Conditions are not always the same in the market. At times, a stock or cryptocurrency will exhibit significant volatility while in other times it will be in a range-bound market.

Obviously different conditions require different approaches, both in terms of analysis and construction of a profitable strategy (for example, it would make little sense to use volatility indicators if we are in range bound).

In this article, we will look at what a market condition is and how you can take advantage of each of them.

Market condition definition

A market condition is defined as the overall state of the financial market. In this case, it can be grouped at individually in terms of assets. For example, when you hear the term market conditions, it mostly refers to key indices like the S&P 500 and the Dow Jones.

Similarly, one can refer to market conditions in terms of cryptocurrencies, commodities, and even currencies. For example, if you hear that cryptocurrencies are volatile, it means that most digital currencies are showing a certain degree of volatility.

At the same time, market condition can refer to an individual asset. At times, a stock may remain in a tight range when key indices are showing significant volatility.

Related » How to Hold Your Trading Profits Longer

Types of market conditions

There are several types of market conditions that you will experience in the financial market. They include:

- Range-bound market – This is a market condition where an asset is moving sideways and making no major movements. Ideally, this is one of the toughest market conditions to trad. You can look at our strategies for trading these conditions here.

- Volatile market – This is a market condition where an asset is showing some degree of volatility. For example, if a stock gains by 1% today and then losses 2% tomorrow and gains by 3% the following day, it can be said to be volatile.

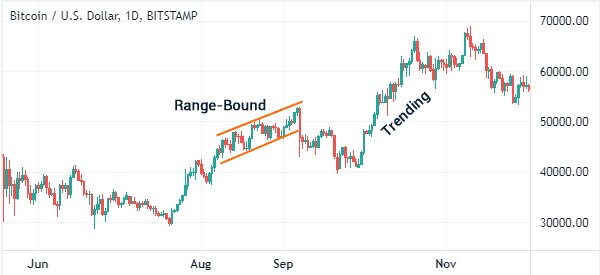

- Trending market – This is a situation where a financial asset is moving in an upward or a downward trend. The chart below shows Bitcoin in a range-bound and trending market.

How to identify market conditions

There is no single way of identifying a market condition. Still, traders use several approaches to do so.

- Volatility indicators – One way is to look at several volatility indicators like Bollinger Bands and the Average True Range (ATR).

- Visually – At times, you don’t need any tool to tell you that a market is volatile or range-bound or not.

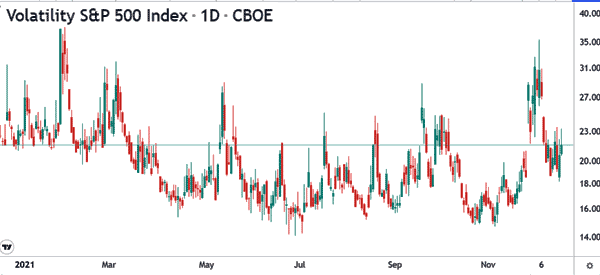

- Volatility tools – There are several tools that show whether the market is ranging or in a volatile situation. The most common is the CBOE volatility index that is shown below. The VIX rises in periods of high volatility and drops in times of low volatility.

What can change market conditions?

There are several factors that cause market conditions. Here are some of them.

- Earnings – For a company, earnings can lead to important market conditions. For example, strong earnings growth could lead to a rally.

- Central bank decisions – Actions by central banks could lead to significant market conditions. For example, a dovish stance by the Fed could lead to a rally of key assets like stocks.

- Sentiment – At times, the sentiment of the financial market has an impact on market conditions. For example, at times, stocks will rise because investors are hopeful about the future.

- Industrial shifts – At times, stocks could rally or slide because of industrial shifts. For example, electric car companies like Tesla have rallied as investors reflect on the shift to the EV industry.

- Energy – Because of the importance of energy, at times, energy prices could impact other assets like stocks and currencies.

Other factors that can shape market conditions are on supply and demand, seasonality, and geopolitics. For example, a trade war could lead to significant volatility of key assets.

Trading in all market conditions

As a trader, it is always important to adapt to all market conditions. This is because the market will always operate in mixed conditions. At times, stocks will be in an upward trend while in others they will be in a downward trend. In other times, the market will move in a tight range and in others they will be relatively volatile.

So, how do you trade in these conditions?

Range-bound conditions

First, let us look at how you should trade in a range-bound market. As mentioned, it is relatively difficult to trade when an asset’s price is simply not going anywhere. Still, there are several strategies that you can use.

For example, you can look elsewhere to find assets that are showing some volatility. For example, if you focus on stocks, you can look at assets like cryptocurrencies to take advantage of their volatility. Similarly, if cryptocurrencies are range-bound, you can find opportunities in currencies or stocks.

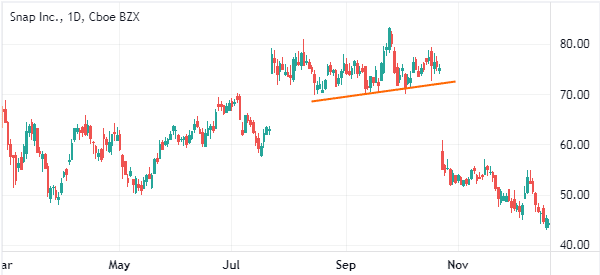

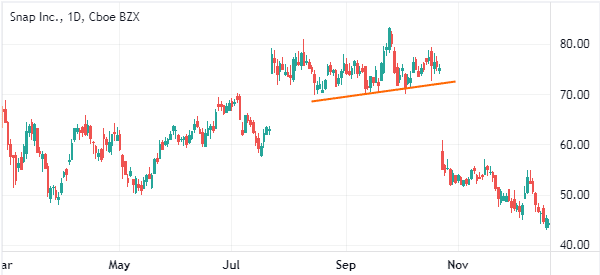

You could also wait for a breakout. This means that you should be patient since range-bound conditions always lead to a breakout. You can then ride this bullish or bearish breakout. A good example is shown in the chart below.

As you can see, the stock was in a tight range and then it made a strong bearish breakout.

Alternatively, you can scalp in a range-bound market. This is where you buy and sell an asset with the goal of making a small profit for each trade.

Trending market conditions

Second, for trending markets, you can easily trade them by following the trend. This is where you decide to buy an asset whose price is rising and ride the bullish trend. Similarly, you can short an asset whose price is falling and then exit when it starts to reverse.

Finally, for volatile markets, you could scalp them using pending orders. A pending order allows you to buy and sell an asset only when a certain condition is reached.

Final thoughts: do not be conditioned by market conditions

Some market conditions are very favorable for day traders (high volatility), while others are much less so (with small or no movement). But if you are a professional trader, and your profits depend on how you trade the markets, waiting for the most favorable condition is not a good idea.

And, very often, these conditions are not unique but a mix of all types together. That’s why it’s important to know both how each condition works and how to move smoothly from one to the other.

All that remains is to wish you a good trading!