A stock market rally, also known as a bull-run, is a period where stocks are rising for a certain period. If the overall stocks rise in a given week, we can call it a stock market rally. This period is a good entry point for day traders, who might decide to follow the trend or go short (after careful analysis, of course).

In this article, we will look at this topic in detail and how you can trade during a period of a strong market rally.

What is a stock market rally?

A stock market rally refers to a period when stocks are in an overall bullish rally. In general, this rally is usually measured in terms of the main indices like the Nasdaq 100, S&P 500, and Dow Jones. These indices usually track the overall performance of the market by following the leading companies.

For example, the Nasdaq 100 index tracks the 100 biggest technology companies while the S&P 500 index tracks the biggest 500 companies in the United States. In Europe, the Euro Stoxx 600 index tracks the biggest firms in the region.

Therefore, if the index is rallying, we could say that European companies are having a major rally.

Causes of a stock market rally

There are several causes of a stock market rally. These are:

- Positive earnings – In most cases, when companies are seeing robust earnings growth, it usually leads to a major rally in the financial market.

- Low interest rates – In most cases, stocks usually rally in a period of low interest rates. That’s because, in such a period, people and hedge funds usually have access to capital to invest in the market. Also, there is usually a rotation from the less yielding bonds to equities.

- Geopolitics – Stocks usually rally when there is a period of geopolitical calm.

- Deals – Stocks usually rally when there is a strong period of deal-making such as mergers and acquisitions.

- Government policies – At times, government policies like fiscal stimulus can help to propel the stocks higher.

Example of a major stock market rally

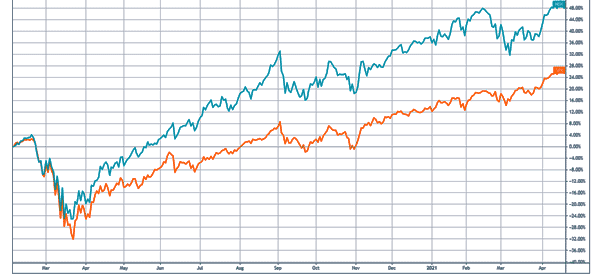

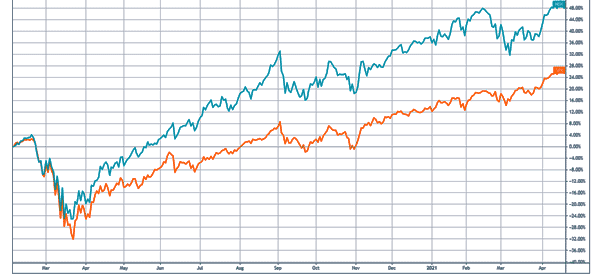

A good example of a major stock market rally is what happened during the coronavirus pandemic.

Stocks declined sharply after the World Health Organization (WHO) declared the disease a global pandemic. They then rallied sharply as all central banks slashed interest rates and governments launched the massive stimulus package.

The chart below shows how the S&P 500 and and Nasdaq 100 rally after the crisis.

Stock market rally vs a stock rally

There is usually a confusion between a stock market rally and a stock rally. As mentioned above, a stock market rally is typically measured in form of major indices like the S&P 500 and Dow Jones.

However, at times, we could have a period of stock market weakness but a stock is rallying. For example, some companies did well when the WHO declared the virus a major global pandemic. Some of the causes of a stock rally are:

- Strong earnings – A company’s shares could rally after it reports strong earnings.

- M&A deal– The stock could rally when a company is said to be acquired.

- Management change – A stock could rally when an old management team is being replaced.

- New investor – There could be a major rally when there is a new respected investor in a company. For example, in April 2021, the GlaxoSmithKline shares rallied after Elliot Management took a stake.

- Sector performance – At times, a stock could rally when the overall sector is doing well.

How to identify rally stocks

How then, do you identify stocks that are rallying? There are several strategies to do this. But the most popular and useful one is to use one of the several free screening tools (Yahoo Finance, Barchart, and Webull for example).

