The morning star candlestick pattern is a common bullish pattern used by price action traders. It is a pattern in a similar class to the other formations like doji, hanging man, hammer, and evening star that we have looked at before.

In this report, we will look at what it is and how you can use it in the financial market.

What is the Morning Star Candlestick Pattern?

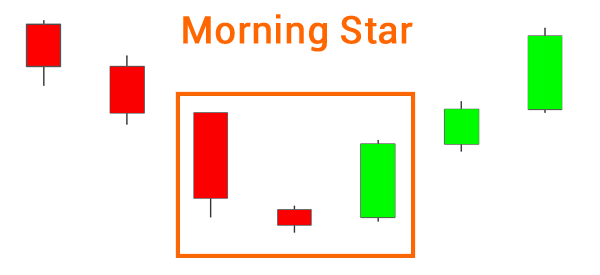

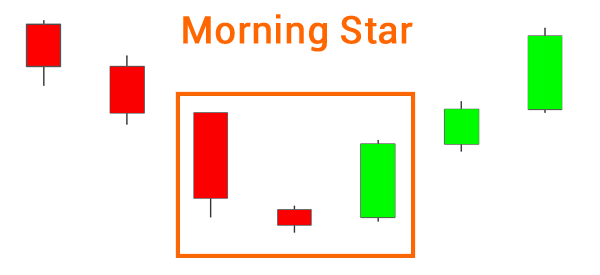

The morning star is a bullish candlestick pattern that is formed during a downward trend. It is known for having three candles that form at the end of a downward trend.

Its formation signifies that traders are starting to worry about the downward trend and that some bulls are coming in.

The first of the three candles usually has a long real body. It is then followed by a relatively small candle and the final one that looks like a star. This star signifies that there is a weakness in the downward trend.

The importance of the morning star happens when the fourth candle opens above the body of the star candle.

It becomes more important if the fourth, fifth, and sixth candlesticks are bullish. That usually sends a signal that there are more buyers in the market.

How to identify a morning star candlestick

Identifying a morning star candlestick pattern is a relatively simple process. To begin with, you need to know how the candle looks like. As described above, it has a small body and two small shadows. If you use the default option in most trading platforms, the candlestick will mostly be red in color.

So, with this in mind, let us look at the step by step process of identifying the morning star candlestick.

- Bearish trend – First, look at the overall trend of the chart. For a morning star to happen, the trend needs to be bearish.

- Large candle – Second, look at a long bearish candlestick pattern. In most cases, look for at least three bearish consecutive candles.

- Small candle – Now, look for a small red candlestick that has a small body and very small shadows.

- Large bullish candle – The small morning star is followed by a large bullish candlestick.

While you might be tempted to buy an asset after seeing this arrangement, it is recommended that you do more analysis. For example, you could do a multi-time analysis to identify the overall trend. Also, you could look at the overall volume to see whether it matches with the new trend.

How to trade with the Morning Star Pattern

The morning star and other candlestick trading method is known as price action. This means that you need to look at the chart and see a pattern emerging. As with other patterns, the most important part of using the morning star pattern is to look at the chart.

› How to identify Trends with the Price Action Strategy

The chart needs to be in a downward trend. In this case, you should look at a situation when the chart is forming lower highs and lower lows.

You should then look at a first big bearish candle. This happens mostly after a major news like interest rate decision, nonfarm payrolls, and manufacturing PMIs.

You should then look at the candle being followed by another bearish candle of a smaller size. The morning star pattern will be verified if the third candle has a small body and is then followed by a small bullish candle and a bigger bullish candle.

Chart example

A good example of morning star at work is shown in the daily chart of the AUD/USD pair below. As you can see, the price formed a deep decline on December 6 2017, followed by a smaller decline on December 7, and a star pattern on December 8.

Shortly after this, the price roared back and reached a high of 0.8135 on January 2018.

Morning star vs Evening star

As mentioned above, the morning star candlestick pattern is eerily similar to the evening star.

The only difference is that while the morning star is a bullish pattern, the evening star happens at the top of an asset.

A good example of the evening star pattern is shown in the NZD/USD pair below.

Advantages & disadvantages of the Morning Doji Star

Pros

There are several benefits of using the morning star pattern.

- It is easy to spot – As seen above, spotting the morning star pattern is relatively easy.

- Accurate – While no pattern is 100% accurate, the morning star tends to do relatively well.

- Multi-assets – The candlestick pattern can be used in all assets including currencies and stocks.

- Reversal indicators – It can be used by other reversal indicators like double exponential moving averages.

Cons

The only major disadvantage of the pattern is that it is very rare in periods of a bull run. That is because in such a period, reversals tend to be limited especially in daily and weekly charts.

Final thoughts

The morning star is an ideal pattern to identify when a bullish reversal pattern is about to form. The secret to success is to use it in a demo account before you use it with your money.

Also, you should also learn other patterns to use them together with the morning star.

External Useful Resources

- Morning Doji Star – CandleScanner

- Triple candlestick patterns: morning and evening star – Tradimo