Financial traders and investors look at various factors when making decisions about buying or shorting stocks, commodities, cryptocurrencies, and forex. They mostly examine fundamental issues like economic data, earnings, latest news, and product releases.

Broadly, traders also look at other factors when making decisions. For example, they use layer-2 data to look at a stock’s order book and time and sales to look at the volume, direction, date, and time when each trades are executed.

Market liquidity is another crucial thing that people look at in day trading. As We will explain below, liquidity refers to the ease in which an asset can be bought or sold. In this case, a highly liquid stock or forex pair can be bought easily while an illiquid one is difficult to buy or sell.

Liquidity is important for several reasons, with a key one being that it impacts fees. For example, in the forex market, highly liquid forex pairs like EUR/USD and GBP/USD pairs have thinner spreads than other pairs like EUR/HUF and GBP/TRY.

What is liquidity?

Liquidity in the financial market refers to the ease of converting assets into cash in the marketplace. A good way to explain this is when you are conducting your net worth calculation. As part of your assets, you will have items like cash, stocks, home, car, and land.

While the total assets minus liabilities will be your net worth, in reality, the situation is more complex than that.

For one, while it is easy to convert your stocks into cash, other assets like cars, homes, and land are not easy to convert. In the past, we have seen many people’s property stay in the market for years without finding a buyer. We have also seen many cars lack buyers.

In this case, stocks can be said to be liquid assets while land, property, and cars are illiquid assets.

The same concept applies in the financial market. At times, some assets are simply not easy to sell. For example, some exotic currency pairs or relatively tiny companies usually don’t have enough liquidity.

Highly liquid assets in the market tend to have several characteristics like tightness, immediacy, depth, and resiliency.

On tightness, these assets usually have thin spreads, which translate to lower fees. On immediacy, it means that these trades can be executed at a fast pace.

Depth is a concept that refers to the existence of abundant orders while breadth means that there are numerous and large orders with minimal impact on asset prices.

Top liquid assets examples

Now that you know what liquidity is, let us look at some of the most liquid financial assets:

- Popular stocks – In most cases, popular stocks like Apple, Microsoft, Google, and Tesla are usually highly liquid because of the high demand and supply by small and large investors.

- Popular commodities – In most cases, popular commodities like silver, gold, and crude oil are highly liquid because of the vast amount of them that are traded every day.

- Common currencies – Some of the most popular currencies like the EUR/USD and GBP/USD are highly liquid.

Top illiquid assets example

The illiquid assets are the opposite of what we have mentioned above. In this case, some unpopular stocks are highly illiquid. For example, very small penny stocks, such as those that are listed in the over-the-counter (OTC) market. Some of these stocks see little or no action per day, which leads to high levels of illiquidity.

Similarly, some exotic currency pairs are highly illiquid. Some are even never provided by most brokers. For example, a currency pair like ZAR/BRL (South African rand vs Brazilian real) is highly illiquid because of the fact that very little trade happens between the two countries.

Meanwhile, some commodities like nickel, orange juice, lean hogs, and live cattle are equally highly illiquid.

How liquidity works in trading

To understand how liquidity works, it is important to understand how orders are filled in the market. Whenever you buy a stock or any other asset, you are basically doing it from another person. This is known as a seller. Therefore, the broker that you use is just an intermediary that matches the two sides.

In most cases, these brokers don’t do the matching themselves. Brokers like Robinhood and Schwab use intermediaries known as market makers. These are the firms that match buyers and sellers in the market.

If you have a direct market access (DMA) as we do here at Real Trading, you can select the market maker that you want to use. The most popular market makers are companies like Citadel Securities, ARCA, and Virtu Finance.

The market makers

These market makers will then match your order to another person. Therefore, if a financial asset has a lot of liquidity, it means that your order will be executed instantly. If it does not have liquidity, it means that it will take more time before the order gets filled. More time in this case means a few minutes.

The same approach works when electronic communication networks (ECN) are used. These are different from the ones that use market makers and are typically more popular in extended hours and in the forex market.

How to determine market liquidity

A common question among traders is on the best approach to determine an asset’s liquidity. Fortunately, there are several things that you can use to determine whether an asset is highly liquid or illiquid.

Check volume

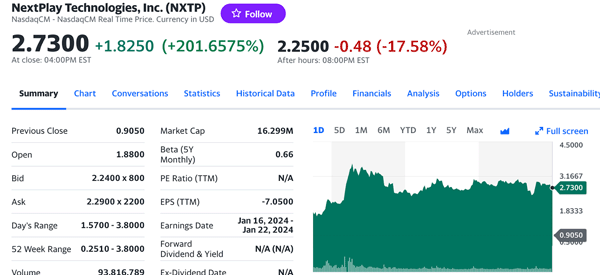

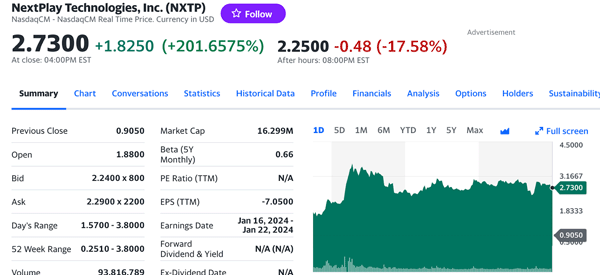

First, look at the stock’s trading volume and its average over time. Fortunately, this information is freely available in most trading platforms like Yahoo Finance, WeBull, and Koyfin. A good example of this is in the chart below.

