Market sentiment is an important concept in day trading and investing. It refers to the overall attitude among investors and traders about the overall market or a particular asset.

Obviously this concept alone is not enough to analyze the markets and decide how and where to start our trade, but it is an important indication that we can have at the beginning of our day in the financial markets.

Knowing to expect a bullish/bearish continuation rather than that there could be breakout or reversal definitely affects our decisions.

In this article, we will look at what market sentiment is and identify some of the most popular gauges used to identify the sentiment in the market.

What is market sentiment?

Market sentiment is the general attitude that investors and traders have in a given day or period. For example, at times, the sentiment will be positive especially when things are going on well. At times, sentiment in the market will be negative, especially when there are potential risks in the market.

As a trader or investor, having a good understanding of the state of the market will help you know whether to buy or sell your holdings. It will also help you decide the types of assets to buy or sell.

This explains why many large managers are usually comfortable paying thousands of dollars for tools that measure sentiment.

» Related: Be Profitable in Every Market Conditions

Fear and greed in the market

A good way to understand the concept of market sentiment is fear and greed. Ideally, fear and greed are the two main drivers of the financial market.

When investors are greedy, they tend to buy assets whose prices are rising without even considering their intrinsic value. There are many examples in all this.

For instance, during the dot com bubble, many investors were comfortable buying stocks of companies as long as they had a .com suffix.

The same situation was seen during the cryptocurrency rally that happened in early 2021. At the time, investors were comfortable buying all cryptocurrencies, including those that had little intrinsic value like Shiba Inu and Dogelon Mars.

» Related: How to Know You Are Being Too Greedy

Fear, on the other hand, is defined as a situation where investors and traders are afraid about major risks in the market. It is a popular type of market sentiment.

For example, in November 2021, most stocks declined sharply after South Africa confirmed the emergence of a new Covid-19 variant known as Omicron.

Top sentiment gauges

Traders use several tools to measure the sentiment in the market. Let us look at some of those gauges.

CBOE Volatility index (VIX)

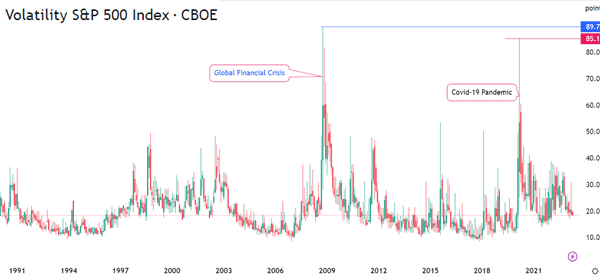

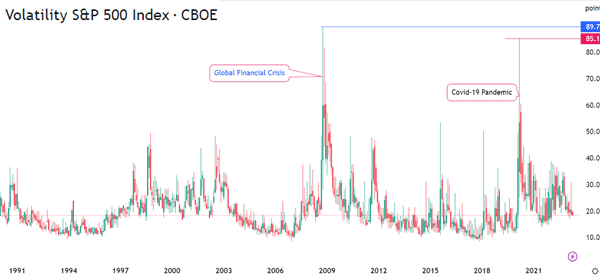

The CBOE volatility index is a popular measure of market sentiment. It is a tool that was created by CBOE and Goldman Sachs decades ago. It assesses the positioning of the option market in the S&P 500 index.

In high-risk markets, or when there is significant fear, the VIX index tends to rise. The chart below shows that the VIX index jumped sharply in 2020 as fear of the Covid-19 pandemic rose.

Fear and greed index

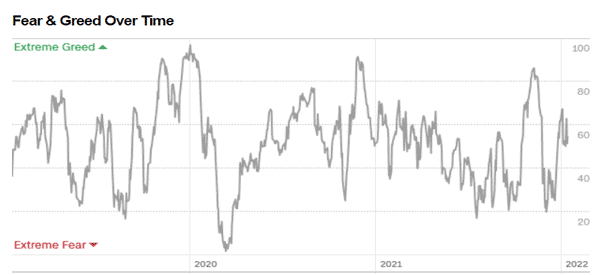

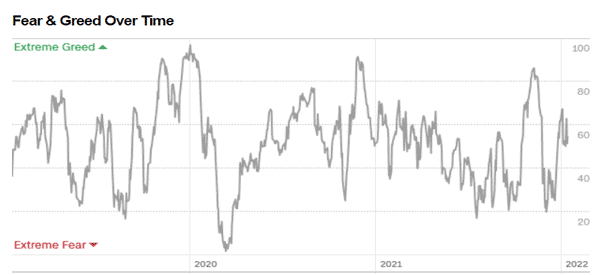

The next measure of sentiment is the CNN fear and greed index. This is a tool that was created by CNN Money and it is a combination of various gauges. It measures market sentiment by looking at things like the CBOE Volatility index, demand for safe havens like bonds, put and call options, and stock price breadth among others.

The gauge ranges from zero to 100. When it moves to 50, the sentiment is usually neutral. A move above 60 is a sign that investors are greedy and when it moves below 40 it is a sign of greed.

The chart below shows that the fear and greed index tumbled to the extreme fear zone as the pandemic started.

Breadth indicators

Some breadth indicators like the McClellan oscillator and the Advance-Decline Line (ADL) are good measures of sentiment in the market. These indicators are calculated by looking at the number of stocks in an index that are rising and falling. Other breadth indicators look at the volume of the indicators.

The idea behind this is simple. If the biggest S&P 500 companies like Apple and Microsoft are rising while most companies are falling, it means that the index strength is not all that good. Therefore, a good look at thes indicators can tell you the sentiment in the market.

» Related: How to Use Market Breadth

Oscillators

At times, oscillators like the Relative Strength Index (RSI) and the Commodity Channel Index (CCI) are important measures of sentiment. Ideally, when they are in the overbought level, it is a sign that traders are excited about the market.

» Related: Other useful indicators as a sentiment trader

How to utilize sentiment in day trading

It is possible to use sentiment as a day trader. In fact, it is common to see many day traders check the performance of the fear and greed index and other sentiment indicators before they start trading. You too can include it in your morning routine.

At times, looking at the overall sentiment will give you more information about the stage that the market is in.

For example, if the fear and greed index has moved to the extreme fear zone, it could be a sign that a bullish reversal is about to start.

In most cases, this price action leads to a bullish breakout in stocks. Similarly, if the fear and greed index is in the extreme greed zone, it is usually a sign that stocks will start a bearish trend in the near term.

Still, sentiment should form a foundation of how you trade. It should help you with other aspects of analysis like technical analysis and price action.

How to check market sentiment

It is easy to check the market sentiment in the financial market. For example, you can form it a habit to check the fear and greed index any time before you start trading.

Also, you should have a look at other sentiment gauges to see how things are doing. Also, you should have access to a watchlist that will give you more details about the top performing stocks and the reason behind their movements.

Related » Get the Most Out of Your Daily Stock Watchlist

Summary

Market sentiment is an important concept that all traders and investors should have knowledge about. It’s not fundamental, but it’s strongly recommended to analyze a little bit the overall of the stocks or assets we intend to trade.

In this article, we have looked at market sentiment definition and some of the best tools to use to measure this sentiment.

External useful resources

- Data Measuring Sentiment & Expectations – Harward Business School

- What is market sentiment and how does it affect the stock market? – Lehner Investments