Overconfidence is a psychological term that refers to the process of being too sure about yourself on a certain issue. A good example of this is during an exam, where a student completes it faster since they believe in their results.

From our point of view, the simplest example is to enter a trade on instinct, without any technical or news analysis (or without looking at the chart).

In psychology this Bias is also known as the Dunning Kruger effect. Specifically, it refers to a person with limited expertise and/or knowledge in a given area who, however, tends to overestimate himself and believe that he’s an expert in this field.

You know those people who get into an argument with a doctor about a medical condition ‘because they read it on Google‘? That’s overconfidence too.

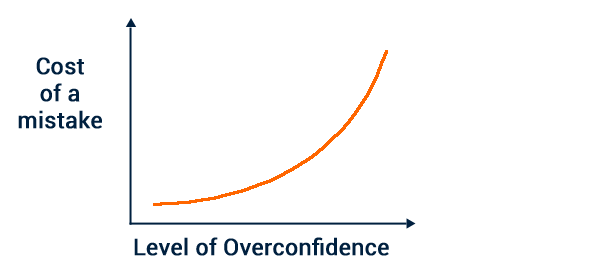

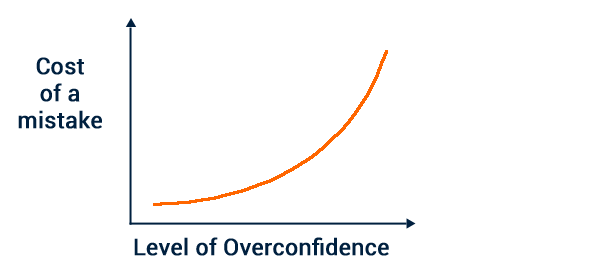

By the way, in most cases overconfidence can lead to significant mistakes in all fields. In this article, we will look at the concept of overconfidence bias and how you can avoid it in trading.

Understand the overconfidence bias in trading and investing

Overconfidence bias is one of the few reasons why most traders and investors fail in the market. While the situation is common among new traders, many experienced participants are not spared either.

A good way to look at this is to use an example.

Assume that a currency pair or a stock is in a strong bullish trend. To enter a position, you do an in-depth technical and fundamental analysis and conclude that the price will start falling. And so, you enter a contrarian trade and short the asset.

However, the asset’s price continues moving in the original direction for a while. But since you strongly believe that it will turn around, you refuse to intervene. In the end, you end up losing your money simply because of your overconfidence.

There have been many good examples about this in the market. For example, for a long time, many value investors argued that Tesla was an overvalued company. Besides, the company sold significantly fewer cars every year.

As such, many of them decided to short the stock since they were overconfident about their thesis. However, in the long-term, the stock continued rising, leading to a substantial short squeeze among the short-sellers.

How overconfidence bias affects traders

There are several ways in which traders manifest overconfidence in the market. Obviously we start from the idea that every trader has a strategy to follow (even if sometimes this is not the case) and that he records his trades regularly in a journal (here we explain better how to do it too).

Overlooking these two aspects for too much confidence can be the death of your account. Let’s see other ways in which overconfidence can affect a trader.

Thinking only about today

First, many overconfident traders ignore the long path that is required to become a successful trader. For example, it is always recommended that traders spend a few months learning more about the financial market before they start their trading journey.

Ignore the demo account

Second, an overconfident trader can decide to start immediately without taking the route of a demo account. For starters, a demo is an account that provides traders with a platform to learn about trading without risking their own cash.

It is always recommended that a trader uses a demo for a while before they start using their real cash.

Not understanding the tools

Third, overconfidence bias can emerge when a trader buys or designs an expert advisor or robot. Here, instead of spending time backtesting and forward testing the bot, they immediately use the bot in a live account.

Believe in your skills (too much)

Fourth, it can be seen in a period when a trader gets overconfidence about their skills and then avoid doing any analysis before they open a trade.

For example, if you are confident that non-farm payrolls will be strong, you can go ahead and sell the EUR/USD pair without doing any research.

Related » The Halo Effect in Trading

Do not use the stops

Last but not least, it can be seen in the form of stops that traders need to enter after opening a trade. They are known as stop-loss and take-profit. In this case, a trader might be so confident such that they ignore adding these necessary stops.

Common causes of overconfidence bias

There are several causes of overconfidence bias among traders and investors. Let us look at a few. First, a winning streak can push a new trader to believe that they have already perfected their art.

For example, a new trader can open several trades and make profits in a demo account and then assume that they know how to trade. As a result, they will open a live account and then continue with the process.

Second, some traders and investors are overconfident because of familiarity bias. This is a situation where traders are overconfident because they have a good understanding about the market.

For example, a trend follower who uses the moving average indicator can be overconfident when it is below an asset. As such, they will then open the trade and remain in it even if the conditions change.

Third, there is a concept known as illusionary bias. It is where traders overestimate their skills in the market. Excessive optimism can also result in overconfidence bias.

Types of overconfidence in trading

There are four main types of overconfidence bias in trading, including:

- Over ranking – this is where a person believes that they are experts in trading when they are not in reality.

- Illusion of control – this is a situation that emerges when people believe that they are solidly in control in the market.

- Timing optimism – this is a type of overconfidence that happens when people cannot estimate the time needed to do a certain task.

- Desirability – this is a type that happens when you have a strong desire to do a certain thing in the market.

How to avoid overconfidence bias

As we have seen above, overconfidence is a difficult thing in the financial market. As such, there are several strategies that one can follow to avoid it. Some of them are;

- Learning – you can avoid being overconfident by learning about the market. If you are a new trader, understand that the process of becoming successful requires that you spend time learning.

- Journal – always use a trading journal when entering and exiting a trade. It might seem like a simple exercise but a demo can go a long way.

- Protect your trades – regardless of how confident you are about a trade, always keep them protected by using a stop-loss and a take-profit.

Summary

In this article, we have looked at what overconfidence is and why it should matter to a trader. We have also looked at the causes of overconfidence and some of the best strategies to avoid being too overconfident in the market.

To be clear: having confidence in one’s own abilities is not a bad thing, but our decisions must always be validated using the right tools (indicators, patterns or others), because the market is not linear and not always a certain event A corresponds to B.

External useful resources

- Over-confidence bias: the downfall of many traders – Currency.com