Day trading and investing in general is one of the fastest growing industries today. People are enticed into the trading world because of the promise of working from home and making money without much effort.

A recent report indicated that many people – especially in the United States – are now allocating money to stocks as institutional investors stay away. They are enticed by the superior returns that have come with the new administration. With these opportunities, many people have fallen prey into online scams.

In this article, We will highlight a few ways of avoiding trading scams.

Is day trading a scam?

This is one of the most popular questions in our industry. Historically, many people tend to view day trading as being a scam because of the vast amount of money that people lose. It is widely known that more than 80% of all day traders lose money.

However, in reality, day trading is a genuine way of making money online. You achieve that by buying and selling financial assets like stocks, cryptocurrencies, and commodities.

Like in most online activities, not every company has good intentions. Besides, it does not take too much money to build a trading website or clone.

Therefore, while day trading is not a scam, there are many companies that operate trading scams. For example, some offer fake brokerage services while others offer trading signals. Other online scams offer managed accounts services.

Examples of day trading scams

As mentioned above, there are a number of day trading scams in the market. Some of the most popular ones are;

- Fake trading website – these are websites that look real. Their intention is to have people register, deposit funds and then they disappear.

- Automated systems – some online scammers offer solutions that allow you to automate your trading. They either charge a one-off payment or a subscription package. In most cases, these systems don’t work.

- Trading signals – another online scam is that of trading signal. Here, the company will charge you a fee so that they can send you signals. Like in automated services, these signals rarely work.

- Copy-trading scams – copy-trading is a situation where you copy trades from an experienced person. While it is a viable trading option, many scammers have embraced the process.

Research about any company

The first thing you need to do to avoid trading scams is doing intensive research about any company that you use. There are companies that promise low-cost brokerages, other companies promise to trade for you or to provide trading signals that are mostly ‘accurate’, while others on the other hand promise unparalleled news that is essential for trading.

In all these, you need to be very careful before falling prey into these companies. You need to do intense research about the companies by considering several factors:

- Read online reviews about these companies (our testimonials). There are many platforms like BBB and Trustpilot that provide platforms for customers to leave reviews.

- Confirm whether the company is registered or regulated by any regulators

- Use companies that you can track. In this, you can find the registered office of the company and its top leaders.

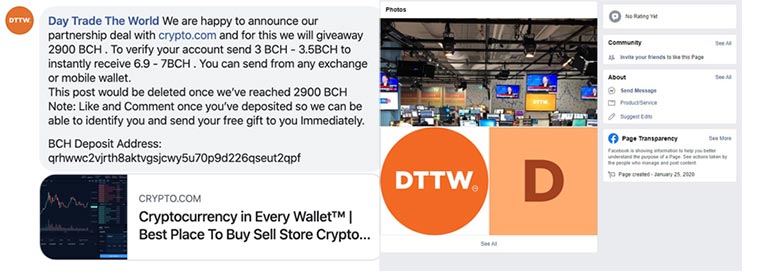

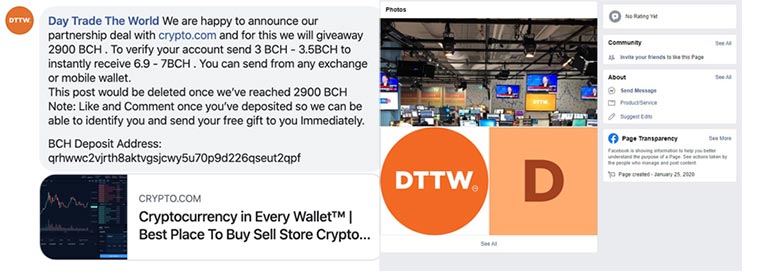

Another thing you need to pay attention to, really. Some scammers tend to steal the identities of both people and companies. This recently happen to our Facebook page.

So, if you’re not 100% sure about something, double check before leave your data.

Some Examples

Often, a ‘successful’ trader will come to your town to have a free seminar with traders. In their marketing, they will show you the lavish lifestyle that they live. They will show you the high-end cars they drive, their choppers and yachts, and their mansions.

In the seminar, they will talk about how they started trading, the losses they made, and how a system they developed has helped them. At the end, they will ask you to become their student.

As a student, you will be required to pay thousands of dollars to access the signals and the trading systems they use. Unfortunately, most of these people are usually scammers. Trust us, if they were so successful, they would focus on trading, instead of selling courses.

You should take time researching about them.

Test the Platform

If you have bought or subscribed to a system, before you spend any money on it, you should backtest it. This is where you use past data to see the performance of the system. The logic is that if the system worked in the past, chances are that it will work again.

Therefore, before you deposit your money on a system, you should test it. If it is accurate, you can go ahead and use it.

Learn the Basics of Day Trading

Unfortunately, most people who are interested in trading don’t know how to trade and don’t understand why the assets move up and down. As a result, they implement the strategies they are told by the ‘experts’ without interrogating them. This is wrong!

Instead, you should take time to learn the basics so that when you are told to buy an asset, you know what you are doing.

Luckily, there is a lot of material on how the financial assets work. Just take time to read these materials to get the basics (you can start from our blog).

Regulations

Another important way to avoid trading scams is to ensure that the company you are using is regulated by a credible regulator. Some of the best regulators are the SEC, ASIC, FCA, and CySEC, among others.

These regulators have the mandate to ensure that brokers operate within the law. Therefore, you should check and confirm whether the broker is regulated. A simple Google search will help you see these.

Learn from the Experts

You need to consult people who have experience in the trading world. If you are a beginner, you can learn a lot from people who have been there, and done that.

By consulting these people, you will be at a good position to separate the truth from fiction. They will guide you on how to be successful by taking the long path that many people avoid.

Summary

Online trading scams are getting more sophisticated. You may receive phishing attempts via email, social networks and even on your phone number, so always be careful when your sensitive data is requested.

In this article, we have looked at some of the most popular types of trading scams. We have also looked at how you can avoid these traps.

We want to close with a request to you. Do not trust those who promise you to generate thousands of dollars without the slightest effort. Trading is a real job, and as such requires perseverance and hard work.

External useful resources

- Is day trading a scam? – Quora