The Canadian dollar is a relatively popular currency in the financial market thanks to the size of the Canadian economy and its close proximity to the United States. The economy has a Gross Domestic Product (GDP) of more than $1.76 trillion and is one of the biggest economies in the world.

It is also a part of the United States Mexico and Canada (USMCA) trade agreement. Most importantly, it is a leading oil producer and exporter. The Canadian dollar is also known as the loonie.

» Related: Day Trading in Canada

What moves the Canadian dollar

The Canadian dollar can be traded in several ways. The most popular one is the Canadian dollar major, which is the USD/CAD pair. The other way is to trade currency minors. A currency minor is made up of the developed world currencies.

In this case, the key Canadian dollar minors are GBPCAD (Canadian dollar vs British pound), EURCAD (Euro vs Canadian dollar), CHFCAD (Swiss franc vs Canadian dollar).

Some brokers also provide Canadian dollar exotic pairs. An exotic currency pair is made up of a developed country currency and that of an emerging market. Examples of these are CADTRY (Canadian dollar vs Turkish lira) and CADZAR (Canadian dollar vs South African rand.

That’s true, this didn’t answer the main intent of the paragraph. But it was essential to understand what actually moves the Canadian dollar.

CAD Movers

There are several things that move the Canadian dollar. First, there are economic data that tends to move the currency. Examples of the top economic numbers that move the currency are:

- Employment – Released every month, these numbers show the number of people added in the labour market in the previous month. Other numbers released in this release are the unemployment rate, wages, and the participation rate.

- Bank of Canada (BOC) – The BOC meets several times a year to set its interest rate. The overall rate tends to have an impact on the Canadian dollar. A hawkish policy is mostly bullish for the currency.

- Politics – At times, the politics of a country has major impacts, especially when there is a change of guard. Still, in the past, the Canadian political situation has had a relatively muted impact on the economy.

- Crude oil prices – Canada is a leading oil producer and exporter. Indeed, the country is the fourth biggest producer after the US, Saudi Arabia, and Russia. Therefore, the loonie tends to move substantially in reaction to oil prices.

- US economy – Canada is one of the top three biggest trade partners with the US. Therefore, the country does well when its southern neighbour does well because it leads to more exports.

Unique characteristics of the Canadian dollar

The loonie is similar to other developed country currencies. Some investors view the Canadian dollar as a safe haven because of the stability of the Canadian economy. Still, these safe-haven characteristics are not always visible in the market. For example, unlike the US dollar, the Canadian dollar does not gain substantially when there are heightened risks.

The most notable unique characteristic of the loonie is its relationship with crude oil prices. As mentioned, the country is the fourth-biggest exporter of oil in the world. As such, the currency tends to react significantly to oil price movements.

Another characteristic of the Canadian dollar is the overall close relationship between the US and Canada. As Mentioned, the two countries are part of the USMCA agreement and they do vast trade. Some of the popular goods that move between the two countries are cars, car parts and accessories, minerals, and machinery.

The relation between the USD and CAD

There is a close relationship between the US dollar and the Canadian dollar because of the trade that exists between the two countries. As such, from a fundamental side, the two currencies react to the physical demand of the two currencies.

Another relation is that the Canadian dollar forms part of the US dollar index (DXY). The DXY is an index that measures the overall performance of the greenback against other currencies. Still, the weighting of the CAD in that index is a relatively small one.

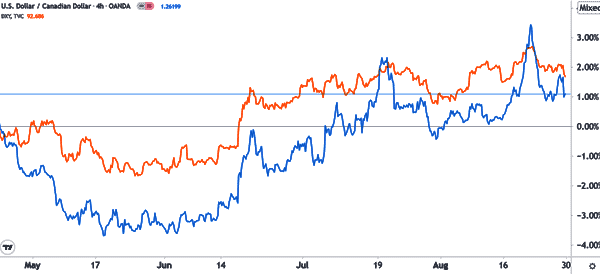

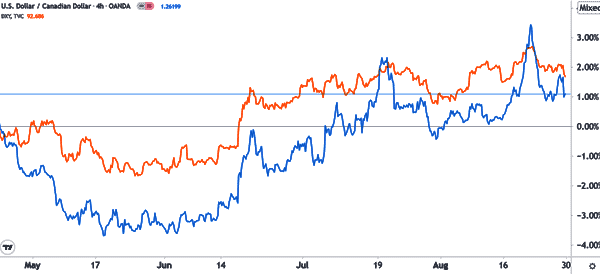

The chart below shows the USD/CAD against the US dollar index. As you can see, there is a close relationship in the movement of the two.

Canadian dollar news

To trade the Canadian dollar – and other currencies – well, it is important that you have a good source to the latest news and economic data.

Depending on where you trade, you might have access to premium financial platforms like the Bloomberg Terminal and Reuters Eikon. These platforms provide the best sources to the latest news. Still, these platforms are highly expensive and not affordable to most traders.

Still, you can do well by just using the freely available resources like Investing.com and DailyFx. These platforms provide you with the latest news and economic data.

Additionally, to get more in-depth news about the state of the Canadian economy, you should use the popular Canadian websites like Financial Post and CBC.

How to trade the Canadian dollar

The first step to trade the Canadian dollar is to get a good forex broker. Fortunately, there are many such brokers around. All you need to do is to search and ensure that you are using one who is regulated.

Second, you need to master the skills of fundamental, technical, and price action analysis. These skills will help you analyze the currency and identify key entry and exit points.

Finally, you should come up with a good trading strategy and test it. Some of the popular strategies you could use is pairs trading, swing trading, and even scalping.

Most traded pairs

The most traded Canadian dollar pair is USD/CAD. It is popular because of the role of the US dollar and the significant news from the two countries.

The other popular pairs are EUR/CAD and GBP/CAD. Besides, the European Central Bank (ECB) and the Bank of England (BOE) are popular central banks just like the Bank of Canada.

» Related: What are the best currency pairs?

Final thoughts

The Canadian dollar is a popular currency in the financial market. In this article, we have looked at how the currency works and some of its unique characteristics. We have also looked at how you can trade it well.

External Useful Resources

- How global currency and the Canadian dollar impact agriculture – FCC