In the past few years, technology has simplified how trading works. Unlike in the past, millions of people have an access to financial assets that are traded in Wall Street and The City.

At the same time, most trading approaches have been automated as well. For example, the process of opening trades has been simplified.

For example, there is no longer any need for you to manually open (or close) your orders, but you can set the trading software to do it for you. That is handy, isn’t it? But as we shall see, there are also drawbacks.

In this article, we will look at pending orders, which are ways of executing trades.

What are pending orders?

A pending order is a type of execution where you direct the broker to open a trade at a later time when certain conditions are met. These orders differ with the popular market orders where trades are executed instantly.

For example, assume that the stock of a company is trading at $10. Although you are long the stock, you believe that it will drop to $8 before climbing. Therefore, instead of opening a market order at $10, you can open an order that will execute a buy trade when the price drops to $8.

As a result, you don’t need to stay and wait for the trade to be executed.

Similarly, if you believe that the stock will climb to $12 and then drop to $5, you can open such a pending order.

How long does a pending order take?

A common question is on how long a pending order takes to be filled. It always depends on whether the asset will move to your specified price. For example, if you set a sell-stop at $5 for a stock that is trading at $6, the trade will only be open if the stock drops to $5.

However, at times, it is good to specify the period when the pending order will be vacated. As a day trader, you can direct the broker to vacate the pending order if the trade is not implemented before the day ends.

After a pending order is opened, it will only be closed if it moves to the stop-loss or take-profit or you stop it manually. It can also be stopped by a margin call.

Growing Popularity

Pending orders have become extremely popular in the financial market. Indeed, they are used by both long-term stock investors and day traders.

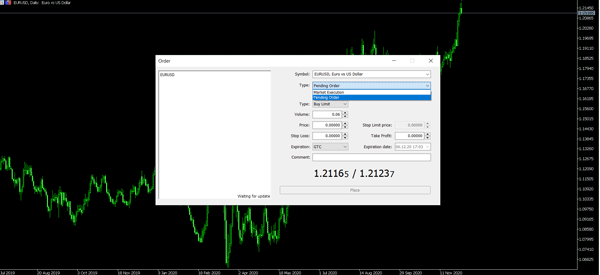

It is easy to execute these orders. For example, in the MT4 or 5, all you need to do is to go to New Order and select the order type where the default is market order. You should click on the order type and then select pending orders, as shown below.

You can repeat the same process in other trading platforms.

Pending orders vs market orders

A common question is whether pending orders are better than market orders and vice versa. In reality, the two order types have their benefits and disadvantages.

For market order, the main benefit is that the order will always be filled. That’s because of the significant liquidity in the financial market. For pending orders, there is a possibility that the order will not be filled. That’s because the price must reach where you have specified to be filled.

The biggest con of market orders is known as slippage. This is a situation where the price you place the order at is different from where it is ultimately executed. For example, you can place a buy trade at $10 and then the broker executes it at $11. This happens mostly in periods of high volatility.

Why is my order still pending?

A common question is why a market order remains pending for some time after being opened. This happens for a number of reasons.

The most common reason is when there is no other order in the other side. When buying a stock, there needs to be a counter party in the other side. If there is none, the broker will leave the order pending for a while.

Related » Fundamentals of Supply and Demand

You can prevent such a situation by only focusing on highly liquid financial assets. In stocks, you can focus on liquid assets like Apple and Microsoft. In currencies, you can focus on liquid pairs like the EUR/USD and GBP/USD.

Pros and Cons of Pending Orders

Don’t lose time

On the other hand, the biggest benefit of pending orders is that you don’t have to wait for your target price to be reached.

In other words, if you believe that a buy position will be opened when the price moves to the 50% Fibonacci retracement, you don’t need to wait for this to happen. Instead, you can set the trade and leave it to trade until it reaches the target.

Prevent Slippage

Another benefit of pending orders is that they help to prevent slippage. While slippage happens in both order types, it rarely happens in periods of pending orders.

Miss good Trades

There are cons to pending orders. For example, at times, you can miss a trade by a small margin. For example, if you have placed a buy stop at $10.50, the stock can reach $10.60 and then reverse. As such, while your thesis is correct, a small point can make you miss an opportunity.

Related » Watch out for FOMO in trading

Types of pending orders

There are several types of pending orders. The most popular of them are buy and sell stop and buy and sell limit.

Buy limit

A buy limit is an order that is placed below the price in anticipation of a bullish trend. For example, if the stock price of a company is trading at $100 and you believe it will drop to $95 and then rally, you can initiate a buy limit trade.

In this case, a buy trade will be initiated at $95. If your thesis works, you will start to profit. However, if the price continues to fall, you will be losing money.

Sell limit

A sell limit trade is the exact opposite of a buy limit. If the stock is trading at $100 and you believe that it will rise to $110 and then drop, you can place a sell limit at $110. Again, if you are correct, the shorting price will be at $110.

Buy stop

A buy stop is a trade that is placed in the overall direction of a trade. For example, if the stock is trading at $100 and you believe that it will continue rising, you can place a buy stop at $110.

But why would you place such a trade? At times, you can get convinced that a bull run will continue so long as the asset breaches a key trend.

Sell stop

A sell stop is a trade that is short trade that is placed below the current price. For example, if an asset is trading at $100 and you expect the trend to continue once it moves below $95, you can place such a trade.

There are other types of pending orders, including buy stop limit (BSL) and sell stop limit (SSL). A buy stop limit combines a stop order and a buy limit order. On the other hand, a sell stop limit is a stop order for placing a sell limit.

What is a protective order?

A protective order is one that cancels an order to buy or sell a financial asset like stock and then resubmits it as a limit order.

Such orders happen in periods of significant market volatility. Brokers implement these orders to protect themselves from completing an order at the worst time.

Summary

Pending orders are used widely in the financial market. Indeed, most professional traders prefer using them instead of market orders. However, as a new trader, we recommend that you spend a substantial amount of time learning about how these orders work.

You should also use a demo account to practice before you put them in your live account.

External Useful Resources

- Market Execution vs Pending Order – Blackwellglobal