You have opened a trade and are in a positive territory. This is the most fulfilling thing for every trader. This is because making money trading is not always a promised thing. People, including some of the best experienced traders lose money!

This reminds us of a Bill Ackman, the legendary investor who lost more than $4.4 billion when his bet on Valeant Pharmaceuticals went south. After initially profiting in his trade, the share price reversed leading to one of the biggest losses in the hedge fund ever. Other brilliant hedge fund managers have also lost a fortune after their holdings reverse.

What is partial profit-taking?

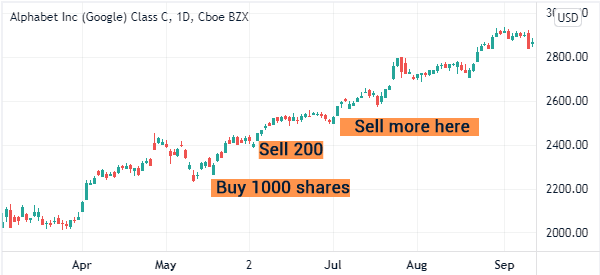

Partial profit-taking is the process of reducing your exposure in a position that is in the profit-making zone. This is a popular risk management strategy in the market because of how markets tend to change direction. A good example of this is shown in the chart below.

For example, you buy a stock at $5 and put a take-profit at $9. As the stock rises to $7, you decide to take some of your money off. You can do this a way of protecting your profits or as a way of allocating capital on other trades.

Related » Timeless strategies you should try

Partial Profit Taking – Be Safe and Take Position

When you have opened a trade and is in the positive territory, you have a number of options.

- Decide to close the trade and lock-up the profits

- Let the trade continue to run until it reaches your preferred place

- Take your profits and let the trade run.

Each of these options has advantages and disadvantages. The advantage of closing the trade is that you are secure, you have made your money. The disadvantage is when you find that you would have made more money if you hadn’t closed the trade. Not a bad decision though.

The advantage of letting it run is that there could be more upside to the trade. The disadvantage is that there could be a reversal that will lead to your profits being squeezed.

What are the advantages of partial profit?

The advantage of partial profit taking is that it secures your account in such a way that even when there is a downside, you will still have the money you took.

An example of this strategy; you buy 1 lot of a currency pair, call it GBP/USD. You buy it at 1.3330 and place a stop loss at 1.3300 and a take profit at 1.3400. Your intention is to close a portion of the trade when it hits 1.3365 and then move the stop loss to 1.3330.

This is now the breakeven point.

In this situation, when the trade hits 1.3365, you will have 35 pips as profit. If there is a correction and now the stop loss is triggered, your total profit becomes $17.50. The trade might go up and your new take-profit will be triggered thus booking you a profit. Therefore, your total profit will be $52.

Why you should consider this Simple Strategy

There are a number of reasons why you want to take partial profit.

Protect youself form reversals

The first reason is that you want to protect your money from a reversal. Remember that reversals happen all the time in trading. That is the main reason why no chart is ever a smooth line: there are tops and dips.

Therefore, if you have a buy position, taking partial profits will help you limit your losses in case of a reversal.

Open other trades

The second reason why it is important to take partial profits is that it allows you to open other promising trades. This is particularly useful for traders with limited amount of money.

Certain times you might open a trade and while it’s still on, you spot a new opportunity. If you don’t have enough money, chances are that you won’t be able to open a new trade. Therefore, by profit taking, you will be at a position to open new trades.

Prevent the influences of new economic data

The third reason you should consider partial profit taking is when new economic data is about to be released and you still have a trade going on. In this situation, if you are in the positive territory you can take your profits and then place the stop loss and take profit at appropriate levels.

This will give you a profit and then protect you when the data is released.

Best profit taking strategies

There are several strategies of booking partial profits.

Prychological level

First, you can book your profit once the trade reaches specific psychological level. For example, if you buy a stock at $10, you can exit it every time it goes up by a point. This means that you should take some profit once it reaches $11, $12, $13, and so on.

Fibonacci retracement level

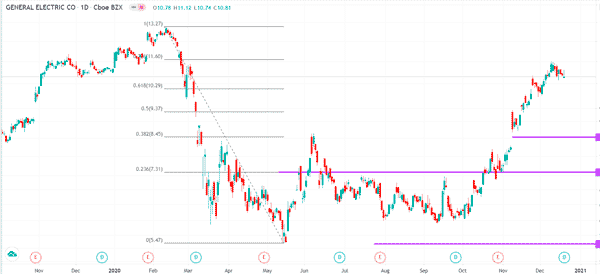

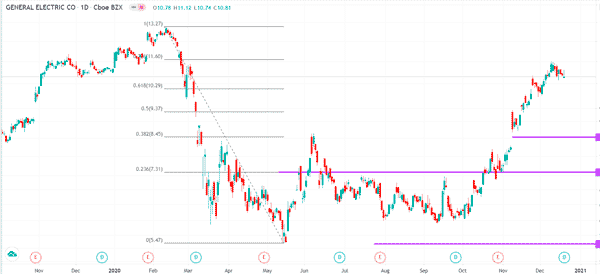

Second, you can decide to book some profits whenever the price reaches a certain Fibonacci retracement level. For example, if you bought GE shares when they were trading at $5, you could have took a partial profit when it reached the 23.6% retracement level at $7.30.

Then, you could have taken another profit when it reached the 38.2% retracement at $8.45, and so on.

Spot another opportunity

Third, you can book profits when another ideal trading opportunity in another asset comes up. In this case, you can take a portion of the profits and repeat the same process for the new opportunity that has arisen.

How to Book a Partial Profit

So, how do you book a profit? Some trading platforms like MT4 and 5 don’t have a good feature that lets you take a partial profit. Some, on the other hand do have.

Therefore, a good approach, although expensive is to just close a trade and then open the same one right away. This is an expensive strategy because you will need to spend money in form of commissions or spread to do this. Also, you may lose money in form of slippage.

When you don’t need partial profit-taking

There are two main times when you don’t need to do partial profit-taking. First, if you are a scalper, this strategy cannot work for you since your goal is to open a trade and close all of it in a short period.

» Related: Scalping Trading Strategy explained

Second, at times, you don’t need to take partial when you have just initiated a trade. At this time, your goal should be to wait for your thesis to work out well.

The only con of partial profit-taking is that you tend to lose an opportunity if the price continues in your direction.

Final thoughts

Booking profits is an essential thing that all traders should do. It will give you money to open more trades. It will also preserve your capital in case something went wrong. The only con for booking profit early is that it may lead you to miss an extended rally.

Other Useful Links

- Why Taking Profits Is Not The Best Strategy – SeekingAplha