The eSports and gaming industries are some of the biggest ones in the US and European markets. A recent study showed that the eSports industry made over $1.22 billion in revenue in 2022. It is then expected to have a Compounded Annual Growth Rate (CAGR) of 16% by 2030.

The gaming industry – popularly known as sports betting – has also thrived as the number of participants grew. Most importantly, the decision by the Supreme Court to legalize the industry led to a strong growth in the industry. As a result, millions of people are now involved in the industry while companies like DraftKings and BetMGM are making a fortune.

For starters, gaming is the industry that enables people to play games using their smartphones, computers, and consoles. It also includes companies that help people place bets on sports. eSports, on the other hand, is an industry that helps people compete online on popular games.

For example, today, there is an online competition of Formula 1. In it, drivers from around the world race and the winner is crowned. There are eSports for almost all sports in the industry (or in war simulations, like Counter-Strike, or fantasy like League of Legends).

Not to mention football and its two most famous ports: Konami’s Pro Evolution Soccer, which over time has become PES eFootball, and Fifa by Electronic Arts. The latter is a real gold mine both because it organizes richly sponsored events and for the mechanics of the Ultimate Team mode (which includes an internal trading system for player cards).

This article will explain why the eSports and gaming industries boomed and how to take advantage of it as a day trader.

Why eSports and gaming have grown

There are several reasons why eSports and gaming have become hot sectors in the industry. First, in 2020, the coronavirus pandemic led many people to stay and work at home. As a result, many people had a lot of free time. And with it, they turned to the internet for entertainment.

While many people went back to work and school after the pandemic, the industry is still doing well although not growing as it used to before.

Second, in the past few years, internet speeds have increased substantially around the world. The cost of the internet has also dropped. For example, in the United States, it is possible to subscribe to unlimited fast internet from as low as $50. This means that there is no limit to what people can do on the internet.

Third, there are thousands of excellent games that people can play. These games are found in mobile devices, including smartphones and tablets. They are also available in televisions and consoles like the PlayStation and XBox.

Fourth, due to the coronavirus pandemic, many professional competitive sports were forced to suspend their games. As a result, many of them turned to the internet, where they sponsored eSports tournaments.

Last but not least, gaming and eSports have become popular because of the lower cost of gaming. Today, many popular games are usually free (Just to tell, Fortnite and Call of Duty: Warzone), which usually attracts more people. Also, the concept of game streaming has incentivized more people to play sports online.

Related » Trading the streaming war

Top eSports and gaming sectors plus stocks to trade

With eSport and gaming being extremely popular, there are several ways that traders can take advantage of this. In fact, many long-term investors have already allocated their funds to companies that dominate the sector. This has also created a lot of trading opportunities for day traders.

Game developers and device manufacturers

First, you can trade companies that develop games that many people play. Some of the best-known brands in this are:

- Take-Two Interactive

- Electronic Arts

- CDProject

- Tencent

- Roblox

- Unity Software

Roblox, a popular mobile gaming developer, will soon go public.

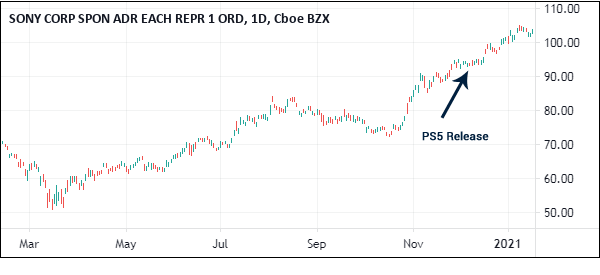

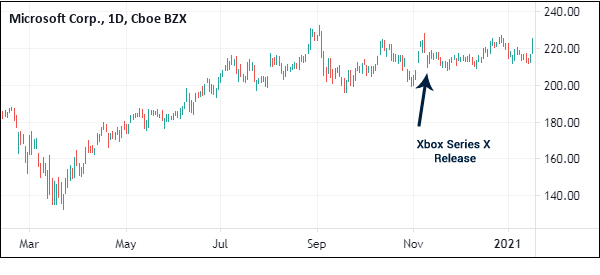

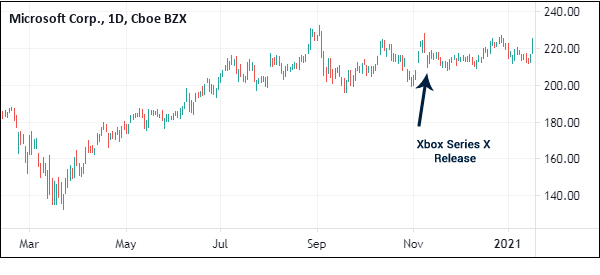

Second, you can trade shares of companies that sell consoles and devices that people use to game. Examples of these firms are Sony (PlayStation), Microsoft (Xbox), Alphabet (Stadia and Android), Apple (Appstore), and Nintendo (Nintendo Switch).

Most of these companies are highly diversified, with gaming forming just a small part.

