Micro e-mini futures are among the popular financial instruments in the financial market today. Millions of people in the United States and around the world trade them each day, at times without realizing what they are trading.

In this report, we will look at micro e-mini futures are, how they work and how you can trade them successfully.

What are micro e-mini futures?

In the late 1990s, the Chicago Mercantile Exchange (CME) launched micro mini futures, which grew increasingly popular in the financial market. They became popular because the value of the main indices was getting extremely expensive for most people to afford. CME is a giant financial services company that is valued at over $86 billion.

The mini contracts were worth a relatively lower amount than the real futures contracts.

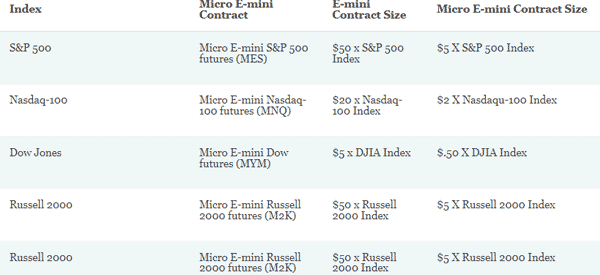

A few years ago, CME launched the micro e-mini contracts of the S&P 500, Nasdaq 100, Dow Jones, and Russel 2000. These contracts were about a tenth of the previous e-mini contracts. They are priced at about $50 times the value of the index.

This means that a single tick of the index usually provides a better result than the real S&P. The chart below shows some examples of e-mini contracts offered by CME.

Advantages of micro e-mini futures contracts

There are several benefits for using these kind of contracts.

High liquidity

First, they are highly traded markets, with hundreds of thousands of transactions happening every day. This means that their liquidity is usually relatively higher.

Highly leveraged

Second, micro e-mini futures are highly leveraged, which means that every tick is usually more profitable.

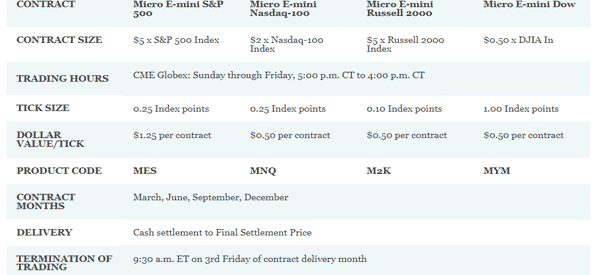

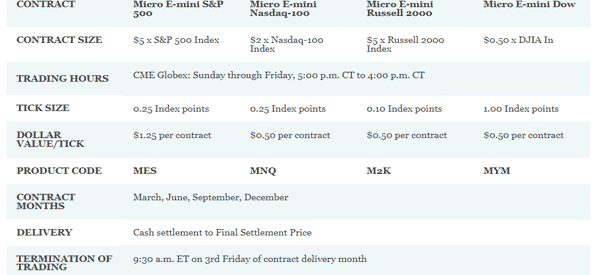

Unlimited time to trade

Third, unlike the normal indices, these contracts are a 24-hour market, which means that you can trade them during any time of the day. The chart below shows some timeframes when trading e-mini futures.

Other advantages

Finally, they are provided by hundreds of brokers from around the world. Other benefits of this futures contracts are:

- Cheap to buy – E-mini futures contracts are significantly cheaper than buying the standard contracts. As a result, they are more affordable to most people.

- Capital efficiency – Micro e-mini futures introduce more capital efficiency to participants. In most cases, brokers offer these contracts with leverage. This means that you can make more money even when your account balance is small.

- Multi-directional – You can make money when the asset’s price is rising and when it is dropping.

How to trade micro e-mini futures

Basically, the process of trading micro e-mini futures is relatively easy. Easy because the futures contracts regularly move in the same direction as the normal futures contract. Therefore, there are several things that you need to do when trading them.

Micro E-Mini Futures brokers

The first thing you need to do when trading these micro e-mini futures is a good broker. While CME provides these assets, it does not have a platform where people can trade. Instead, it uses online brokers who provide these services.

Some of the top micro e-mini futures brokers in the United States are Schwab, Interactive Brokers, Fidelity, and TD Ameritrade among others. Robinhood does not provide these services.

Fundamental Analysis

First, you need to conduct a fundamental analysis, which is the process of looking at the underlying factors that will move the asset. For example, the S&P 500 micro e-mini futures will rise if some of the popular companies in the index release strong earnings.

Also, they will climb if the Fed lowers interest rates.

Technical Analysis

Second, as a day trader, it is essential that you conduct a technical analysis to determine where you will enter your trades. For starters, technical analysis refers to the process where you use indicators and other chart analysis patterns to predict where the financial asset will go. Some of the popular technical tools you can use are moving averages, Relative Strength Index (RSI), and Bollinger Bands.

Chart Analysis

Chart analysis is also an essential part in trading micro e-mini futures contracts. This includes using tools like Fibonacci retracement, pitchfork, and candlestick analysis patterns.

Risks of trading Micro E-Mini Futures

As with all financial assets, trading micro e-mini futures has its own risk. Some of these risks are:

- Leverage risks – Leverage is usually a good thing when the market is performing well. However, when things go south, it exposes you to more risks.

- Liquidity problems – In some cases, some traders have found it a bit difficult to exit trades. At times, the process takes too much time for an order to be executed, which can lead to more losses.

- 24-hour trading risks – While being opened on a 24-hour basis is a good thing, it also exposes traders to risks, especially when there is little market activity.

Final thoughts

Micro e-mini contracts are relatively new tools that are offered by many brokers today. They offer a better way to trade in indices by making them more affordable. However, as mentioned there are also risks involved in these activities.

External Useful Resources

- Are these contracts ‘the Next Big Thing’? – Investopedia

- List of micro e mini futures – CME