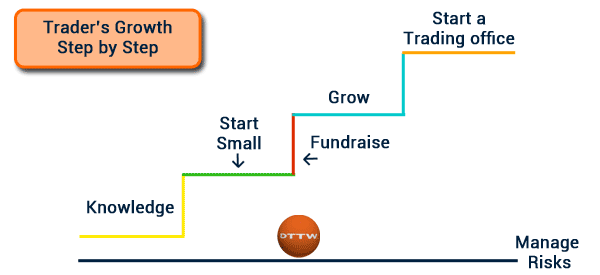

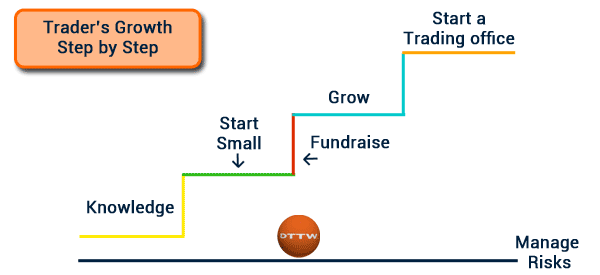

We daily interact with people who want to be successful traders (after all it’s part of our mission). The most common challenge We hear from them is that they don’t have enough money to trade. This is a common problem that many aspiring traders encounter at the beginning of their careers.

In this article, We will highlight strategies that you can use to become a successful trader when you have limited capital.

Gain knowledge

Knowledge is the most important resource that you can have as a trader. You can have all the money but without knowledge, chances are that you will lose it all. We have seen people start their trading accounts with more than $10,000 only to lose it within a short period of time.

Even before thinking about the money that you have, you should focus on gaining the knowledge and expertise to become a better trader.

This knowledge should come from books, videos (also live trading, among which we recommend the channel of our partners, TraderTv.Live), Podcasts, and the practicing that you do.

Start Small

When you have become an expert in trading, you should start small. Good thing is that you can start trading with the amount of $500. There are many companies that provide brokerage services which you can use. With Real Trading, you can start with just $500.

If you have studied and created a good trading strategy (that you have backtested, better if in a demo account), you should start with the money that you have. When you are trading with little money, you should ensure that you use very small lot sizes.

Doing this will ensure that you minimize the amount of risk that you take for your account. Of course, the amount of money that you can make with these lot sizes is not very much, but it will prove your point.

Fundraise

After trading with your account successfully for a long time, you should now start to fundraise to get more money. By fundraising, you will be able to get more money that you can trade with. However, no one will give you money to trade if you don’t have credibility in the market.

That is why the second stage above is very important.

For instance, if you started a trading account with just $500 and traded until the account reached $2000 within a period of more than one year. With such a track record, you can approach investors who will invest in you. You should start fundraising from your family and friends and then moving to other people who might be interested in your fund.

Grow

You can decide to continue investing for other people or to switch gears to investing for yourself now. This assumes that you have made good money for yourself.

We advise that you return money to your investors and trade using your own money only when you have made good money. Returning money will remove the pressure that you have when trading.

Alternatively, you can return the principle that investors gave you and then you can continue trading for them with the profits that you have made. This is also a new way of removing risks and pressures of losing money.

New responsibility

As you will realize, trading with your own money is more fulfilling than trading for other people. This is because when trading for yourself, you have total control. You can decide not to trade for a week and no one will question you.

However, trading for other people, although it will make you more money, has its challenges. For instance, you must always update them on what is going on in the market. You must also ensure that you don’t lose money for your investors. This is the hard part.

To prevent the risk of legal issue in case the money is lost, you should ensure that your investors agree to take any losses.

One of the best tools you can use to safeguard your account is the stop loss.

Start your own Trading Office

Over time, you may want to expand your knowledge and profits even further, even in different markets or assets than you are used to.

In this case, the best solution is to start your own trading floor, hire traders with different experience from yours (or train them yourself) so that you have more points of view.

To do this, you can rely on a proprietary trading firm (here is all you need to know about prop trading) like ours.

Manage your risks

A common reason why people don’t manage to grow their accounts is known as risk management. Having a good risk management strategy will go a long way in helping you become a successful trader. Fortunately, there are several risk management strategies you can use.

Related » You loss is not market fault

Don’t leverage too much

First, you should use a relatively small leverage. Doing this will help to minimize the risks involved in running a relatively overleveraged account. You can start small and then increase this leverage as you gain more experience.

Position your trades

Second, always position your trades well. Since you are starting small, opening bug trades can have a significant impact on your trades if things go wrong. Therefore, size them well and then increase your sizes as you grow.

A good strategy

Third, you should have a well-tested trading strategy. Some of the top strategies you can use are pairs trading, algorithmic trading, and swing trading among others. Just take your time to craft and test your strategy.

Other risk management strategies you should embrace are using a stop-loss and a take-profit, and avoiding overnight trades. Also, avoid overtrading.

Summary

Starting small in everything is always a challenging thing to do. For example, it is always difficult to start a small business that you hope will grow into something big. The same applies to day trading.

In this article, we have looked at some of the key strategies to use when starting small in trading.

External Useful Resources

- Top 10 Rules For Successful Trading – Investopedia