Swing trading is a popular strategy where traders buy or short assets and then hold them for an extended period of time.

Typically, swing traders hold their positions for a few days like two to three days. Their goal is to identify a pattern and follow it for some time.

In this article, we will look at some of the top strategies to swing trade in a volatile environment.

Swing trading vs day trading

Swing trading is a different strategy than day trading. While swing traders identify and capture moves for a long time, day traders focus on buying or selling and holding trades for a few minutes. Their goal is to make a small profit per trade.

Also, they oppose the idea of holding a trade in the overnight market because of the risks that are involved.

A good example of swing trading is where you identify an asset whose price is rising and then decide to buy it. After buying the asset, you will hold it for a few days until the trade turns around.

What are volatile markets?

A volatile market is a period when financial markets are not moving in a solid direction. For example, it happens when the financial market is rising in a given day and then falling in another one.

There have been periods of high volatility in the past. For example, in early 2022, there was a significant amount of volatility after Russia decided to invade Ukraine. Similarly, there was volatility when the Covid-19 pandemic started.

Causes of volatility

There are several key causes of volatility in the financial market. Some of them are:

- Corporate earnings – Stocks tend to show a large degree of volatility when companies are publishing their quarterly results. In this case, companies tend to deliver new news to investors, which could lead to volatility,

- Geopolitics – At times, when there is uncertainty about geopolitical events, stocks tend to be highly volatile. A good example is during the Russian invasion of Ukraine an the trade wars between the US and China.

- Federal Reserve – The Fed tends to lead to more volatility especially when it starts to hike interest rates.

There are other causes of volatility that affect companies themselves. For example, there is usually volatility that happens when a company makes a major announcement such as a profit warning.

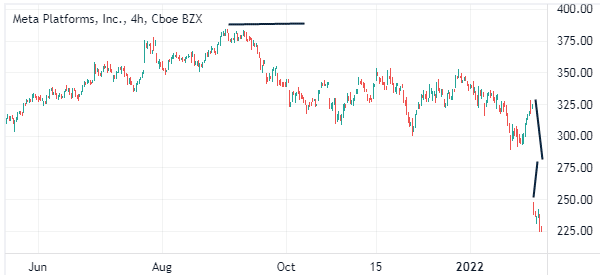

Second, a company can lead to volatility when it announces a big loss. As shown below, Facebook’s shares declined sharply when the company announced weak quarterly results.

Third, in the oil market, there is usually high volatility when Saudi Arabia and OPEC make major moves. For example, if they decide to slash production, investors tend to rush to oil markets.

How to identify volatile markets

There are a number of methods that can help you to identify volatile markets. First, you can just look at the overall performance of indices like the Dow Jones and Nasdaq 100.

For example, if you see the Dow Jones rising by 800 points and then closing 100 points higher, that is a sign that markets are volatile. In other words, you don’t need to use a tool to tell you that the market is volatile.

Data available on premarket

Second, you can use pre-market data to identify stocks that are making huge moves. As a day trader, it makes sense to focus on stocks that are making big positive and negative moves. In addition, you can use tools such as Investing.com to find stocks making huge moves.

Tools and indicators

Third, you can have a watchlist, which is a group of companies that you typically follow. You can then look at the performance of these stocks.

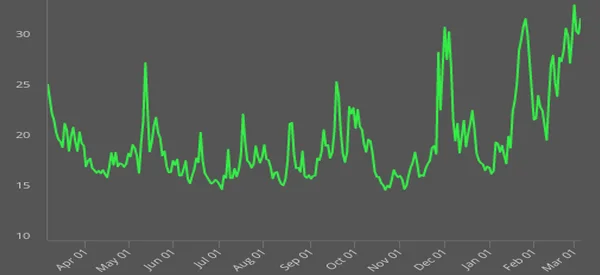

Further, you can use the CBOE VIX index to find the situation in the market. VIX is the most useful tool that measures volatility. As shown below, the index jumped sharply when Russia invaded Ukraine.

Further, you can use volatility indicators like the Average True Range, Bollinger Bands, and Bollinger Bandwith to see whether there is volatility.

Finally, you can use tools like the Fear and Greed index to find out whether there is a strong volatility in the financial market.

How to swing trade in a volatile market

There are several swing strategies you need to use in high volatile markets. It is important to remember that the swing trader’s analysis must include 2/3 days, and therefore the reaction to sudden movements within a few hours is less effective.

Pending orders

First, it is always important that you have a stop-loss and a take-profit when using this strategy.

The take-profit and stop-loss will automatically stop your trades when certain levels are reached. These are very important tools because of the impact that volatility has on stocks. For example, as stock can close at $25 and then open at $30.

Level of leverage

Second, as a swing trader, you need to limit your leverage in high volatile markets. The more leveraged you are, the worse the situation will be if the assets you have bought or shorted go against you. Therefore, reduce your exposure to leverage.

Limit your exposure

Third, as a swing trader, you need to limit your short exposure. When you short an asset, you are simply betting that the asset’s price will retreat. Sadly, is possible to go through a short squeeze when the markets are volatile.

A short squeeze is a situation where the stock you have shorted goes parabolic. It is a very dangerous situation because it can bring potentially endless losses, but there are also some methods to spot in time and exploit these squeezes to generate profits.

Fourth, ensure that your exposure in the market is a bit low. This means that you should ensure that your trades are not all that big.

Summary

Volatile markets are the best for day traders and swing traders because this is where more trading opportunities emerge. In this article, we have explained some of the top strategies to use and how to trade in such volatile markets.

External useful resources

How do I trade volatile stocks, that swing dramatically, yet may still end up going my way? – Quora