe.

External useful resources

- How To Protect Your Trading Account Balance? – Atozmarkets