The video streaming industry is rapidly growing, helped by the significantly fast internet speeds and competition. The industry was estimated to be worth more than $50 billion in 2020 and to grow at a compounded annual rate of more than 20% in the next few years.

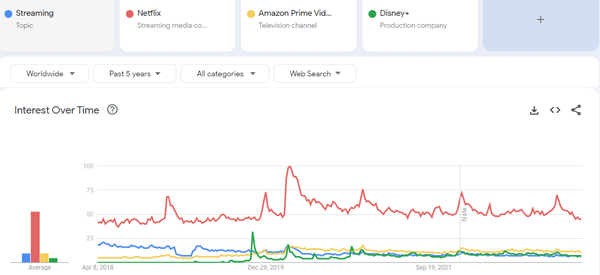

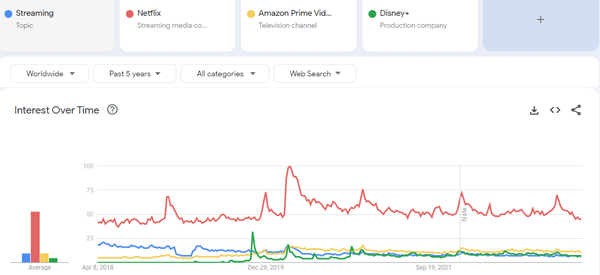

To get a better idea, take a look at this Google Trends chart from the last 5 years.

The first thing that jumps out at you is the steady growth of searches around Netflix and Amazon Prime, two of the biggest competitors (while ‘streaming’ as a generic word goes down more and more).

And then the explosion given by the start of the Pandemic from Covid, which practically doubled the global interest. The trend is obviously down now, but the levels are still higher than two years ago. And these are just two of the players.

This article will look at how the streaming industry works and some of the top streaming stocks to trade.

How video streaming works

Video streaming is a relatively simple concept. In the past, many Americans used to buy movies from some of the local dealers. The biggest one was Blockbuster that had more than 9,000 stores in the country. There was no streaming option at the time because the technology did not exist and the internet was relatively slow.

While some video streaming companies existed at the time, the biggest disruptor was Netflix. At a time, the company’s founder, Reed Hastings, wanted Blockbuster to buy it. When the deal failed, he decided to pivot his DVD delivery business into streaming.

The concept behind video streaming is relatively easy. A company like Netflix buys rights to movies and television series from their creators. They also spend billions of dollars creating content that they will own forever. They then upload these movies to data centers and create a platform where people can subscribe to.

Their customers pay a small fee every month and they can unsubscribe at any time. A Netflix subscription goes for less than $15 per month.

Types of video streaming companies

There are several types of video streaming companies. First, there are streaming companies that are ad-supported.

These are platforms that don’t charge a monthly fee every month. Instead, they make money through advertising. The most popular of these ad-supported video streaming services is YouTube.

Second, there are companies that use a hybrid model that combines advertisements and subscription. YouTube and Hulu are two of the most popular platforms (for anime the best is instead Crunchyroll).

Third, there are companies that don’t rely on adverts. Examples of these companies are Disney+ and Netflix (it started to offer a subscription with ads, but it is still paid at a lower price).

Fourth, there are services like Amazon Prime that was created to provide an extra feature for Amazon Prime subscription.

Another category of video streaming is based on content type. There are broad platforms that include all segments of the industry like Netflix and Disney+. There are also niche companies like Curiosity Stream that focus on documentaries.

At the same time, there are streaming services that focus mostly on games. The most popular companies in the sector are Huya and Amazon, which owns Twitch.

Key data to watch in streaming companies

As a trader or investor, there are several important data you need to watch, especially in their earnings report. Some of these key numbers are:

- Active users – Many companies publish the number of their monthly or daily active users. These are important numbers because they provide data on whether a company is growing or not.

- Advertising vs subscription revenue – Many streaming companies like Netflix and Disney make money through subscriptions and advertisements. Therefore, it is important to watch whether their ad revenue is growing or not.

