Trading and investing are two risky activities. The field is so risky that on a daily basis millions of people lose money. Even the most successful traders and investors are alive to the fact that their trading involves risks, and many of them have lost tremendous amount of money in the past.

Warren Buffet, one of the most successful investors of our time has lost money in the past too. The same is true for William Ackman, the poster boy of activist investing who has managed to lose more than $8 billion in the past one year.

However, there are a number of strategies that successful hedge funds use to reduce the risks of losing money.

Hedge funds derive their name from the fact that they hedge their trades. This means they make money regardless of the direction the market moves. In simple words, they are uncorrelated to the market movements.

First of all..What is Arbitrage Trading?

Arbitrage Trading in the simplest term is the act of buying an item (such as gold) while simultaneously selling a related item (such as the dollar) in the same market or in a different market.

The idea behind this is that of correlation.

Correlation is a statistical process that measures the mutual relationship between items. In the financial market, the correlation can be between items in the same industry (such as Facebook and Twitter) or items that are in different areas such as crude oil and the dollar.

It could also be between different markets such as the Nikkei and the Dow.

→ How Maximize Returns with a good Statistical Arbitrage Strategy

The foundation of correlation is that items in different sectors are in some way related. For instance, though crude oil and dollar are different, the dollar is used to buy oil. This introduces some sort of relationship!

Arbitrage trading when used well can be very helpful to traders. Let’s take a good example of what has been happening in the crude oil market.

Types of Arbitrage in trading

There are several types of arbitrage in the financial market. Let’s go take a closer look at some of the most famous ones.

Merger arbitrage

This type of arbitrage happens when an M&A deal is announced. In most cases, shares of the company being acquired will typically rise since the acquirer needs to pay a premium.

For example, Salesforce said that it would acquire Slack for more than $40. At the time, Slack’s shares was trading at less than $20. In most cases, shares of the acquiring company tends to decline when such a deal is announced. This is because the company will typically need to add debt and cut dividend to fund the acquisition.

Covered interest rate arbitrage

This is a type of arbitrage that involves using the exchange rate risk is hedged with a forward contract. For example, if the US dollar has a deposit rate of 2% while the New Zealand dollar is about 4%.

If the NZD/USD exchange rate is 1.500, it means that investing $1,000 in the US will bring $1,020. However, if you exchange the USD to NZD and invest in New Zealand, you will have a future value of $1,040. This strategy us mostly used by large traders and investors.

Sector arbitrage

At times, it is possible to have arbitrage opportunities across sectors. For example, if oil price rises, it means that transportation companies will have less profit unless they increase prices. Therefore, you ca buy energy stocks and go short those in the transportation sector.

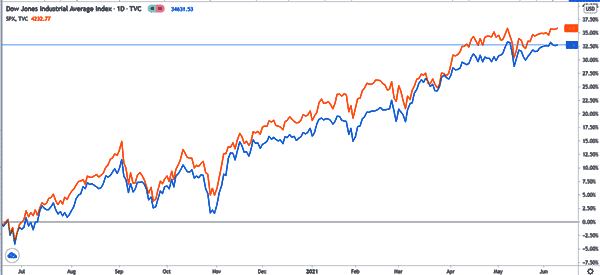

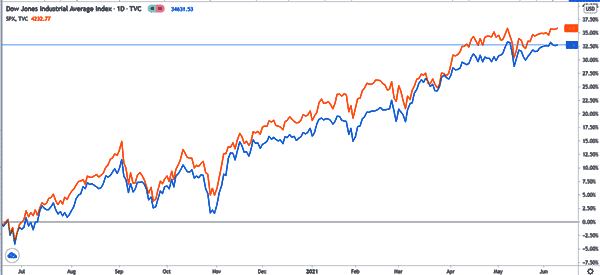

There are other types or arbitrage such as statistical, political, triangular, and index arbitrage, among others. For example, in index arbitrage, you can buy the Dow Jones and short the S&P 500 since these indices tends to move in the same direction.

Practical Examples

Oil Supply and Price

In the past years, WTI (Western Texas Intermediary) and Brent (the global benchmark) has been moving in the same direction. This means that WTI and Brent have the tendency of moving in the same direction.

This can be explained in terms of demand and supply: When the supply of oil rises, the effect is that the price of oil will go down. When the supply eases, then the price moves up. Therefore, if there is a glut in the market, all the oil in the market will be affected.

This effect will move to the oil drillers and also the oil marketers who will suffer from the reduced oil prices. This will also be transferred to the gasoline prices.

Other Assets

The same concept is similar in other items/assets. For instance, in the steel business, an increase in the amount of steel in the market has the impact of pushing the steel price down. With the steel price down, the effect of this is that the infrastructure industry will enjoy a period of reduced prices.

Therefore, a steel company such as ArcelorMittal will likely have a negative correlation with a company such as Century 21 which is a real estate developer.

How to be successful in Arbitrage Trading

At face value, it seems that arbitrage trading is a simple idea. However, to be successful, you need to understand how to do correlation techniques. Luckily, there are many tools online that can help you carry out correlation of various assets.

This is especially because the correlation of the assets changes from time to time. A correlation result of 1 indicates a perfect correlation while that of -1 shows inverse correlation.

In case of a perfect correlation, such as in Brent and WTI (at the time of writing this), you can buy one and sell the other one in small quantities. This will help you mitigate the losses.

More Useful Links

- Discover how to Arbitrage the Forex Market on ForexOP

- Learn how to Arbitrage Trading on Investopedia