A parabolic stock is one whose price rises sharply within a short period. For example, a stock that is trading at $10, can suddenly jump to $12 followed by $14, and then $20 within a short period. When this happens, it can be said to have made a parabolic move.

In this article, we will look at what a parabolic stock is, what causes them, how to trade them, and the risk management strategies to use.

What are parabolic stocks?

In most cases, shares tend to move by a relatively small percentage that is less than 1%. This is normal because of supply and demand issues. However, in certain periods, a stock can make a significant move. This is where it suddenly jumps after spending a few days in consolidation.

These parabolic moves are usually popular among small-cap companies and penny stocks. The same situation is common in other financial assets like commodities, cryptocurrencies, and currencies.

A good example of this is what happened during the Wall Street Bets situation in early 2021. At the time, social media users managed to push the stock price of companies like AMC Entertainment and GameStop up by more than 300% within a matter of days.

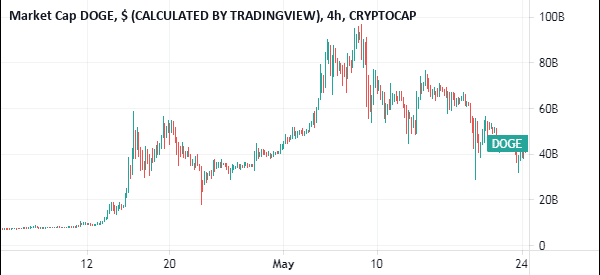

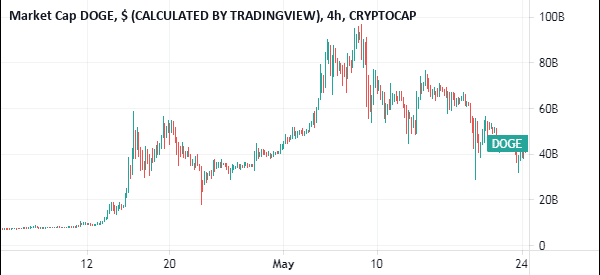

Similarly, parabolic moves were seen in the cryptocurrency market as some meme coins like Shiba Inu and Dogecoin more than doubled within a few days.

What happens when stocks go parabolic?

The most important thing that happens after a stock goes parabolic is a short-squeeze. A short-squeeze is a situation where short-sellers make significant losses after a stock rises sharply.

For starters, a short-seller is a person who benefits when a stock drops. They do this by borrowing shares, selling them, and then buying them again when the price drops.

The challenge for short-selling is that the maximum loss you can make is unlimited since there are borrowed funds involved and there is no limit to which a stock can rise. When you are long a stock, the maximum possible loss is you losing your entire account.

A short-squeeze is more painful for a stock that has a high short interest. Short interest is the percentage of a stock that is held by short-sellers. A good example of a stock that went parabolic and then plunged is VinFast, a Vietnamese company.

As shown above, the company went public in the US using a SPAC merger. Shortly afterward, the stock surged by over 600%, making it bigger than companies like Ford and General Motors.

Causes of parabolic moves

There are several key causes of parabolic moves in stocks. And they are very different from each other! That’s why it’s important to also understand the environment of the stock you intend to analyze: you avoid interpreting signals in the wrong way.

Social Media

First, as we saw during the Wall Street Bets situation, social media has an important role in moving stocks. Indeed, before GameStop, we saw parabolic moves in shares of companies like Hertz. The company’s stock jumped sharply even after the firm went bankrupt as social media users pumped it.

M&A deal

Second, a stock can have a parabolic move after a merger deal is announced. For example, if a stock is trading at $20, its share price will have a parabolic move when a bigger company announces that it will acquire it for $28. Parabolic moves can also happen for other related companies that could become targets

Fed Decisions

Third, a stock could have a major jump after a policy change by the Federal Reserve. For example, if the Fed suddenly turns dovish, it could lead to a sharp increase in shares of certain companies.

In most cases, growth companies tend to outperform when interest rates are low while value stocks lag.

Major News

Fourth, a new announcement by a company can lead to a major parabolic move. For instance, if a company like Ford announces a new car model that is loved by analysts and investors, the stock could jump. Similarly, if Apple announces a major upgrade to the iPhone or an introduction of a new service, its stock could have a parabolic move as well.

Sector/industry trend

The other cause of a parabolic move could be related to a sector or an industry. At times, stocks in one industry could go parabolic. This situation tends to happen when there is important news or hype in a sector.

For example, in 2023, companies like C3.ai and Nvidia surged because of the hype surrounding artificial intelligence (AI). As these stocks jumped, Nvidia’s market cap jumped to over $1 trillion.

Another example is what happened in 2021 as Tesla shares jumped. At the time, other companies in the EV industry also went parabolic. At the time, investors wanted to buy the next big thing in the EV industry. The market cap of a company like Rivian soared to over $100 billion, making it bigger than Ford despite having no sales.