- Cancellations – Another important number to watch but one that many companies don’t love reporting. You can use external estimates to see the number of customers who canceled their transactions.

- Revenue growth – Further, like with other companies, you should watch how the company growth is happening. You can look at this number on a quarter-on-quarter basis.

- Profitability growth – Most companies publish their results every quarter. You should look at whether their profits are growing or not.

Popular streaming stocks

Netflix

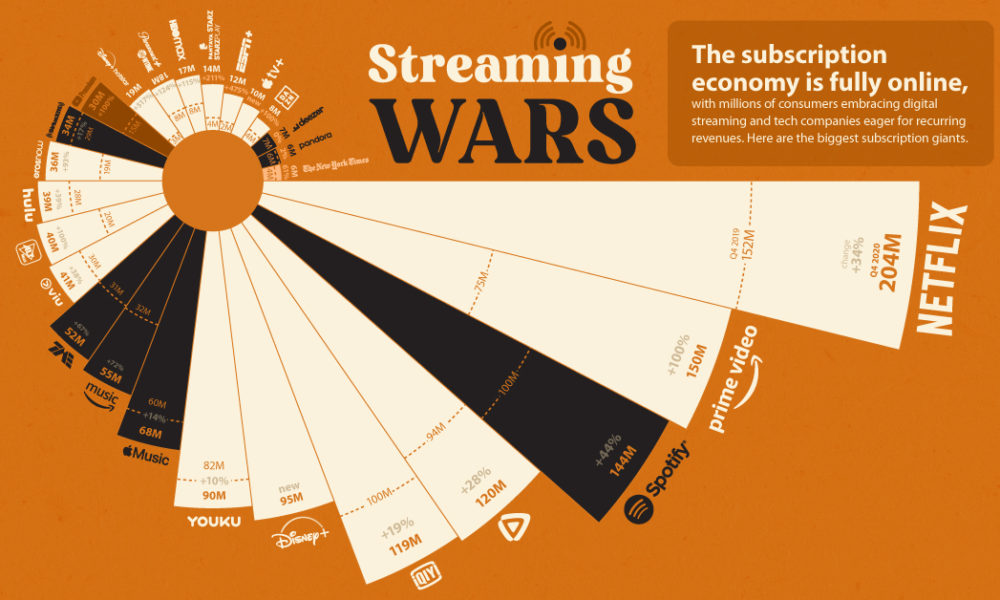

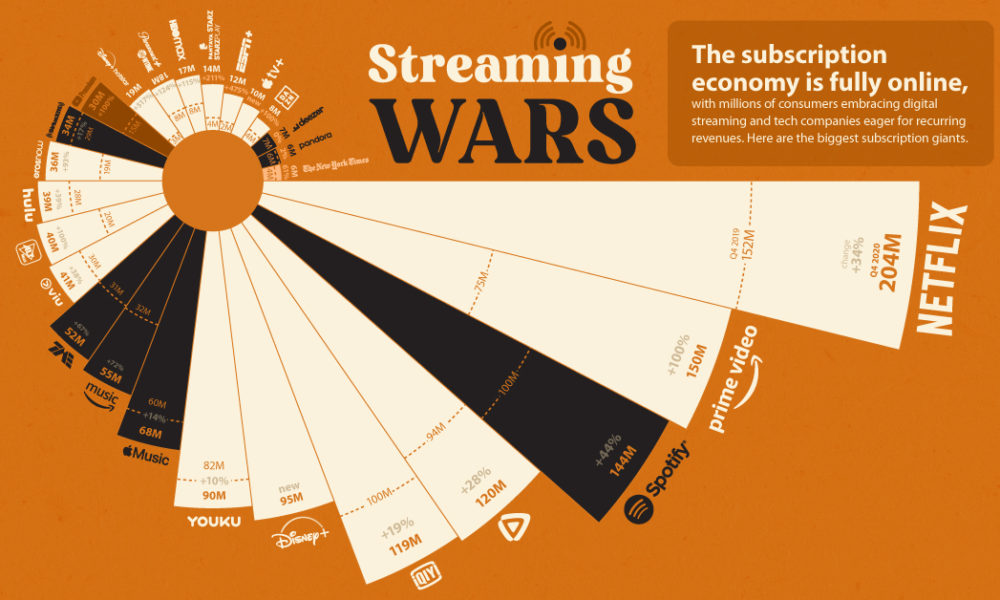

Netflix is the biggest video streaming service in the world with a market cap of more than $220 billion and more than 200 million customers. The company has annual revenue of more than $31 billion and a net income of more than $2.7 billion.

The Netflix stock is one of the most actively traded stocks in the United States and is a member of the FAANG group. The company adds millions of new customers every month and spends billions of dollars in content creation.

Amazon

Amazon is a leading player in video streaming in three main ways. First, the company owns Amazon Prime Video, a standalone service that also acts as an add-on for its Prime service. Prime subscribers get several products, including free delivery and free music streaming.

The product is also available for a fee to users who are not members. While Amazon does not declare its numbers, it is estimated to have more than 170 million subscribers. Still, this segment is just a small part of Amazon’s business.

Second, the company makes money in streaming since it is the leading data center provider to many companies in the sector. Amazon’s AWS powers Netflix, ViacomCBS, and Disney.

Finally, Amazon makes money through Twitch, which is the biggest game streaming service in the world.

Disney

The next big streaming stock you can invest or trade in is Walt Disney. The company is one of the biggest media companies in the world. It owns theme parks, television stations, cruise line, and Disney+.

Disney+ has become one of the fastest-growing streaming services in the world. The service has added more than 100 million subscribers in less than two years. They are attracted to the company’s big library of content that caters to people of all ages.

ViacomCBS

ViacomCBS was created after the merger of Viacom and CBS in 2019. The company is a large media conglomerate that owns some popular brands like MTV, BET, CBS, Comedy Central, and Nickelodeon, and Pluto TV.

