Some time ago, we looked at the Smart Money Index (SMI), a popular indicator used by Wall Street traders.

The general premise of the indicator is that there are two types of traders in the market: smart money and dumb money. The smart money are usually wealthy and successful traders who are quick to identify trends.

On the other hand, dumb money are the relatively new traders who relatively make simple and costly mistakes.

In this report, we will look at the Shakeout, which is another common strategy applied by successful traders. Its concept is eerily similar to that of the smart money index.

What is a Shakeout?

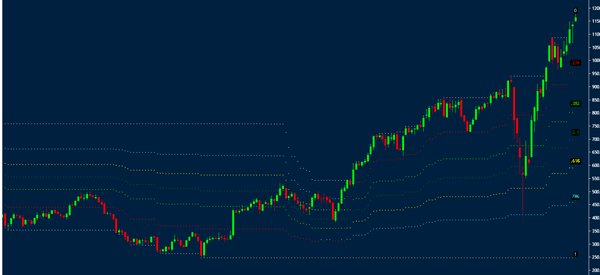

A good way to explain it out is to look at the Chipotle Mexican Grill stock that is shown below.

The chart shows that the company’s stock has been in a sharp upward trend in the past five years. However, along this path, the stock has had some pullbacks that are shown in rectangles.

The most recent pull back happened in March, at the height of the pandemic. After the pullback, the stock continued to rally.

So, what is a shakeout?

It is a period in which smart money pushes a stock or any other asset lower and then buys it back.

Technical and industrial shakeouts

There are two main types of shakeouts: technical and industrial shakeouts. A technical shakeout happens because of how chart patterns are arranged. For example, if an asset has had a strong parabolic bullish move, there is a possibility that its price will retreat at some point as traders take profit.

This is known as a technical shakeout. Some of the most common patterns of technical shakeouts are head and shoulders, wedges, and symmetrical triangles.

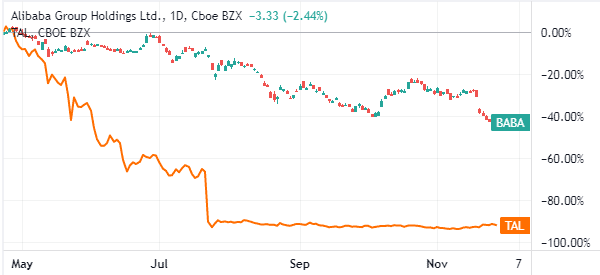

An industrial shakeout is when the sell-off is spread across a sector or a geographical location. For example, the chart below shows that a shakeout happened in Chinese stocks like Alibaba and TAL Education in 2021.

When they happen?

A shakeout happens when most investors push a stock or asset lower sharply. This is usually because of several factors. For example, a company may be going through internal challenges. Also, a previous strong stock can have a shakeout as many traders take a profit.

Chipotle makes a good example because of Bill Ackman, one of the best-known hedge fund managers. As the stock declined, he continued to invest in the company.

And as a result, he has doubled his returns in the new money in the past few months.

If you want to avoid shakeouts, we suggest to watch this video from our partners.

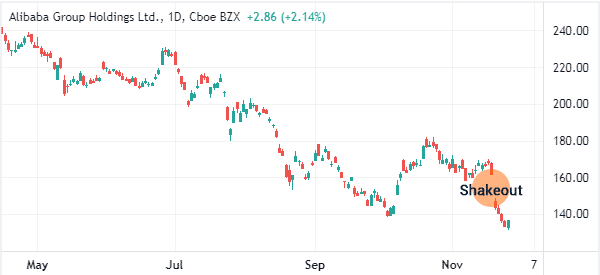

Alibaba is another good example of a shakeout. As shown below, the stock collapsed in 2021 as China intensified its crackdown on the tech sector. This drop can be viewed as a shakeout.

How to trade shakeouts

There are several ways you can use to trade shakeouts in the market.

Shakeout Strategy #1 – Buy the Dip

A relatively common strategy is to buy the dips, which happen after a financial asset generates a major rally.

A dip happens when an asset in a major rally starts to decline. As they drop, most retail traders start fearing and sell them. As they sell, it reaches a point where the smart money starts to buy them back.

A good example of this happened recently, when traders started to sell Facebook shares because of an ad boycott. As the stock dropped, many retail traders who were afraid of the situation sold their Facebook shares.

As they did this, the smart money, which figured out that the boycott would have minor impacts on Facebook shares started to buy. As we write this, Facebook stock is trading near its all-time highs.

Shakeout Strategy #2 – Earnings

A shake out may also happen after a company releases its earnings. If a firm releases weak quarterly earnings, the stock price may drop as traders react to this.

As it starts to drop, many inexperienced traders will sell the stock. And as they do it, the big money will be scooping it in the cheap.

Related » How to trade During the Earning Season?

Shakeout Strategy #3 – Fibonacci Retracement

Another strategy to trade shakeouts is using the Fibonacci retracement. This is a tool that you draw by connecting the lowest and highest points of an asset.

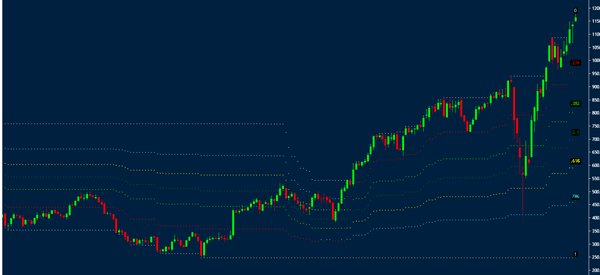

In the chart below, we have drawn the Fibonacci retracement tool in the Chipotle stock. As the stock dropped, it moved below the 23.6% retracement, then below the 38.2%, 50%, 61.8%, and 78.6% retracements.

Therefore, your goal is to identify a strong entry point based on these retracements.

Shakeout Strategy #4 – Trailing Stops

Finally, another strategy to trade shakeouts is to use trailing stops. These are stops, similar to other popular stop losses, with the main difference being that they move up with the price.

As a result, even with a pull back, you will still retain the profits you made earlier on.

Final thoughts

A shakeout is a strategy that happens regularly. The main foundation of the strategy is that not all pullbacks are usually bad. Instead, these pullbacks create a good entry point for traders and investors.

We recommend that you always take time to study the reasons why the price of an asset has dropped and its long-term implications.

External useful Resources

- How To Invest In Top Stocks: What Is A Stock Shakeout? – Investors.com