Another period when stocks in one industry went parabolic was during the dot com bubble. At the time, all companies with a dot com suffix surged as investors placed their bets on the next big thing. For example, Cisco became the biggest company in the world during that period.

The similarity of all these periods is that the situation always ends the same way. For example, the dot com bubble ended with many companies going bankrupt. Similarly, some smaller EV companies that surged in 2021 went bankrupt.

Psychology: fear and greed

The other important reason why stocks go parabolic is because of emotions. In this case, the most important emotional driver is greed.

As mentioned in the previous point, investors and day traders tend to avoid the Fear of Missing Out (FOMO). As such, they buy rising stocks hoping that they will not miss the next big thing.

A good example of this happened during the meme stocks era of 2021. At the time, many investors bought its shares hoping that it would be the next big thing. The stock jumped to a high of $120.8 and then crashed to below $20.

More causes

Other reasons why a stock may have a parabolic move are when a new respected investor like Warren Buffett and Bill Ackman buys shares and when a company announces a new investment. When that happens, many retail and institutional investors tend to buy the same stock.

Further, when a company is added into an index like the Nasdaq 100 and S&P 500, it can lead to parabolic moves. This is because the inclusion will lead to more purchases by funds that track these indices.

How to find parabolic stock and movers

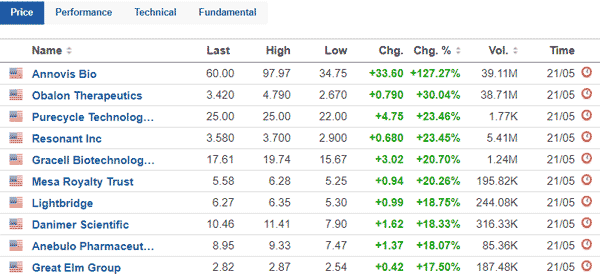

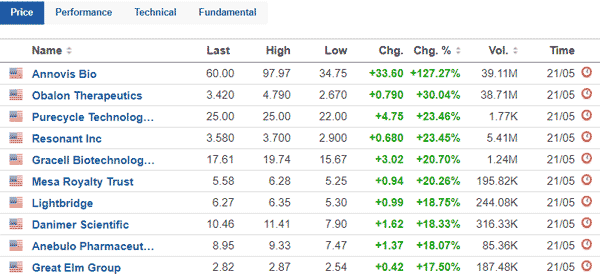

There are several ways of spotting companies making parabolic moves. One of the best methods is to subscribe to a free watchlist that will send you the top movers early before the market opens. Another approach is to use platforms like Investing.com to see top movers in a certain session.

For example, the screenshot below shows the top movers at the time of writing. We see that the Annovis Bio stock rose by 127%.

The company’s stock rose by as much as 240% in a single session after it announced new progress on a drug it was developing. This parabolic move is shown in the chart below.

Should you buy or short a parabolic stock?

A common question is whether you should buy or short a parabolic stock. When you buy a stock that has just gone parabolic, your goal is to benefit as the bullish trend continues.

On the other hand, if you short a stock that has gone parabolic, you hope that it will soon have a reversal.

Our recommendation is that you should be careful when buying or shorting parabolic movers. The risk for buying is that the stock could nosedive and leave you holding the bag as shown in the VinFast chart above.

The best approach is to just wait and see how the stock evolves. Shorting too early could see you suffering from a short-squeeze. Read the reasons for the squeeze, use your trading journal, and use pending orders.

Parabolic stock chart analysis

As we can see above, a parabolic stock is one that jumps sharply within a trading session. So.. What happens when a stock goes parabolic? We see several things about this.

For one, the Annovis stock rose from a low of $28 to a high of $97.87. However, we see that the stock did not remain at the highest point. Instead, it pared back some of these gains and ended the day at $60. Indeed, this is how most parabolic moves happen.

Let’s take a closer look at GameStop that made a parabolic move in the first quarter of 2021. As we can see, the stock rose sharply to $482 and then declined. This decline happens as some of the earlier buyers take profit.

How to trade parabolic stocks

Trading parabolic stocks can be a highly profitable strategy. However, it can also present its risks. One thing is common: you will mostly miss the first parabolic move because they happen so fast.

However, you can make money going forward! For one, there are usually two outcomes when a parabolic move happens.

First, the stock can consolidate and form a bullish flag or a pennant and then continue with the upward trend. Second, as with the case of GameStop above, the stock could retreat and go back to where it was before.

If you spot a bullish consolidation move, you can buy the stock and hope that it will keep rising. However, if you don’t spot any pattern, you can short it and hope that it will drop.

Still, be careful about shorting parabolic stocks because short squeezes are common. You should always reduce your risk by sizing your position well and by having a stop loss on all your trades.

Final thoughts

Trading parabolic stocks is a relatively easy process but doing the wrong thing can lead to significant losses. In this article, we have looked at what a parabolic move is, how it happens, some of the causes, and some of the risk management strategies to use.

Could these be a good option for you, or would you rather focus on other types of stock?

External Useful Resources

- The Nature of Parabolic Trends – Medium