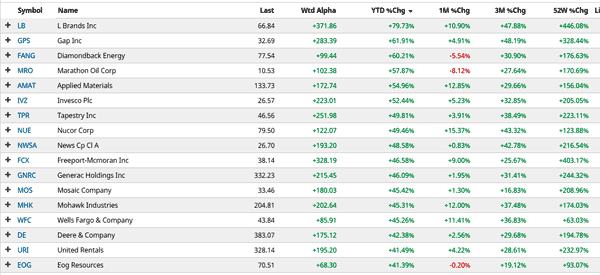

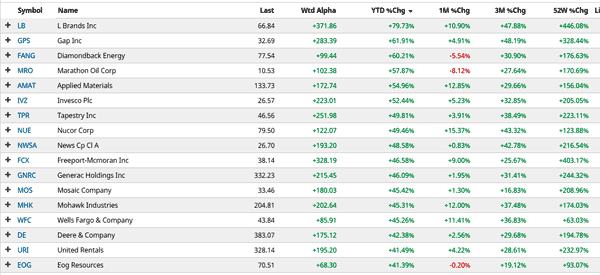

If you are interested in trading rallying stocks, you could select the performance of the stock in a given period. For example, in the chart below, we have narrowed down the best performing stocks in the S&P 500 between January to April 2021.

You can use the same approach across the popular indices like the Nasdaq 100 and Dow Jones. Also, you can narrow this by looking at the several sectors, like the S&P Energy and S&P retail sectors.

»A guide to Day Trading Stock Screener«

Strategies to trade a rallying stock

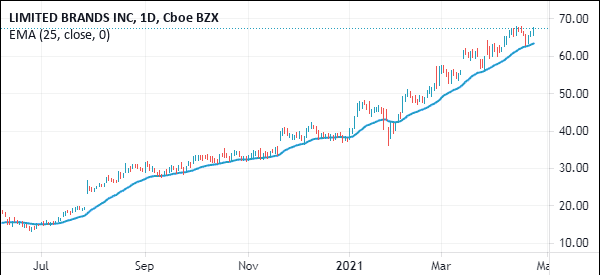

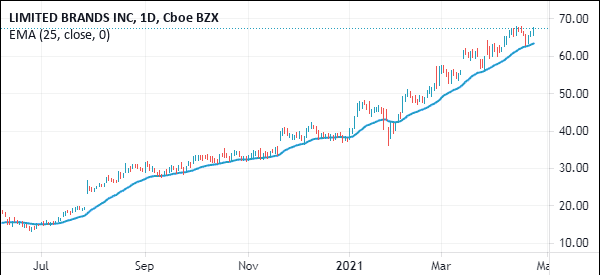

There are several strategies you should use when trading a stock or stock market rally. With the benefit of hindsight, the best strategy would be to buy and hold stocks that are rallying. For example, if you bought L Brands in January 2021 and held it until April, you would have made a return of almost 80%. However, in reality, this is usually easier said than done.

For one, even rallying stocks tends to have a periods of weakness. Still, we recommend several strategies.

Use MAs and Bollinger Bands

First, you should use the moving average or Bollinger Bands. For example, when using a moving average, you could buy and hold the stock so long as it is above a certain moving average. You should exit only when the price moves below this moving average.

Other trend indicators you can use to trade stocks in a major rally are the Parabolic SAR, Donchian Channels, and Average Directional Movement index.

A good example of this is shown in the chart below.

Buy the dip

Second, you could use the concept of buying the dips. This is where you wait for an asset’s price to drop and then buy it. The argument is that a stock in a major rally will have certain periods when it drops. In this case, you should use several tools like the Andrews Pitchfork and Fibonacci retracement to use it well.

Also, you could use the concept of Elliot Wave to identify the market cycles.

Final thoughts

In this article, we have looked at some of the important concepts of the stock market rally. We have also looked at the difference between a stock rally and a stock market rally. Further, we have identified the best indicators and tools to use when you are trading in this period. And we have also seen that there are different approaches to try to maximize profits. Which one do you prefer?

External Useful Resources

- Day Trading the Afternoon Rally – Stock Investing Today