A spinning top candlestick is a relatively easy-to-identify candlestick pattern in the market that is usually a sign of indecision among buyers and sellers. In this article, we will look at what the candle spinning topper pattern mean and how to trade it.

What is the spinning top candlestick?

For starters, there are many types of candlestick patterns in the financial market. We have looked at some of these patterns before. They include patterns like the Doji, bullish and bearish engulfing, and hammer, among others.

The spinning top candlestick is a pattern relatively different from most of these candles because of where it forms and what it tells traders. For one, while most candlestick patterns are signs of reversals or continuation, the spinning top is a sign of indecision.

This pattern happens when the asset forms long upper and lower shadows and a relatively small body. The length of the upper and lower shadows and the body can vary.

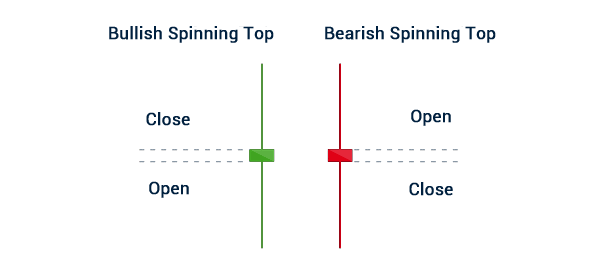

The chart below shows how a bullish and bearish candle spinning topper.

Bullish and Bearish spinning top

A bullish spinning top is formed when the price opens substantially higher than the open price and then the sellers come back in and push it lower by the end of the day or candle period.

On the other hand, a bearish spinning top pattern happens when the price opens sharply lower and then buyers come back in. In the two situations, the price usually closely above or below the opening price.

How to trade the spinning top candle

While a spinning top candlestick is a relatively easy to spot, the fact that it gives a sign of indecision makes it relatively difficult to use. At times, it can tell you that a reversal or more consolidation is about to happen.

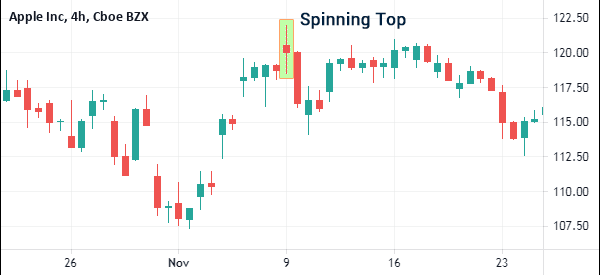

For example, in the chart below, we see that the spinning top in the Apple shares led to a small decline and further consolidation.

Similarly, in the spinning pattern on the EUR/USD pair, we see that the pair did not make substantial moves after the candlestick pattern was formed.

Therefore, we recommend that you use the spinning top candle pattern sparingly and don’t rely on it solely. Instead, we suggest that you focus on other tools in the price action strategy.

Some of the top recommended tools that you hould use in trading are the bullish and bearish engulfing, hammer, triangle, VWAP, and evening and morning stars, respectively.

Top Spinner vs doji

Therefore, a spinning topper is often confused with a doji pattern. The only difference between the two is that the Doji pattern opens and closes at the same point. Another difference is that the doji is typically a sign of reversal. When it happens, it sends a signal that price will reversal.

On the other hand, the spinning top is usually a sign of uncertainty or indecision in the market.

The idea behind indecision is also relatively easy to explain. For one, in a bullish spinning top, the price opened sharply higher and provided signals that bulls are doing well. However, as this happens, sellers come back in and push the price lower close to the opening price.

Another notable difference between the Doji and the spinning top is that the Doji tends to form at the top or bottom of a trend. On the other hand, the spinning top happens at the top or middle of the chart.

Summary

The spinning top pattern is a relatively easy-to-see candlestick pattern in the financial market. In this article, we have looked at how it forms and how to use it well in the financial market. We have also looked at the risks of using the pattern and some of te popular alternatives to the pattern.

External Useful Resources

- 2 Trading Methods to Increase Top Spinner Accuracy – Trading Sim