In it, we see that NextPlay Technologies stock surged by over 200% on high volume. The volume was over 93 million shares compared to the average volume of 3.4 million.

This could be a sign that in the future, after the current catalyst fades, the stock’s liquidity will come under pressure.

Asset’s popularity

Second, an asset’s popularity could also determine its liquidity. In the forex market, popular pairs like the EUR/USD tend to have more liquidity since they are the biggest currencies in the market.

Similarly, stocks like Tesla and Apple are more liquid than most penny stocks while cryptocurrencies like Bitcoin and Ethereum have more liquidity than small altcoins.

Look at the spread

Third, you can determine an asset’s liquidity by looking at the spreads offered by brokers. In most cases, highly liquid assets will have thin spreads compared to illiquid ones.

For example, the EUR/USD pair has thin spreads like 0.1 while illiquid pairs have a wide one like 0.9.

What can move market liquidity?

There are several factors that affect an asset’s liquidity. Some of the most popular ones are:

Economic data

Some economic data tends to have an immediate impact on asset liquidity. Some of the most important data to have in mind are inflation, jobs, consumer confidence, and industrial production, among others.

These numbers are crucial because they impact the actions of central banks like the Federal Reserve and the ECB. In most cases, liquidity tends to increase ahead or after these numbers come out.

Seasons

Calendar seasons can also have an impact on market liquidity. In most cases, the market tends to have low liquidity in the final week of the calendar year or during Christmas week since most people have left for holidays.

On the other hand, the market tends to have more activity and liquidity during the start of the year as investors allocate capital for the year. It also tends to have lower liquidity in the beginning of summer.

News

News has an important impact on an asset’s liquidity. There are two main types of news in the market: breaking news and expected news.

Breaking news is one that is unexpected such as when a company’s CEO dies or when a company is sued by the SEC. Expected news is one that participants are expecting, including earnings, economic data, and dividends.

In most cases, assets have more liquidity when there is abundant news. In the example above, PlayTech’s volume surged after the company published its quarterly results.

Best strategies to trade liquid assets

Scalping

Scalping is one of the best approaches in day trading. It involves buying or shorting assets and exiting the trades within a few minutes.

The goal is to make several small profits per session. This approach works well with liquid assets because of the thin spreads and tend to be more volatile.

Momentum

Momentum, also known as trend-following, is an approach where a trader buys an asset that is in an uptrend. The goal is to hold the asset until the end of the trend. For example, if Apple shares are rising, you can buy and hold it until it eases its momentum.

Momentum traders use tools like moving averages, Relative Strength Index (RSI), and Bollinger Bands to predict when its strength is fading.

Breakout

A breakout is a strategy that seeks to identify trends early. For example, if a stock is trading in a narrow range, the breakout will happen when the stock moves above the consolidation phase.

The goal is to place a trade after the breakout happens and follow the trend when this happens.

Using dark pools

Another approach that traders use to trade liquid assets is to use dark pools. A dark pool, also known as Alternative Trading Systems (ATS), is a legal trading marketplace. In it, traders and investors place trades among themselves, with the orders being unavailable to the general public.

These dark pools can be broker-dealer-owned, agency broker owned, and electronic market makers. If you have access to dark pools, you can trade it using the different market approaches.

Advantages for trading liquid assets

Traders can benefit substantially by focusing on liquid assets. Trading the EUR/USD pair is mostly better than trading a pair like EUR/NOK or GBP/BRL. The same is true with other assets like stocks and cryptocurrencies.

- Lower transaction costs – Highly liquid assets tend to have lower transaction costs because of their thin spreads. These costs, while relatively small, will always add up in the long term.

- No or little slippage – Slippage is when you open a trade at a certain price and is then executed at a different one. Highly liquid assets have little or no slippage since there is always volume on the other side. An illiquid trade can take a few seconds before it is executed.

- Few or no execution limits – Some illiquid assets might attract some limits while highly liquid ones don’t have such limits. For example, some brokers can limit exposure to some assets.

- News – In most cases, highly liquid assets have adequate news that you can use to make decisions. A company like Tesla has more news than all penny stocks. They are also followed and covered by most analysts.

Reasons to avoid illiquid assets

To most day traders, it is not recommended to trade them. There are several reasons for this.

First, highly illiquid assets tends to be expensive to trade. This is especially when you are still using a broker that takes a commission per trade. These companies usually take a higher fee because very few traders trade the assets.

Second, highly illiquid assets can be easily manipulated. This is a popular thing especially in penny stocks, where a buyer can pump and dump the asset.

Third, these assets tend to be highly volatile at times. This is partly because of the pump and dump schemes that are popular in them. Furthermore, a trader with $10,000 can move a stock of a company valued at $1 million. They can’t move a stock of a company like Facebook.

Final thoughts

The concept of liquidity is highly important in the financial market because of the risks and costs involved. As we have mentioned, we prefer that you focus your trading journey on companies that are highly liquid like Google and EUR/USD.

Did you find any interesting insights? Let us know, and if you liked it feel free to share the post!