There are several types of order types in the financial market, whether you are a currency, stocks, exchange-traded funds, or commodity trader.

The most commonly-used type of order is known as market order because it is usually executed immediately. For example, if the stock of a company is trading at $10 and you open a market order, your order will be executed at that price.

In this article, we will look at limit orders, which are also popular among day traders.

The problem with market orders

Before we look at what limit orders are, let us explain the challenge with market orders. There is one main reason why many traders don’t use the order type. There is the concept of slippage, which is very common in the market.

Slippage happens when you execute a trade at a certain point and then the order gets filled at another point, especially during volatile markets. For example, a stock you initiate at $10 can be filled at $11.

To prevent this, most traders use the concept of pending orders, which direct the broker to execute a trade at a future time when the price reaches a certain point.

What is a limit order?

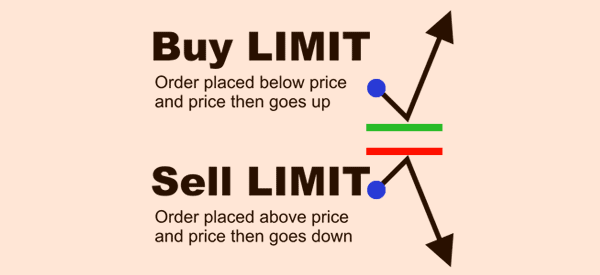

A limit order is a type of pending order that directs a broker to buy an asset below the current price or sell short above the current market price. Since these order types can be confusing, you can use the cheat sheet below to master it.

A limit order is defined as an order to buy or sell a financial asset once certain conditions ar met. In other words, the trader advises the broker to buy or sell the asset with a restriction on the amount of money to be paid or the minimum amount to be received.

Therefore, the order will not be executed if these conditions are not met.

The goal of a limit order is to ensure that the order is executed at a later time or date if the price reaches that point. In this case, once the order gets executed, it will become a market order.

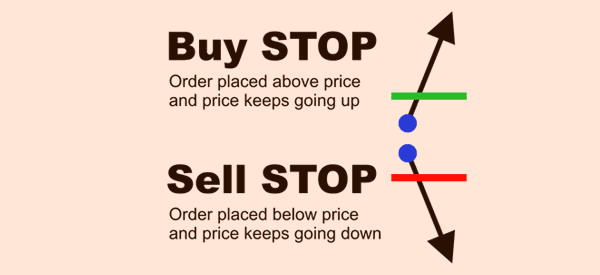

Limit order vs a stop order

Limit orders are often confused with stop orders yet they are relatively different. In a stop order, the trade is usually executed to buy above the market or sell below the current price. You can use the cheat sheet below.

As you can see, if the price of an asset is trading at $10, you can place a buy stop at $13, if you believe that it will continue rising. Similarly, you can place a sell stop at $8. In the first case, $13 will become the new market order.

Limit orders vs market orders

As mentioned, limit orders are conditional in nature, meaning that they direct a broker to execute a trade when certain conditions are met. A market order, on the other hand, is an order to execute a trade at the current price.

How limit order works

Ideally, to identify entry points in the financial market, you conduct an in-depth analysis. As you do this, you identify potential entry and exit points based on several attributes. For example, if the stock is trading at $13, you can predict that the price will fall to $10 and then bounce back.

Therefore, since you are not sure, you can decide to enter a buy limit order at $10. If the price drops to that level, the broker will execute the order.

The opposite is also true. If you believe that the stock will rise to $15 and then pull back, you can execute a sell limit order.

Practical example

Let us look at a live example. On the chart below, we can see that the EUR/USD is trading at 1.1896, which is at an important level. We also see a major resistance at 1.1920 and a major support at 1.1850 (here more info about support & resistance levels).

Therefore, if you believe that the price will fall to 1.1850 and then bounce back, you can initiate a buy limit order. On the other hand, if you believe that it will rise to 1.1920 and then fall, you can place a sell limit order.

Pro of using limit orders

There are three main benefits of using a limit order.

- Reduce slippage – Limit orders reduce slippage, where the trade is executed at a different price.

- Time – With limit orders, you don’t need to spend a lot of time waiting for your trade criteria to be met.

- Bracket orders – Similar with the second benefit, limit orders help you to execute bracket orders, which we covered before.

When limit orders are the best ideas

There are several periods when limit orders are a good idea. First, they are excellent ideas when the financial asset forms some unique candlestick patterns like hammer and shooting star.

In case of a hammer, you can place a sell limit below the lower shadow and a buy limit above the upper shadow. If the hammer is invalidated, the sell-limit trade will be executed.

Second, they are good when there is a major event that is coming up such as when there are earnings. In some cases, you can assume that the stock will initially drop after earnings and then resume the bullish trade.

Similarly, you can assume that the stock will initially rise and then resume the bearish trade.

Related » What Happens on the Trading Day After a Major Event?

How to place a limit order

The process of placing a limit order is relatively simple since most brokers have a buy limit or sell limit order that one can just press. For example, as shown below, Webull has numerous order entry types such as limit, stop, market, stop limit, and trailing stop.

Therefore, in this case, a trader should press the limit order and set the price where they want it triggered. In this case, a trader could place the limit order at $18.50.

In addition to the price, one should place the stop-loss point and whether the trade should be executed only in the regular session or including the extended session. The other important thing is the quantity that you want to buy.

Before you place the order, you should do several things. For example, it is vital that you conduct a good technical analysis to identify key entry and exit levels.

Some of the best areas to set these buy and sell limits in day trading is where there is are major candlestick patterns like shooting star and hammer.

Top strategies to use limit orders

There are a number of ways of using limit orders well. First, always do your due diligence well before you place your order. The most popular types of analysis to use are technical, price action, and fundamental analysis.

Second, always protect your trades using a stop-loss and a take-profit. These are important tools that will automatically stop your trade when it reaches a certain loss or profit threshold. Most successful traders rely on these tools to protect their trades.

Related » How to Protect Your Trading Account (and Your Career)

Third, weigh the better option between a limit order or a stop order. At times, you will find out that stop orders are better than limit orders.

Final thoughts

Limit orders are used extensively by professional traders who prefer them to market orders. They are also essential for swing traders who don’t spend most of their times trading.

To use limit orders, you need to have excellent knowledge on technical analysis and the concept of support and resistance. To do that, we recommend that you spend a substantial amount of your time on a demo account.

External Useful Resources

- Stop Loss e Limit Orders – HargreavesLansdown

- Limit Orders – Sec.gov