It also owns several streaming companies like Paramount+ and CBS. These services have millions of subscribers from around the world.

Alphabet

Alphabet is a member of FAANG and is also a leading player in the video streaming industry. The company owns YouTube, the biggest player in the sector that has millions of users globally. YouTube is a hybrid platform that has an ad-supported model and a paid service.

Like Amazon, Alphabet also makes money by providing services to companies in the video streaming sector like Netflix and Disney.

Apple Tv+

The Video on Demand service launched by Apple in November 2019 operating in the Internet distribution of movies, TV series and other paid entertainment content.

It was one of the initiators, along with Disney+, to trigger the so-called ‘streaming war’ that we had talked about quite some time ago.

Huya

Huya is a Chinese game-streaming company that is worth more than $3.9 billion. The company has more than 198 million users and it makes money through advertisements and subscriptions.

Roku

Roku is another video stock you can invest in or trade. The company provides services that help all these streaming companies get seen on television. It sells a cheap device that allows streaming. Recently, it has also started to invest in its content.

Discovery

Discovery is a well-known brand that has millions of users through its Discovery+ product. In 2020, it was reported that the company would merge with Time Warner, in a deal that will create a $150 billion company.

Why streaming stocks are struggling

There are several reasons why streaming companies have struggled in the past few years. These include:

- Rising competition – In the past, Netflix was the only game in town. Today, the industry has become extremely crowded, with companies like Comcast and Disney trying to gain market share.

- Content costs – Another reason is that content costs have been in a strong upward trend. Companies like Netflix and Disney spend billions of dollars in content costs. As competition rises, these costs will continue rising.

- Back to work – Streaming companies did well during the pandemic as more people stayed at home. Today, most people have gone back to the office, affecting its growth.

Summary

The streaming business is seeing robust growth globally. This trend will likely continue in the future as people abandon cable. In this article, we have looked at how it works and some of the popular streaming stocks to trade or invest in.

External Useful Resources

- Streaming Wars: Which video streaming stocks could win the battle? – Catana Capital