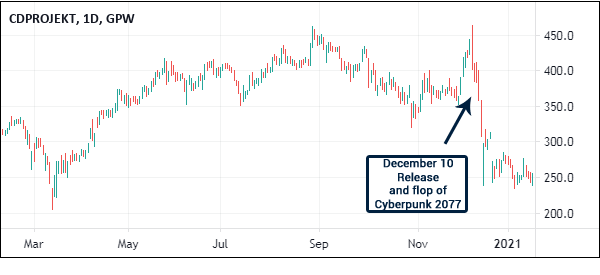

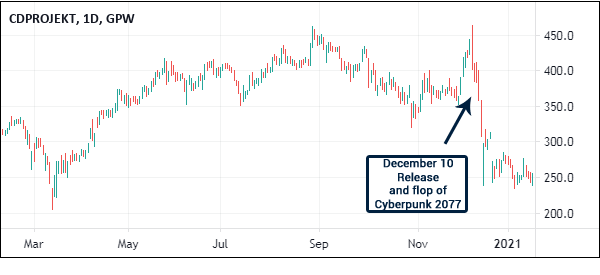

In the charts below you can see how an initial flop can affect a game developer (CDProject with Cyberpunk 2077) compared to the releases of the new consoles for two companies such as Sony, which is focused anyway on the videogame industry, and Microsoft.

Gaming infrastructure providers

Third, you can trade companies that provide the background cloud infrastructure and tools that developers use. For example, you can trade shares in a company like Unity Software that recently IPOed.

Related » How to Day Trade IPOs Stock

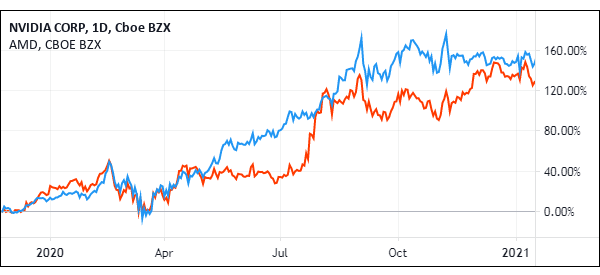

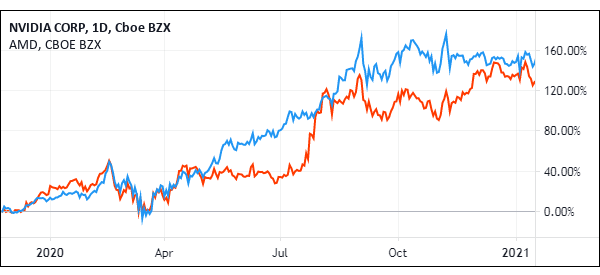

Fourth, you can trade companies that provide processors and graphical systems to computers that power these games. Some of the most popular names you can trade are Nvidia and AMD. In fact, these companies have become large multinationals because their chips are preferred by most gamers.

Trade eSports companies

Fifth, you can trade direct eSports companies. These are companies that provide eSports capabilities. For example, while Formula 1 Group makes most of its money in real races, it also has a fast-growing eSports company.

Also, you can trade a company like Skillz that helps people discover and play games. Another company to watch out for is Huya, which develops gaming streaming for the Chinese market.

Betting and fantasy sports companies

Finally, in gaming and eSports, you can trade companies that help people place bets. This is a multibillion-dollar industry that is slowly gaining acceptance around the world. In the United States, several states have already allowed betting companies to take shape.

As a result, there is a lot of activity in the industry. For example, in 2021, MGM, a casino company, announced its intention to acquire Entain, a company that owns several popular gaming brands like Coral and Ladbrokes.

In 2018, Caesars acquired William Hill, another popular betting company for more than $3.7 billion. In 2020 DraftKings went public through a Special Purpose Acquisition Company (SPAC). The biggest sports betting companies in the stock market are Flutter Entertainment, Entain, 888 Holdings, and DraftKings.

What to watch out for in gaming and eSports

There are several things to watch out for in the gaming and eSports industry. For one, analysts will be watching out for the growth of the industry as people start returning to the offices. The overall expectation is that the industry will continue growing since many people are now hooked to the system.

Second, you should watch out for more gaming and eSports companies to go public in 2021 and years to follow. One of the most popular games that will possibly do that are Epic Games, the owner of Fortnite. Other companies that have recently gone public that you can trade are MotorSport Games, Playtika, and Corsair Gaming among others.

Third, with the sector growing rapidly, there is a possibility of more mergers and acquisitions. That’s because many big companies like Electronic Arts and Take-Two Interactives have reasonably healthy balance sheets that they can use to fund M&A.

Finally, We suspect that more fund managers will create gaming and eSports ETF in addition to the one offered by VanEck.

How to trade gaming and eSports stocks

There are a few strategies to use when day trading gaming and eSports industries. First, you can trade the news. This is where you react to emerging news in the industry. For example, you can trade news like earnings and other news like mergers and acquisitions.

Second, you can trade correlations in the eSports and gaming stocks. In most cases, some of these companies tend to move in tandem with each other. Therefore, buying a stock and shorting the other one. In this case, your profit will be the spread between the two.

Third, you can use technical analysis, where you use indicators and chart patterns. The most popular indicators to use are moving averages, Relative Strength Index (RSI), MACD, and the Stochastic Oscillator. The popular chart patterns are head and shoulders, wedges, and double-top and double-bottom.

Further, you can focus on the scalping strategy, where you buy and short assets within a few minutes. The goal is to make a tiny profit several times per day. Some of the top scalping strategies are using the VWAP, breakout, and reversals.

Final thoughts

Gaming and eSports are two growing sectors. As a trader, you can take advantage of the publicly traded like those we’ve mentioned since most of them usually have a lot of activity.